The Ministry of Home Affairs has just issued a circular detailing a number of articles of the Law on Social Insurance on compulsory social insurance contributions, effective from July 1, clearly stating the method of one-time payment for the remaining time to be eligible for pension and the time of retirement.

Regarding the conditions for receiving benefits , employees who are of retirement age but have a maximum of 6 months of mandatory social insurance contributions remaining can continue to pay one time for the missing period to receive pension. The monthly contribution is equal to the total contribution rate to the Pension Fund for the deceased of that person and the employer before leaving work, which is 22% of the average monthly salary used as the basis for payment according to current regulations.

The regulation on one-time insurance payment for the missing period is applied to employees working under normal conditions, participating in compulsory social insurance from 14 years and 6 months to less than 15 years. This group includes: Male employees aged 61 years and 3 months, female employees aged 56 years and 8 months, and increasing until 2028, male employees aged 62 years, female employees aged 60 years in 2035; officers, professional soldiers, non-commissioned officers, soldiers, military students, officers, non-commissioned officers, technical specialists, conscripts, students in the police and cryptography; regular militia; people infected with HIV/AIDS due to occupational accident while on duty.

For people of retirement age with reduced working capacity, the mandatory contribution period is from 19 years and 6 months to less than 20 years.

The earliest time to pay the one-time payment for the missing months is the month immediately preceding the month in which the employee is eligible for retirement. The time to receive the pension is calculated from the month immediately following the month in which the employee has paid the full amount.

Regarding the time of receiving benefits , when a worker quits his/her job but has enough years of contributions, he/she will receive benefits from the month following the month of reaching retirement age. In case the worker is still working and participating in mandatory social insurance, benefits will be calculated from the month following the month of termination of the labor contract or termination of work.

People with reduced working capacity who meet the retirement age and contribution period conditions will be entitled to benefits from the month following the month in which the conclusion of the reduction is made. In case the conclusion is made before the month of reaching retirement age, benefits will be calculated from the month after the time of reaching retirement age.

For those whose date and month of birth cannot be determined, but only the year of birth (or month and year of birth) is recorded, the time to receive pension is calculated from the month following the month of reaching retirement age according to regulations.

July 1, 2025 is considered the earliest pension date for retirees who have paid from 15 years to less than 20 years of social insurance.

For those who no longer have enough original documents showing the time working in the public sector before January 1, 1995, the time to receive pension is the time stated in the settlement document of the Social Insurance agency.

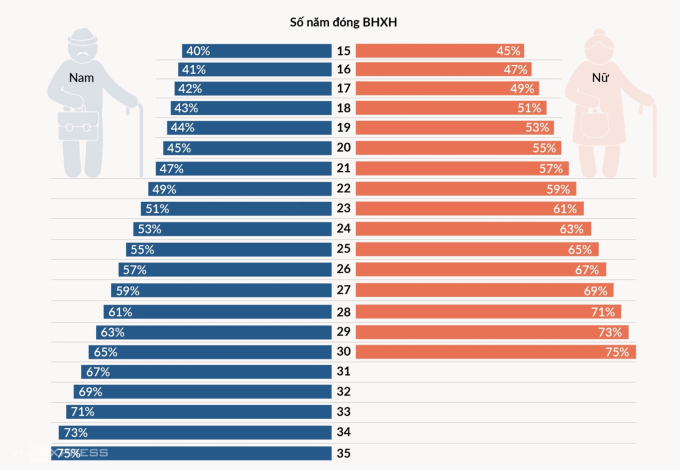

Regarding the one-time subsidy , if men have paid social insurance for over 35 years and women have paid social insurance for over 30 years but still participate in the system, the subsidy is calculated at 0.5 times the average salary used as the basis for payment for each year exceeding the ceiling before retirement, and 2 times for each year if still participating after retirement.

The whole country currently has nearly 3.4 million people receiving monthly pensions and social insurance benefits.

VN (according to VnExpress)Source: https://baohaiphongplus.vn/thoi-diem-huong-luong-huu-voi-cac-nhom-dong-bao-hiem-bat-buoc-415608.html

Comment (0)