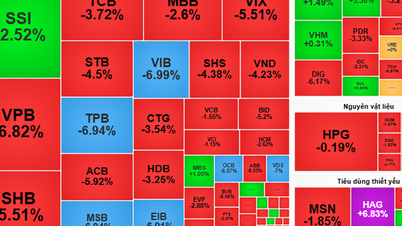

According to experts, the most appropriate time to tax bonus shares is when investors sell shares - Photo: AI drawing

The Ministry of Finance is seeking comments on a draft decree amending and supplementing a number of articles of Decree 126 guiding the implementation of the Law on Tax Administration, in which it is proposed that personal income tax will be deducted, declared and paid immediately when individuals receive dividends or bonuses in the form of securities.

However, this proposal has received mixed reactions as soon as it was put forward. The Vietnam Association of Financial Investors (VAFI) has just issued a document commenting on the above draft, in which it has presented many notable arguments to counter the proposal from the Ministry of Finance.

Tax should be collected when investors make profit

According to VAFI leaders, distributing bonus shares to investors - essentially using after-tax profits or corporate funds to distribute to shareholders - is a common practice in the world .

The issuance of bonus shares at a certain time does not increase the company's equity, which means it does not increase the company's capital and does not change the ownership ratio of each shareholder in the company.

It is important to note that buying and holding bonus shares does not guarantee profits. Share prices may fluctuate unfavorably due to many factors such as a general market decline, macroeconomic difficulties, business losses, reduced profits, businesses being taxed or facing fierce competition in the industry, etc.

"Therefore, countries around the world have regulations that income tax is only collected when bonus stock investment is profitable, and the time to calculate tax is when investors sell bonus stocks," VAFI leaders emphasized.

VAFI also cited the practice that bonus stock tax is determined according to the "capital gain tax" mechanism (tax on capital difference), that is, taking the average selling price minus the average purchase price and then multiplying by the tax rate.

This tax rate should be based on the level of development of the stock market, the number of shares held, family deductions and income from wages...

However, determining tax rates is complicated. Many small or developing markets such as Vietnam do not currently apply a "capital gains tax", according to VAFI.

Businesses cannot "run after" tax collection on behalf of others.

In general, the nature of personal income tax according to international and Vietnamese practice is to only tax when business activities are profitable or generate income. The purchase of bonus shares should only be taxed when investors sell and make a profit, according to VAFI.

Currently, exchanges, depositories and securities companies can easily calculate the number of bonus shares and the cost price, without difficulty in determining whether investors sell at a profit or loss.

Therefore, VAFI leaders emphasized that individuals who hold bonus shares but have not sold them cannot be considered to have income, and cannot become subjects of personal income tax.

In addition, the company issuing bonus shares cannot perform the function of paying taxes on behalf of investors.

According to the Enterprise Law, they are not responsible for paying this tax. Suppose the enterprise pays on their behalf, they must use the company's money to pay on their behalf, then the investor must refund the money.

For listed companies with tens of thousands of shareholders, including foreign shareholders, it is difficult to ensure that all shareholders will transfer their money back.

Therefore, the most appropriate time to tax bonus shares is when investors sell shares, according to VAFI.

In the long term, this organization recommends that the Ministry of Finance should consider applying the "capital gain tax" mechanism to securities transaction tax, to overcome the situation where investors lose money but still have to pay taxes.

Source: https://tuoitre.vn/nha-dau-tu-chua-ban-co-phieu-thuong-khong-the-coi-co-thu-nhap-va-phai-nop-thue-20250707183733342.htm

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

Comment (0)