Domestic gold price today 7/9/2025

As of 4:30 a.m. on July 9, 2025, the domestic gold bar price is based on the closing price yesterday, July 8. Specifically:

DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.3-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 200 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119-121 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.3-121 million VND/tael (buy - sell), gold price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 9, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.5-117.5 million VND/tael (buy - sell); the price increased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell); the gold price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 9, 2025 is as follows:

| Gold price today | July 9, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119 | 121 | +500 | +500 |

| DOJI Group | 119 | 121 | +500 | +500 |

| Red Eyelashes | 119.3 | 120.5 | -200 | - |

| PNJ | 119 | 121 | +500 | +500 |

| Bao Tin Minh Chau | 119 | 121 | +500 | +500 |

| Phu Quy | 118.3 | 121 | +500 | +500 |

| 1. DOJI - Updated: 7/9/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC HCM | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC DN | 119,000 ▲500K | 121,000 ▲500K |

| Raw material 9999 - HN | 108,400 ▲500K | 112,500 ▲500K |

| Raw material 999 - HN | 108,300 ▲500K | 112,100 ▲200K |

| 2. PNJ - Updated: 7/9/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,700 ▲500K | 117,300 ▲400K |

| HCMC - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Hanoi - PNJ | 114,700 ▲500K | 117,300 ▲400K |

| Hanoi - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Da Nang - PNJ | 114,700 ▲500K | 117,300 ▲400K |

| Da Nang - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Western Region - PNJ | 114,700 ▲500K | 117,300 ▲400K |

| Western Region - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - PNJ | 114,700 ▲500K | 117,300 ▲400K |

| Jewelry gold price - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 114,700 ▲500K |

| Jewelry gold price - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,700 ▲500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,700 ▲500K | 117,300 ▲400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,700 ▲500K | 117,300 ▲400K |

| Jewelry gold price - Jewelry gold 999.9 | 114,000 ▲600K | 116,500 ▲600K |

| Jewelry gold price - Jewelry gold 999 | 113,880 ▲600K | 116,380 ▲600K |

| Jewelry gold price - Jewelry gold 9920 | 113,170 ▲600K | 115,670 ▲600K |

| Jewelry gold price - Jewelry gold 99 | 112,940 ▲600K | 115,440 ▲600K |

| Jewelry gold price - 750 gold (18K) | 80,030 ▲450K | 87,530 ▲450K |

| Jewelry gold price - 585 gold (14K) | 60,800 ▲350K | 68,300 ▲350K |

| Jewelry gold price - 416 gold (10K) | 41,110 ▲250K | 48,610 ▲250K |

| Jewelry gold price - 916 gold (22K) | 104,310 ▲550K | 106,810 ▲550K |

| Jewelry gold price - 610 gold (14.6K) | 63,720 ▲370K | 71,220 ▲370K |

| Jewelry gold price - 650 gold (15.6K) | 68,380 ▲390K | 75,880 ▲390K |

| Jewelry gold price - 680 gold (16.3K) | 71,870 ▲410K | 79,370 ▲410K |

| Jewelry gold price - 375 gold (9K) | 36,340 ▲230K | 43,840 ▲230K |

| Jewelry gold price - 333 gold (8K) | 31,100 ▲200K | 38,600 ▲200K |

| 3. SJC - Updated: 7/9/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,000 ▲500K | 121,000 ▲500K |

| SJC gold 5 chi | 119,000 ▲500K | 121,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,000 ▲500K | 121,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,400 ▲500K | 116,900 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,400 ▲500K | 117,000 ▲500K |

| Jewelry 99.99% | 114,400 ▲500K | 116,300 ▲500K |

| Jewelry 99% | 110,648 ▲495K | 115,148 ▲495K |

| Jewelry 68% | 72,341 ▲340K | 79,241 ▲340K |

| Jewelry 41.7% | 41,751 ▲208K | 48,651 ▲208K |

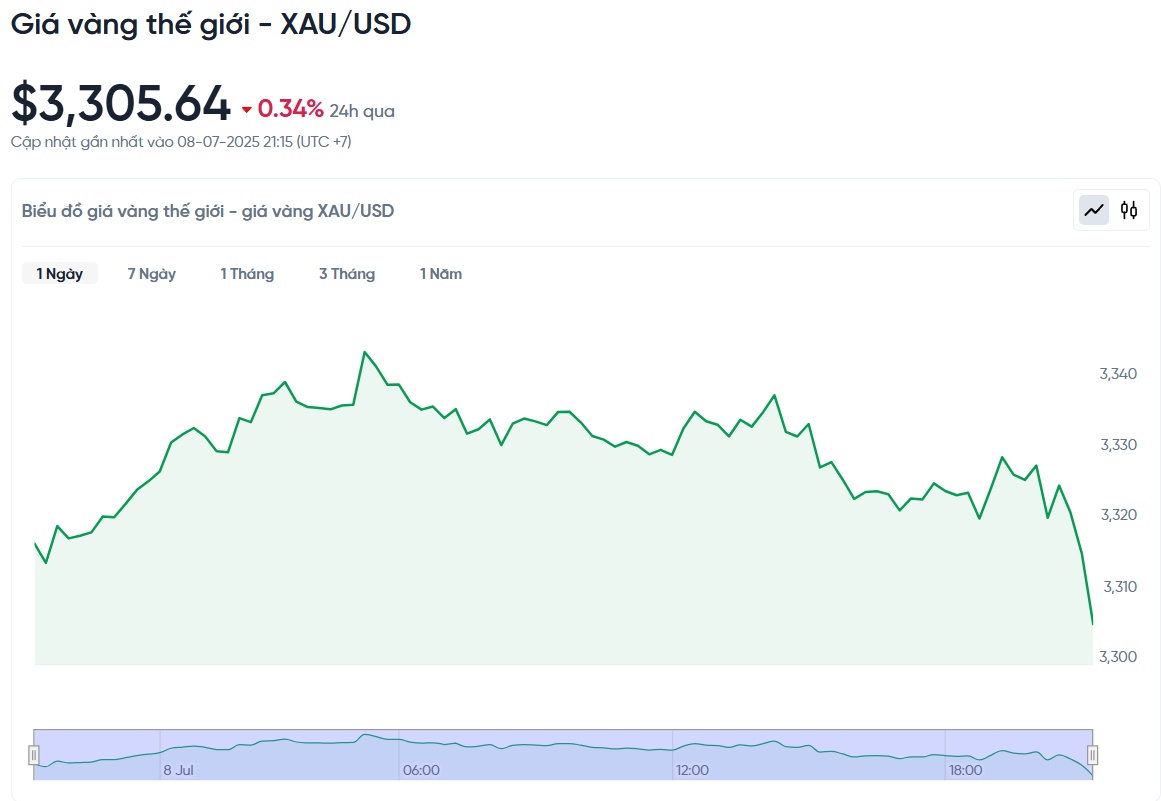

World gold price today 7/9/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 9, Vietnam time, was 3,305.64 USD/ounce. Today's gold price decreased by 11.43 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,305 VND/USD), the world gold price is about 108.25 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 12.75 million VND/tael higher than the international gold price.

World gold prices fell slightly due to market optimism about the possibility of reaching a trade agreement between the US and its partners. In addition, the stronger USD and rising US Treasury bond yields also put additional pressure on gold, making it difficult for prices to increase.

Specifically, spot gold prices fell 0.34%, while US gold futures also fell 0.12% to $3,314.98/ounce. The yield on 10-year government bonds hit its highest level in more than two weeks, making gold, which does not pay interest, less attractive.

The US is ramping up trade pressure as President Donald Trump warns 14 countries of higher tariffs starting August 1. However, some countries such as Japan and South Korea are working to negotiate to lessen the impact. The delay to August also gives the parties an opportunity to find a solution.

The market is focused on trade developments ahead of the July 9 deadline, but optimism about the possibility of a deal has made investors more adventurous, limiting the upside momentum of gold prices, according to expert Peter Grant from Zaner Metals.

Markets are awaiting the minutes of the US Federal Reserve’s latest policy meeting, due on July 10, along with speeches from several Fed officials this week. These will help predict the direction of the economy and monetary policy in the coming time.

The risk of inflation from tariffs could prompt the Fed to delay a rate cut until next year, making it harder for gold to rally sharply, according to economist Hamad Hussain of Capital Economics. Investors currently expect the Fed to cut rates by about 0.5% by the end of the year, starting in October.

Besides gold prices, silver prices fell 0.5% to $36.57/ounce, platinum fell 0.8% to $1,359.97 and palladium fell 0.2% to $1,108.77.

Gold Price Forecast

According to Tim Waterer, a market analyst at KCM Trade, investors are not too worried about the threat of tariffs from US President Donald Trump. The demand for gold as a safe haven has not really exploded, causing the price of gold to temporarily wait and not increase strongly.

Bond yields are high and Asian markets have reacted relatively calmly to trade developments, both factors making it difficult for gold to rise in the short term. Currently, the yield on the 10-year US government bond is near a two-week high, increasing the opportunity cost of investing in gold.

Gold investors are focusing on the US Federal Reserve's (Fed) monetary policy moves, as this will be an important factor in determining gold price trends in the coming time. The minutes of the Fed's June policy meeting, expected to be released this week, will give the market a clearer view of the central bank's interest rate adjustment plan.

Currently, the US dollar is on a strong trend, making it more difficult for gold. However, if trade tensions escalate, gold could become a safe haven again, especially as concerns about stagflation (high inflation and slow growth) and trade wars increase.

Gold prices have remained high recently, supported by safe-haven demand amid geopolitical and trade uncertainties. Money flowing into gold ETFs and strong demand from central banks have also supported prices. However, in the short term, gold prices may continue to move sideways due to a lack of strong momentum to increase or decrease significantly.

Jim Wyckoff, an analyst at Kitco, said the gold market is in a "tug of war" state, reflecting the lack of strong enough factors to push prices out of the current range. In the long term, the gold price trend remains positive, but buyers need new signals to break out of the current trading range.

According to Wyckoff, investors should keep a close eye on macroeconomic and geopolitical developments, as these factors could create a spike that could help gold break out of its sideways phase and establish a new trend.

Source: https://baonghean.vn/gia-vang-hom-nay-9-7-2025-gia-vang-trong-nuoc-va-the-gioi-kho-tang-gia-vi-muc-thue-quan-cua-my-10301864.html

Comment (0)