However, the challenges are not small, requiring businesses to form supply chains, cut costs to the maximum to increase competitiveness, and diversify markets to maintain export growth in the coming time.

Economist , Dr. Nguyen Minh Phong: The beginning of the signing of the Vietnam - US Bilateral Trade Agreement

According to information posted by US President Donald Trump on social media about the trade agreement with Vietnam, it can be seen that there are 3 tax rates that will be applied to Vietnamese goods.

That is 10% for products that prove 100% of their materials are of Vietnamese origin; 20% for most other products and 40% for transit goods.

This is a fairly favorable ending after many negotiation sessions between Vietnam and the United States, especially direct phone calls between General Secretary To Lam and US President Donald Trump.

This will be the beginning of a larger issue of moving forward with Vietnam and the United States signing a more fair and sustainable bilateral trade agreement.

In my opinion, this tax rate can still increase the competitiveness of Vietnamese goods compared to other countries, but it also affects some industries, in which the textile and garment sector may be negatively affected due to the low level of localization of raw materials.

To adapt and overcome the barriers, in my opinion, businesses need to restructure their supply chains to reduce the foreign content ratio, thereby reducing tax rates, while reviewing and minimizing costs to balance profits with the new tax rates.

Businesses should also negotiate with US import partners to share some of the risks. In the long term, businesses should diversify their markets, not just rely on the US, to minimize risks. In the current context, authorities need to listen to businesses and support them to overcome the challenges ahead.

Mr. Luu Hai Minh, Chairman of the Board of Directors of Nhat Hai New Technology Joint Stock Company - founder of the OIC NEW brand: Tax rates are beneficial for 100% Made in Vietnam goods.

After US President Donald Trump announced the trade agreement with Vietnam on social media and especially the phone call last night between General Secretary To Lam and US President Donald Trump, as an enterprise exporting to the US market, we are very excited.

If the tax rates are officially applied, especially for products that can prove that 100% of the materials are of Vietnamese origin, the tax could be reduced to 10%, which will create a great advantage for businesses exporting "Made in Vietnam" products.

On the contrary, if the import tax on goods from the US is reduced to 0, it will also create favorable conditions for businesses to increase the import of machinery and equipment, invest in production and business, thereby improving the quality and competitiveness of businesses.

In addition to many solutions that have been applied in the past to ensure stable exports to the US market, businesses will carefully study information and taxable areas to have appropriate solutions.

In particular, to achieve the 10% tax rate when proving origin, we will continue to strengthen the stable supply chain, develop raw material areas and improve product quality to increase competitiveness in the US market.

Executive Director of the Faculty of Finance and Banking (Nguyen Trai University) Nguyen Quang Huy: The first step towards a period of high-quality, deep and proactive integration

The phone call between US President Donald Trump and General Secretary To Lam marked the two countries reaching a strategic bilateral trade agreement. Accordingly, Vietnam will be subject to a 20% tax on goods exported directly to the US and a 40% tax on goods transiting through a third country.

The 20% tax rate, if applied, is much lower than the 46% rate announced by the US and also lower than the 40% rate that is expected to be applied to transit goods. It must also be said that although the 20% tax rate is not low, compared to competitors taxed at 40%, Vietnamese enterprises still have a clear competitive advantage.

This agreement, in a profound view, is a clear recognition by the United States of Vietnam's real and transparent manufacturing capacity, the beginning of a period of high-quality, deep and proactive integration.

The trade agreement also opens up a stable, long-term export corridor to the US - the world's largest and most demanding consumer market. However, businesses need to diversify their export market and product portfolio to avoid over-dependence and prevent risks.

In the context of increasingly strict origin control, businesses must proactively increase the localization rate from 60% to nearly 100% in some fields. This is not only a trade defense measure, but also a path to forming an independent, sustainable and elite production ecosystem.

Negotiating agencies continue to play a role in reviewing, recommending and negotiating to further adjust tax rates to optimal levels, while strengthening a solid legal position for Vietnamese goods.

The Government needs to accelerate the implementation of policies to support high-quality FDI, prioritizing projects with spillover effects, technology transfer, and contributions to sustainable development goals. Public-private partnership mechanisms, industry cluster models, and national innovation centers need to be elevated to strategic levels.

It can be said that the phone call between US President Donald Trump and General Secretary To Lam is not only a diplomatic-economic event, but also a milestone to establish Vietnam's new role on the global map: From a manufacturing country to a smart manufacturing country, an economy with identity; from a "participant" to a "game-maker".

Source: https://hanoimoi.vn/my-du-kien-ap-thue-20-doanh-nghiep-tin-thach-thuc-nhieu-song-co-hoi-cung-khong-it-707924.html

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

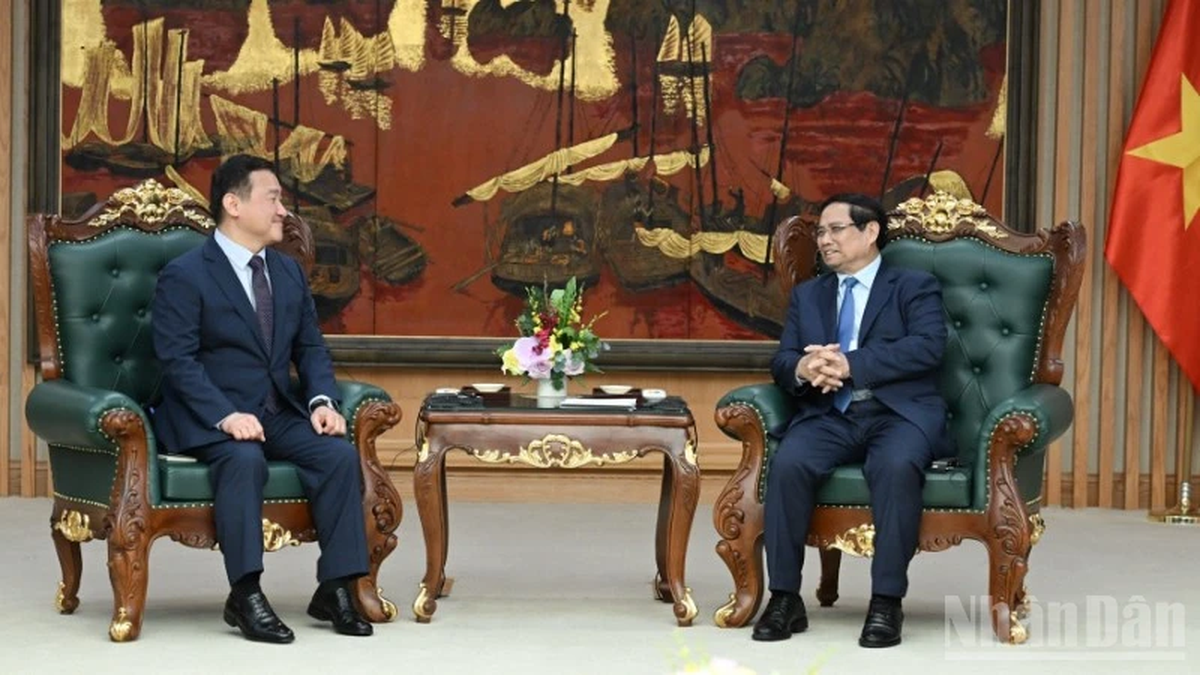

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

Comment (0)