Domestic gold price today June 16, 2025

As of 4:30 a.m. on June 16, 2025, the domestic gold bar price is based on the closing price yesterday, June 14. Specifically:

DOJI Group listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 2.9 million VND/tael in buying direction - increased by 3.1 million VND/tael in selling direction compared to the beginning of last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.8-120.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 2.9 million VND/tael in buying direction - increased by 3.1 million VND/tael in selling direction compared to the beginning of last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-120 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price increased by 3 million VND/tael for buying and 2.8 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.8-120.3 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday, the price increased by 2.9 million VND/tael in buying direction - increased by 3.1 million VND/tael in selling direction compared to last week.

SJC gold price in Phu Quy is traded by businesses at 117-120 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions. Gold price increased by 2.5 million VND/tael in buying direction - increased by 2.8 million VND/tael in selling direction compared to the beginning of last week.

As of 4:30 a.m. on June 16, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price increased by 2.5 million VND/tael in both buying and selling directions compared to the beginning of last week.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 3 million VND/tael in both buying and selling directions compared to last week.

The latest gold price list today, June 16, 2025 is as follows:

| Gold price today | June 16, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 117.8 | 120.3 | - | - |

| DOJI Group | 117.8 | 120.3 | - | - |

| Red Eyelashes | 119 | 120 | - | - |

| PNJ | 117.8 | 120.3 | - | - |

| Bao Tin Minh Chau | 117.8 | 120.3 | - | - |

| Phu Quy | 117 | 120 | - | - |

| 1. DOJI - Updated: June 16, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,800 | 120,300 |

| AVPL/SJC HCM | 117,800 | 120,300 |

| AVPL/SJC DN | 117,800 | 120,300 |

| Raw material 9999 - HN | 109,500 | 114,000 |

| Raw material 999 - HN | 109,400 | 113,900 |

| 2. PNJ - Updated: June 16, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,000 | 116,800 |

| HCMC - SJC | 117,800 | 120,300 |

| Hanoi - PNJ | 114,000 | 116,800 |

| Hanoi - SJC | 117,800 | 120,300 |

| Da Nang - PNJ | 114,000 | 116,800 |

| Da Nang - SJC | 117,800 | 120,300 |

| Western Region - PNJ | 114,000 | 116,800 |

| Western Region - SJC | 117,800 | 120,300 |

| Jewelry gold price - PNJ | 114,000 | 116,800 |

| Jewelry gold price - SJC | 117,800 | 120,300 |

| Jewelry gold price - Southeast | PNJ | 114,000 |

| Jewelry gold price - SJC | 117,800 | 120,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 | 116,800 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 | 116,800 |

| Jewelry gold price - Jewelry gold 999.9 | 113,200 | 115,700 |

| Jewelry gold price - Jewelry gold 999 | 113,080 | 115,580 |

| Jewelry gold price - Jewelry gold 9920 | 112,370 | 114,870 |

| Jewelry gold price - Jewelry gold 99 | 112,140 | 114,640 |

| Jewelry gold price - 750 gold (18K) | 79,430 | 86,930 |

| Jewelry gold price - 585 gold (14K) | 60,340 | 67,840 |

| Jewelry gold price - 416 gold (10K) | 40,780 | 48,280 |

| Jewelry gold price - 916 gold (22K) | 103,580 | 106,080 |

| Jewelry gold price - 610 gold (14.6K) | 63,230 | 70,730 |

| Jewelry gold price - 650 gold (15.6K) | 67,860 | 75,360 |

| Jewelry gold price - 680 gold (16.3K) | 71,330 | 78,830 |

| Jewelry gold price - 375 gold (9K) | 36,040 | 43,540 |

| Jewelry gold price - 333 gold (8K) | 30,830 | 38,330 |

| 3. SJC - Updated: June 16, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,800 | 120,300 |

| SJC gold 5 chi | 117,800 | 120,320 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,800 | 120,330 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,700 | 116,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,700 | 116,300 |

| Jewelry 99.99% | 113,700 | 115,600 |

| Jewelry 99% | 109,955 | 114,455 |

| Jewelry 68% | 71,865 | 78,765 |

| Jewelry 41.7% | 41,460 | 48,360 |

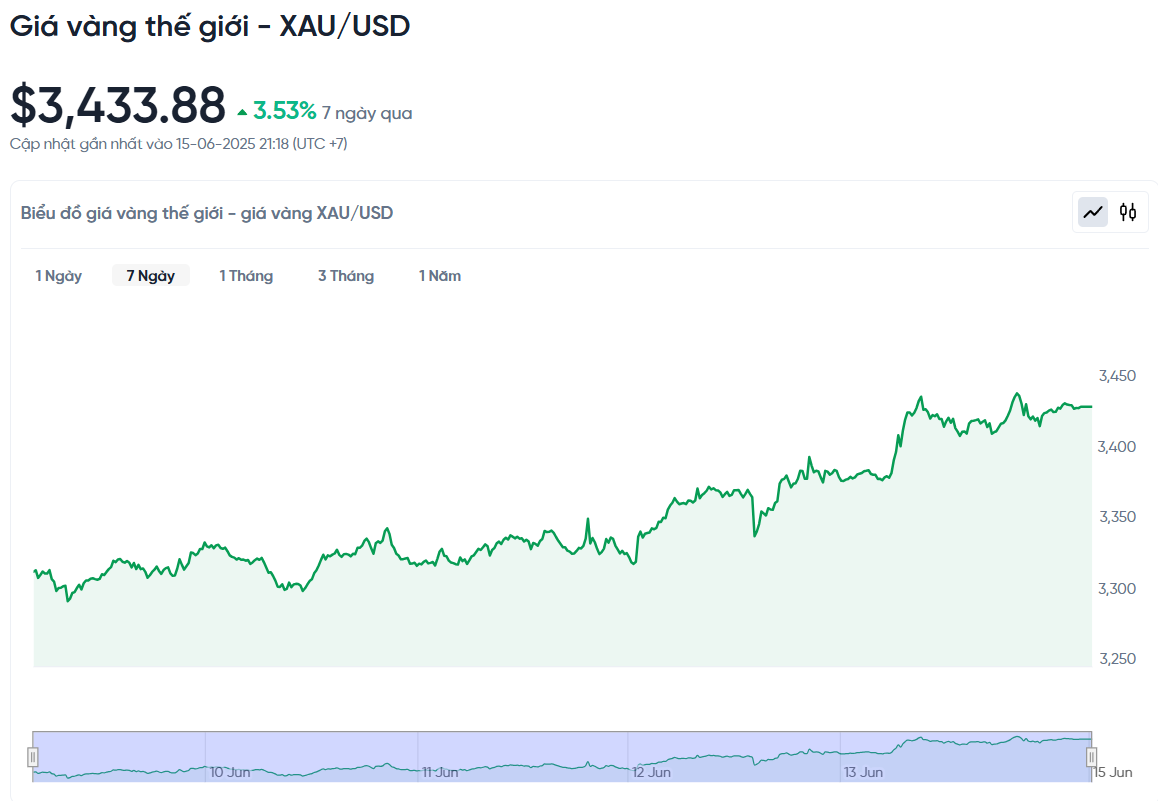

World gold price today June 16, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on June 16, Vietnam time, was at 3,433.88 USD/ounce. Today's gold price remained unchanged compared to yesterday but increased by 117.02 USD/ounce compared to the beginning of last week. Converted according to the USD exchange rate at Vietcombank (26,223 VND/USD), the world gold price is about 112.66 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 7.64 million VND/tael higher than the international gold price, down nearly 1 million VND/tael compared to last week.

Gold prices closed last week at a record high, surpassing $3,400 an ounce, thanks to a wave of safe-haven buying as tensions between Israel and Iran escalated. However, many experts are cautious about the possibility of prices continuing to break the peak next week.

"The Israel-Iran conflict could keep gold above $3,400, but it's unlikely to push prices higher without further escalation. History shows that geopolitical rallies are difficult to sustain in the long term," said Ole Hansen, head of commodity strategy at Saxo Bank.

Michele Schneider, market strategist at MarketGauge, warned investors to brace for short-term volatility as traders take profits. However, she said the long-term trend of gold prices remains unchanged. Conflicts can have many consequences, such as higher inflation, so while prices may peak temporarily, I don’t think this is a turning point.

Investors are cautiously waiting after the Israeli airstrike, said Naeem Aslam, chief investment officer at Zaye Capital Markets. He highlighted the importance of oil prices and Iran's response: "If Iran retaliates strongly, especially if it threatens oil supplies through the Strait of Hormuz, gold could explode on hedging demand. On the other hand, if tensions ease, the rally in gold could stall."

However, Mr. Michael Brown from Pepperstone is still optimistic about the long-term prospect of gold price increase: "The latest developments reinforce the role of gold in investment portfolios in the context of uncertainty. I believe gold prices will continue to increase, especially when organizations are diversifying reserves."

After a week of focusing on inflation figures, next week markets will turn their attention to interest rate decisions from central banks and signals on future monetary policy.

The week will start with the Empire State Manufacturing Survey report on Monday, followed by the Bank of Japan’s (BOJ) interest rate decision in the evening. On Tuesday, traders will be closely watching May U.S. retail sales data to gauge whether consumer sentiment is weakening.

Wednesday is a big day for the Federal Reserve, with its monetary policy decision. While markets expect interest rates to remain unchanged, all eyes will be on Chairman Jerome Powell to see if he hints at a possible rate cut in the future. The same day, May housing starts and weekly jobless claims figures are due out early.

U.S. markets will be closed on Thursday for the Juneteenth holiday, but two major central banks, the Swiss National Bank (SNB) and the Bank of England (BOE), will announce monetary policy decisions. The trading week will close with the Philly Fed Manufacturing Survey report on Friday.

Gold Price Forecast

Regarding the short-term outlook, Mr. Peter Grant from Zanier Metals predicted: "If the threshold of 3,400 USD/ounce is surpassed, the gold price next week may encounter some minor resistance at 3,417 USD and 3,431 USD. However, the possibility of setting a new peak is very high if the current upward momentum is maintained."

FxPro senior market analyst Alex Kuptsikevich predicts that gold prices will continue to rise in the coming period. The reasons come from strong buying demand from central banks, a weak USD and increasing geopolitical tensions.

Central banks are buying gold at record levels, Kuptsikevich said. They are expected to buy more than 1,000 tonnes of gold a year in 2022-24, pushing global reserves to 36,000 tonnes by the end of last year – close to the record of 38,000 tonnes in 1965. Gold now accounts for 20% of global reserves, surpassing the euro (16%) and second only to the US dollar (46%).

The second factor supporting gold prices is the weakening US dollar and falling US Treasury yields. US inflation has not increased as much as feared despite tariffs, while the economy has shown signs of slowing. This has led the market to expect the Fed to cut interest rates as early as September, earlier than the previous forecast of October.

Geopolitics cannot be ignored. Gold has proven its safe-haven status by rallying sharply following the latest Middle East tensions. Demand will increase further if the conflict escalates.

Kuptsikevich said $3,400 an ounce would be a key level to watch. If it is successfully broken, gold prices could continue their upward trend. Otherwise, the market could see a short-term correction.

In addition to geopolitical factors, gold prices next week will pay special attention to the US Federal Reserve's monetary policy meeting and Chairman Jerome Powell's speech. This could be a key factor in determining the precious metal's upward momentum in the coming time.

"If the Fed signals more dovishness than expected after the latest inflation report, this could add strength to gold bulls. This scenario could push gold prices above the record $3,500 level, especially if supported by geopolitical factors. On the other hand, if the Fed is cautious and does not hint at a rate cut, gold prices could lose their appeal as investors adjust their expectations," said Lukman Otunuga, senior market analyst at FXTM.

Technically, Otunuga said the daily chart for gold remains bullish, with a high probability of continuing to push the price towards the record high of $3,500 and beyond. Conversely, if it fails to hold that level, the price could fall back to the $3,400 or even $3,360 region.

Source: https://baonghean.vn/gia-vang-hom-nay-16-6-2025-gia-vang-trong-nuoc-cao-hon-the-gioi-7-64-trieu-dong-10299711.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)