The Tax Department of Region I has just issued a warning about the situation of fake tax authorities asking taxpayers to update their address information.

This unit said that the tax authority does not require organizations, enterprises, and business households to submit citizen identification cards or business registration certificates to update information according to the two-level local government model.

Therefore, taxpayers need to be vigilant against acts of impersonating tax authorities via phone, email, or text messages to defraud and profit. Taxpayers should absolutely not follow instructions from unofficial sources of information.

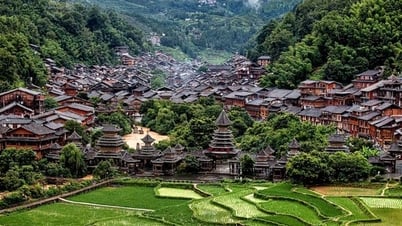

According to the tax authority, all requests for updating taxpayers' address information are fake. Photo: Pham Hai

The Tax Department of Region I also informed that the tax authority has reviewed, standardized, and updated the addresses of organizations, enterprises, and business households according to the list of 2-level administrative areas (provincial and communal levels) on the tax sector's database system.

The tax authority will notify the taxpayer of the taxpayer's address according to the new administrative area and information of the tax authority directly managing the taxpayer (via the electronic tax transaction account, taxpayer's email, eTax Mobile application of the legal representative).

Enterprises, business households, cooperatives, cooperative unions, and cooperative groups continue to use the business registration certificate, household business registration certificate, cooperative registration certificate, cooperative group registration certificate, and branch/representative office/business location registration certificate that has been issued.

Recently, other tax units such as Tax Department of Region VIII and Tax Department of Region XV also sent official dispatches to taxpayers, affirming that changing the taxpayer's address according to the new administrative area list does not require taxpayers to adjust the information on the Business Registration Certificate.

The official notice from the tax authority is the basis for the taxpayer to explain to the relevant authority or to the customer in case the address stated on the invoice is the address that the tax authority has updated according to the new administrative area list but the information on the business registration certificate is still the address according to the old administrative area list.

Source: https://vtcnews.vn/co-quan-thue-canh-bao-ve-cac-yeu-cau-cap-nhat-dia-chi-moi-qua-dien-thoai-ar951934.html

Comment (0)