The stock market's upward momentum continued for the fourth consecutive session. In the morning, the market was somewhat shaky, with the VN-Index changing colors as buyers and sellers struggled. However, the level of fluctuation was not too strong as liquidity was recorded as relatively low.

After 1:30 p.m., the market had a more solid increase and successfully tested the short-term resistance level of 1,380 points. Liquidity increased towards the end of the session with buying power dominating.

VN-Index closed nearly 7 points higher than the reference, up to nearly 1,385 points. This is the new peak price area of the market this year and the highest level since the end of April 2022.

HoSE has 204 stocks increasing, nearly double the 109 stocks decreasing. Of which, 12 stocks are purple with many representatives having liquidity of hundreds of billions. Today's positive developments mainly come from demand in the mid-cap group while on the contrary, some bluechip stocks have adjusted after a session of "carrying" the market.

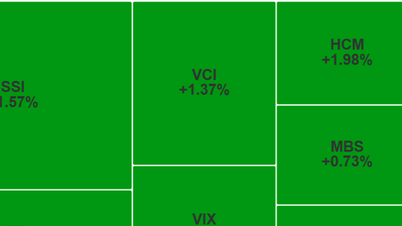

The outstanding performance today is the group of securities stocks - an industry with high sensitivity to the market outlook. The board is almost completely covered in green, including VIX, HCM, FTS and CTS increasing to the maximum amplitude. VIX alone recorded liquidity of nearly 1,617 billion VND, the highest in the market.

In addition, important codes of the industry such as SSI or VND also accumulated over 4%. BSI, SHS, VCI, MBS, EVF also closed higher than the reference around 3-5%.

In the 4th consecutive session of increase, liquidity on HoSE floor also accumulated more than 1,400 billion. Total transaction value today recorded over 22,400 billion VND.

Positive sentiment also spread to foreign investors as they returned to net buying about VND886 billion. Today, foreign investors focused on disbursing in GMD, GEX, VIX and SSI.

In the last news of the previous session, Saigon - Hanoi Securities (SHS) assessed that the market has recovered and increased strongly since the time the US temporarily suspended the imposition of reciprocal tariffs. In the short term, investors will focus their expectations on the new tax rate after trade negotiations and expected second quarter business results.

This analysis group believes that the current price range is not attractive for disbursement, and that there needs to be a basis and accurate data to evaluate businesses, as well as macro factors. According to SHS, individual opportunities in the market still exist but need to be carefully evaluated.

PV (synthesis)Source: https://baohaiphongplus.vn/stock-stock-day-song-vn-index-lap-dinh-moi-trong-nam-415476.html

Comment (0)