At the end of the stock market session on July 9, VN-Index closed at 1,431 points, up 15.8 points, equivalent to 1.12%.

At the opening of the trading session on July 9, the VN-Index continued its upward momentum from the second half of the previous session, quickly increasing by 6 points compared to the reference level. The main increase in the morning session came from banking and securities stocks, helping the general index surpass the 1,430-point mark. However, the increase was soon narrowed due to increased profit-taking pressure from technology stocks.

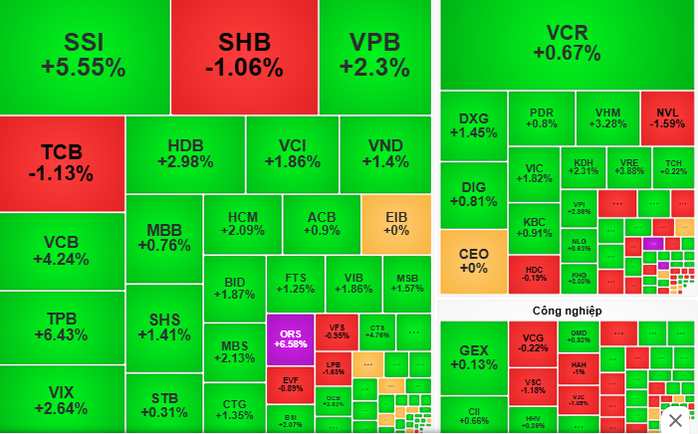

In the afternoon session, green spread to other sectors, helping the index regain the 1,430 point mark. However, profit-taking pressure continued to appear in some large-cap stocks such as TCB, SHB , LPB (banking) and FPT (technology), causing the increase to be restrained. Market liquidity remained high, reaching VND34,000 billion. Foreign investors continued to net buy strongly with a total value of VND1,947 billion, focusing on stocks such as SSI, SHB and VCB.

At the end of the session, VN-Index closed at 1,431 points, up 15.8 points, equivalent to 1.12%.

According to VCBS Securities Company, with support from large-cap stocks, VN-Index successfully conquered the 1,430-point mark, despite recording some fluctuations due to profit-taking pressure.

The recommendation for the trading session on July 10 is that investors should maintain holding stocks that are showing good growth momentum, while taking advantage of speculative cash flow to disburse into stocks that attract cash flow with the goal of surfing T+. Notable industry groups include securities, some real estate stocks and banks.

Dragon Viet Securities Company (VDSC) commented that the liquidity on July 9 increased compared to the previous session, showing that profit-taking pressure increased, but cash flow was still enough to absorb supply and support the market. This increase could help the VN-Index reach new highs in the near future.

However, supply may continue to increase as the market moves up and the rally may stall if there is a strong dispute with sudden liquidity.

"Investors need to closely monitor supply and demand developments to assess the possibility of an expansion of the uptrend. On the buying side, investors can exploit opportunities in stocks that show good signals from the support zone or are forming a continuing uptrend pattern. On the selling side, investors should consider taking short-term profits at good price zones to preserve profits" - VDSC recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-10-7-nhom-co-phieu-nao-tiep-tuc-dan-song-196250709165412583.htm

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)