14 years of applying credit room

In Official Dispatch No. 104/CD-TTg on enhancing the effectiveness of monetary and fiscal policy management (dated July 6, 2025), the Prime Minister requested the State Bank to strive for a full-year credit growth of about 16% compared to 2024 and by 2026, manage credit growth according to market tools and remove quotas. The State Bank urgently reviews, analyzes, assesses impacts, studies international experience, and urgently considers removing administrative tools in credit growth management through allocating credit growth targets to each credit institution...

Up to now, the State Bank has applied the credit limit tool for credit institutions for 14 years, since 2011 when inflation increased to 18.13% due to the consequences of loose monetary policy and trade deficit, government spending increased continuously leading to increased aggregate demand. Previously, from 2005 to 2010, Vietnam's money supply and credit balance grew rapidly, with an average growth rate of 30%/year, the amount of money in circulation was large while the amount of domestic products did not increase correspondingly, leading to high inflation. After tightening monetary and fiscal policies, inflation decreased sharply, in 2015 it was at 0.6% and from 2020 to now, inflation has been maintained in the range of 1.84-3.24%. Positive credit growth results in 2025 after a long period of being affected by the Covid-19 pandemic have made many people interested in removing credit limits.

According to experts, the credit room for banks is like a "valve" that controls the money supply to the economy . Because looking back at the past, when credit growth was "hot", there were times when it exceeded 30%, causing many consequences and risks to the banking system in particular, as well as the economy in general. When banks raced to increase credit growth, they would lend "easy", causing bad debt to increase. In fact, the banking industry has spent a long time dealing with the burden of bad debt, so the credit "valve" has played a positive role in releasing the "blood clot" of bad debt, with credit growth in recent years being controlled to only about 12-14%, ensuring the safety of the banking system, as well as promoting economic development.

Former Chairman of the Board of Directors of Loc Phat Joint Stock Commercial Bank (LPBank) Nguyen Duc Huong said that the State Bank's application of credit room has helped the State Bank manage credit growth flexibly, with specific and clear criteria in allocating credit to banks such as scale, asset quality, etc. Previously, the credit room was actually effective, contributing to stabilizing the monetary market, "cooling down" interest rate races, bringing sustainable health to banks, which are considered the backbone of the economy. Not to mention, the credit room also helps authorities control the amount of money circulating in the economy, thereby actively controlling inflation, contributing to stabilizing the value of money.

Still an effective tool

According to the State Bank's leaders, although applying the credit room, the State Bank flexibly operates this tool based on the actual domestic economic situation, as well as considering the developments of the global economy. For example, in 2024, instead of granting each batch as in previous years, the State Bank assigned the entire credit growth target to banks from the beginning of the year, based on the financial health score, from which banks proactively made credit plans. However, this is not a hard target that the management agency continuously adjusts based on the health of the economy, as well as the banks themselves. In fact, the State Bank has twice loosened the credit room in 2024 for banks with good growth or reduced the room for banks that do not ensure growth.

To achieve the GDP growth target of over 8% in 2025, the State Bank has set a credit growth target of 16%, equivalent to an additional amount of VND 2.5 million billion. As of June 30, the outstanding credit balance of the banking system exceeded VND 17.2 million billion, up 9.9% compared to the end of 2024, up 19.32% compared to the same period in 2024, the highest credit growth since 2023.

Many opinions say that at this time, with the characteristics of the economy largely dependent on capital from banks, the credit room is still an effective tool to control money supply. However, in the long term, it is possible to abandon the credit limit tool and use other tools, but this can only be done when market conditions are ripe and when monetary policy no longer has to simultaneously achieve multiple goals at the same time as it does now.

The State Bank's implementation of a roadmap to limit and eventually eliminate the allocation of credit growth targets for each credit institution is considered necessary in the current context. However, the State Bank needs to carefully analyze the factors to find a balance between benefits and risks. Because, to remove the credit room, conditions such as a stable macro economy, under-control inflation, and the health of the banking system are required.

Head of Monetary Policy Department, State Bank of Vietnam Pham Chi Quang:

There is no permanent solution.

During the period of loose monetary policy (2005-2010), credit growth increased rapidly, at times up to 54%, causing many credit institutions to be on the brink of bankruptcy. Therefore, to maintain the credit system from collapsing, the State Bank has built a credit room policy, which plays a positive role in helping to achieve sustainable economic growth and control inflation. However, there is no permanent solution. The State Bank recognizes that this is an administrative solution that needs to be changed.

In 2025, the State Bank will remove the credit room for foreign banks, non-bank credit institutions..., only applying to commercial banks. This is a stage in the removal roadmap. The State Bank will have solutions suitable to Vietnam's actual conditions to both stabilize the macro economy and control inflation. The State Bank will carefully study and evaluate policies to remove the credit room.

Associate Professor, Dr. Nguyen Huu Huan - Ho Chi Minh City University of Economics:

Credit management by room is no longer suitable.

Credit management by granting credit limits has been maintained for a long time. Therefore, the State Bank should also consider abolishing it, because although credit room management is effective, it is an administrative measure and is no longer appropriate. However, the historical lesson of hot credit growth from 2007 to 2010 leading to high inflation is still there and the State Bank had to use credit room to regulate the flow of money into the market.

Vietnam's current monetary policy is multi-targeted, promoting economic growth, stabilizing exchange rates, but still controlling inflation. The currency market is volatile, so when removing credit room, the State Bank needs to apply quantitative models, use data and use Artificial Intelligence (AI) technology for analysis to be able to manage. Otherwise, shocks to the economy like in 2008, inflation increased sharply due to excessive credit easing.

Economist, Dr. Le Hong Phong, former General Director of LPBank:

Time to consider removing credit room

Credit is growing in the right direction and is expected to continue to increase strongly in the last months of the year. Therefore, it is appropriate for the State Bank to consider removing the credit room in the coming time.

Previously, the annual allocation of credit room at a certain rate sometimes led to underutilization of the limit. Some banks, because they did not fully utilize their credit room, had to find ways to meet their year-end targets to qualify for the State Bank to grant the following year a credit room equal to or higher than the previous year. Eliminating the credit room will overcome the uneven utilization of the room.

When there is no more credit room, banks will base on their financial capacity, risk management ability and business strategy to decide on the scale and growth rate of outstanding loans. From there, capital will flow into areas with high demand and great growth potential such as manufacturing, export, high-tech agriculture, clean energy, infrastructure, etc.

Thanh Nga recorded

Source: https://hanoimoi.vn/bo-room-tin-dung-can-co-lo-trinh-708467.html

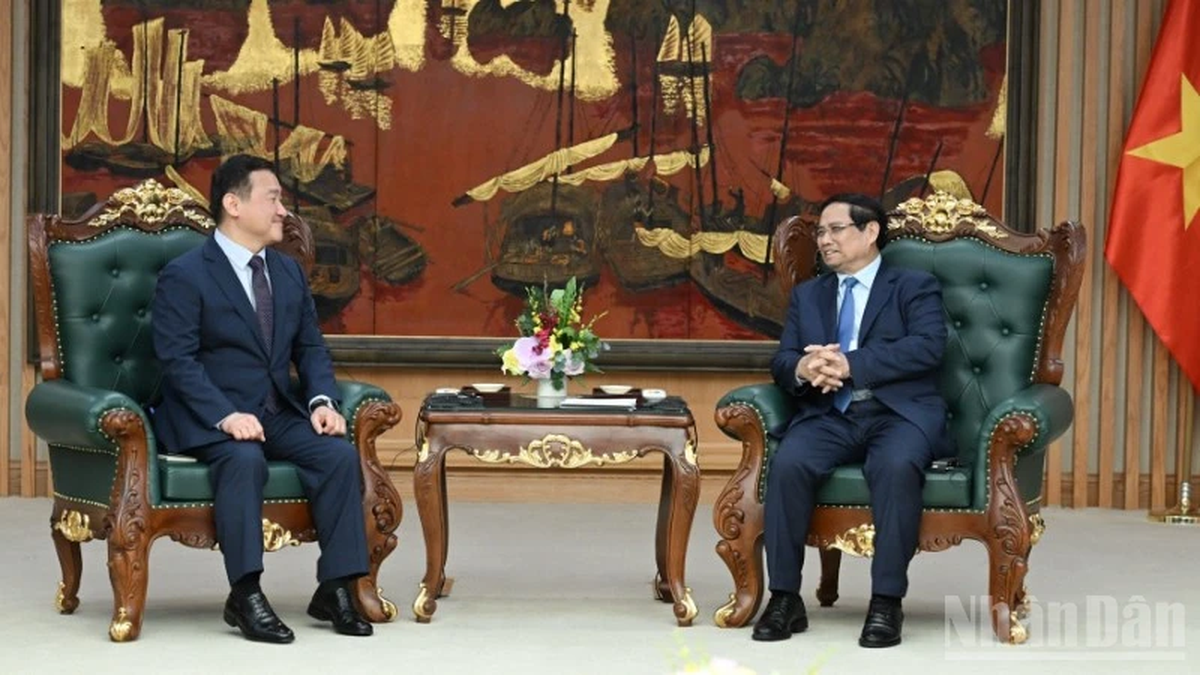

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

Comment (0)