According to experts, this regulation represents an open but cautious step, helping businesses access capital more effectively, while increasing transparency and better risk management for investors, thereby promoting sustainable development of the bond market.

Unblocking capital flow

Ms. Nguyen Ngoc Anh - General Director of SSI Fund Management Company (SSIAM) - said the new regulation aims to strengthen the screening of financial capacity of issuing enterprises, thereby minimizing the risk of corporate bond default.

According to Ms. Ngoc Anh, the debt-to-equity ratio is usually around 3 times, depending on the industry and the characteristics of the business. Therefore, allowing a maximum of 5 times, including bonds expected to be issued, will not tighten the market as some fear.

According to Ms. Ngoc Anh, the positive point of the regulation is that it excludes industries with large and specific capital needs such as real estate and public companies that have been and are subject to transparent supervision.

In addition, the new regulation also does not apply to issuing organizations that are state-owned enterprises, credit institutions, insurance enterprises, reinsurance enterprises, insurance brokerage enterprises, securities companies, and securities investment fund management companies that comply with relevant legal provisions.

Data from Vietnam Investment Credit Rating Company (VIS Rating) on all non-public companies in Vietnam in the past 3 years shows that about 25% of companies have a debt-to-equity ratio exceeding 5 times or negative equity.

Mr. Nguyen Dinh Duy, CFA, director - senior analyst of VIS Rating - said the new regulation on financial leverage ratio limit applies to non-public companies issuing individual bonds.

While high leverage is a significant credit risk for low-rated issuers, the rating agency found that among the 182 companies that defaulted on their bonds, the main cause of defaults was not high leverage, but weak cash flow and poor liquidity management.

"It is noteworthy that less than 25% of the above-mentioned late payments have a leverage ratio exceeding 5 times or negative equity, while the average ratio of the remaining 3/4 is only 2.8 times, approximately equal to the average of other issuers that do not have late bond payments," VIS Rating experts analyzed.

This shows that assessing a company's credit risk should not only be based on a single financial indicator such as leverage ratio, but also pay attention to operational and financial management factors such as cash flow and liquidity.

The "key" to protecting investors

According to experts, the current problem of the market is to focus on information transparency. Specifically, for bonds issued by enterprises with high debt-to-equity ratios, the prospectus may be required to clearly state that these are "high-risk bonds", along with mandatory credit ratings from reputable organizations so that investors can fully evaluate them.

Investor classification is also important. Regulations now require private placements to be issued only to “professional investors,” protecting less-informed retail investors from complex, risky financial products.

However, according to SSIAM CEO, it is necessary to create conditions for foreign investors, who are willing to accept high risks in exchange for attractive returns, to access these products once they clearly understand the nature of the risks.

Expert Nguyen Dinh Duy said that most investors consider more than just financial leverage when buying corporate bonds. Investors must evaluate not only the credit risk at the issuer level but also the specific risks in each debt instrument. These factors include payment priority, collateral quality and legal commitments.

According to this expert, unlike corporate credit ratings that often reflect overall credit capacity, bond credit ratings reflect the specific terms of each bond, providing a more accurate assessment of credit risk. Such detailed assessments help investors make more informed decisions, in accordance with the risk level of each bond.

Mr. Nguyen Quang Thuan, Chairman of FiinGroup, said that Vietnam's credit balance to GDP will be around 136% by the end of 2024. This is a very high level compared to other countries in the region, and at the same time shows too much dependence, creating challenges and risks for the financial system.

This reality requires continued reform of the capital market. According to Mr. Thuan, it is necessary to develop the corporate bond market first so that large-scale enterprises can diversify their capital sources and have the conditions to extend their debt terms because commercial banks have difficulty meeting the conditions.

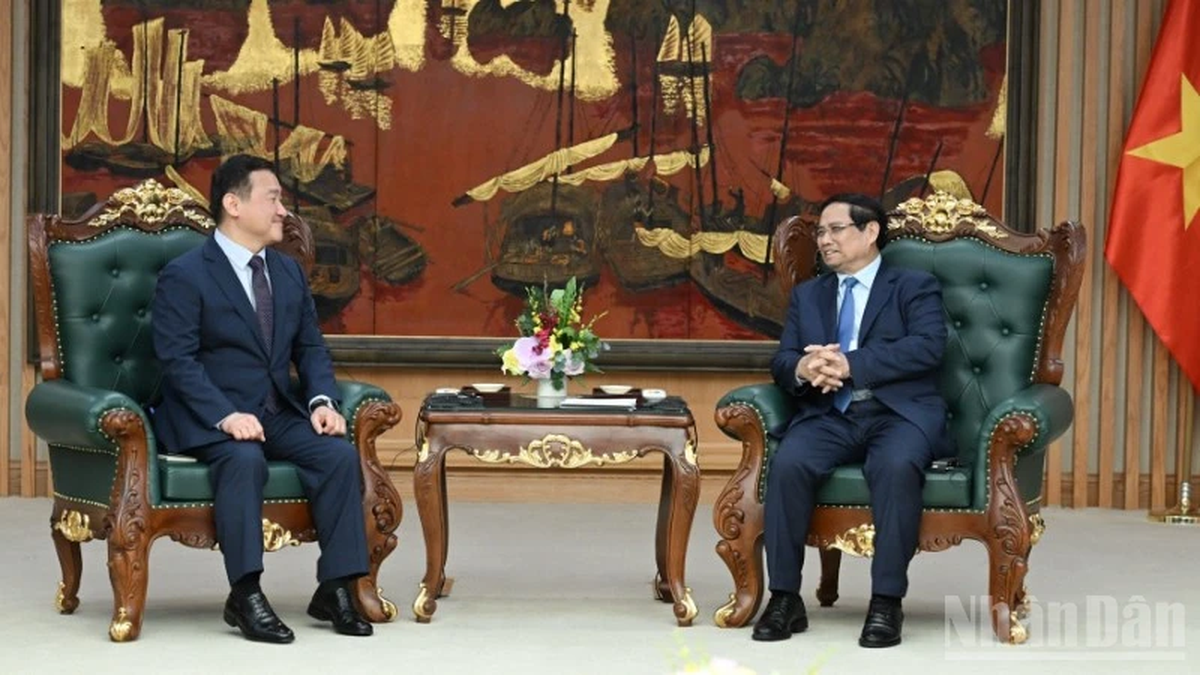

Banking is the industry group with the highest value of corporate bond issuance today - Photo: Q.D.

80% of bonds issued by banks

According to data from VIS Rating, June 2025 recorded the highest monthly bond issuance value since 2022, reaching VND94,000 billion, up 36% over the previous month, but more than 80% were privately issued bonds by banks.

As of the end of June, major private banks (ACB , MBBank and Techcombank) have completed about 50% of their bond issuance plan for 2025, the rest will continue to be deployed in the second half of the year. In the non-financial corporate sector, the housing real estate industry accounts for a large market share, of which Vingroup and related companies account for 81% of issuance in the first 6 months of 2025.

VIS Rating estimates that approximately VND222 trillion of bonds will mature in the next 12 months. Of these, 44% will be issued by issuers with weak or lower credit profiles. At the same time, 92 bonds with a total value of approximately VND50 trillion have been extended for two years or less under Decree 08 for the 2023-2025 period, mainly to reduce short-term payment pressure and avoid late payment.

Statistics also show that the total outstanding bond debt in the market is over 1.36 million billion VND. Of which, there are 2,180 individual codes and 103 public codes from 404 issuing organizations.

According to experts, bond issuance outside the banking system is still recovering slowly. The main reason is that the credit environment with low interest rates is causing businesses to prioritize borrowing from banks instead of issuing bonds.

Bond market should not be over tightened

In response to opinions that it is necessary to continue tightening the conditions for issuing individual bonds after a series of market events in the period of 2022-2023, according to Ms. Nguyen Ngoc Anh, bonds are instruments with unique characteristics, where even a one-day delay in payment is considered a violation of obligations, while bank loans are only classified as bad debt group 3 if they are delayed from 91 to 180 days. Therefore, tightening this market too much is not the optimal solution.

"More reforms are still needed to unleash the true potential of this capital mobilization channel. The bond market will not be able to 'transform' overnight. But if it goes in the right direction, it will become an important blood vessel for the economy , helping businesses access capital more effectively, while protecting investors through information transparency and clear risk classification," Ms. Ngoc Anh affirmed.

Source: https://tuoitre.vn/thi-truong-trai-phieu-se-coi-mo-nhung-khong-con-de-dai-20250706074252335.htm

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/d869c6b3e4da42399e2cd0f4ca26050c)

Comment (0)