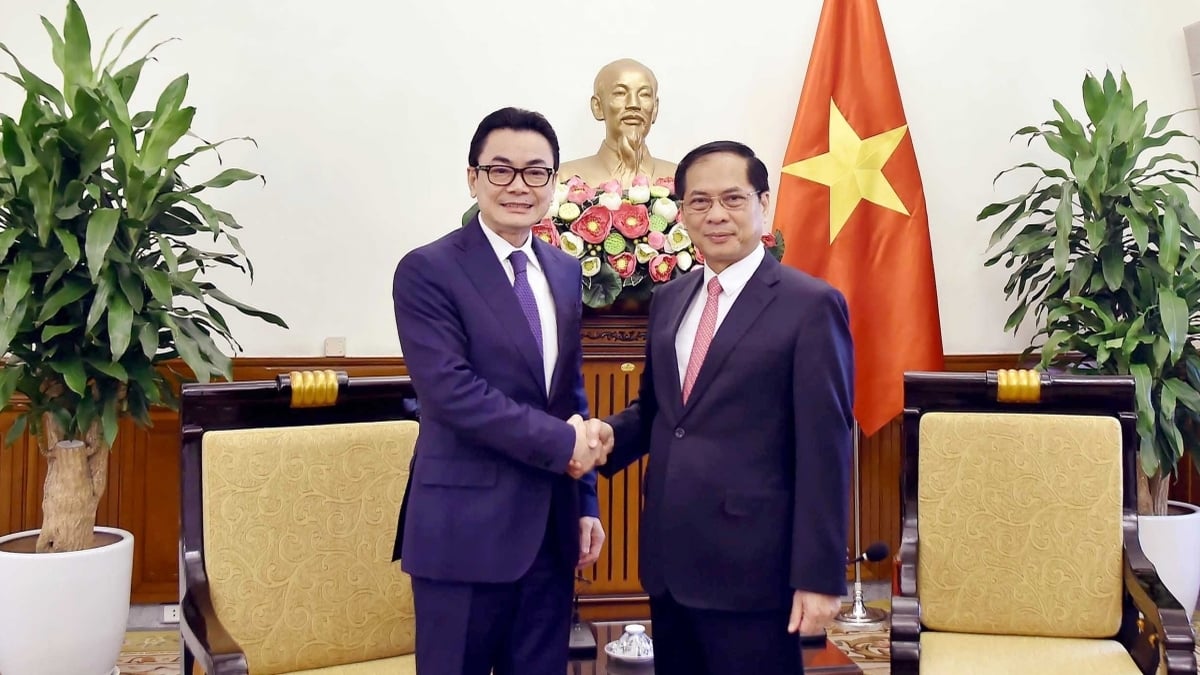

The National Assembly voted to pass the Law amending and supplementing a number of articles of the Enterprise Law. (Photo: VNA)

Previously, Minister of Finance Nguyen Van Thang, authorized by the Prime Minister, reported on the reception and explanation of National Assembly deputies' opinions on the Draft Law amending and supplementing a number of articles of the Law on Enterprises.

Adding beneficial owner information will incur compliance costs

According to him, regarding the regulations related to “beneficial owners of enterprises,” the Standing Committee of the Economic and Financial Committee and many National Assembly deputies agreed to stipulate the concept of “beneficial owners of enterprises” in a general direction, stipulating general principles as in the draft Law to be similar to the Law on Prevention and Combat of Money Laundering.

The Government accepts the opinions of National Assembly deputies on technical comments on the responsibility for collecting, storing, and providing information on beneficial owners of enterprises and the content of the regulations assigning the Government to provide specific guidance on criteria for determining beneficial owners of enterprises, sanctions for violations when failing to provide information as prescribed...

Regarding some opinions proposing to add a transitional provision (Article 2 of the draft Law) stipulating a specific time limit for enterprises established before the effective date of this Law to supplement information on beneficial owners of the enterprise, the Government accepted and amended in the direction that supplementing information on beneficial owners of the enterprise is carried out simultaneously at the time the enterprise carries out procedures to register changes to the enterprise registration content.

The Minister added that the draft Law does not specify a specific deadline for enterprises established before the effective date of this Law to provide information about the beneficial owners of the enterprise to the business registration authority for the following reason: requiring enterprises to carry out a separate administrative procedure just to declare additional information about the beneficial owners of the enterprise will increase the number of administrative procedures, resulting in compliance costs for enterprises.

This is not suitable in the context that the Party and State are implementing many drastic policies and strategies to simplify and reduce the time and costs of administrative procedures for businesses. At the same time, this requirement is also not suitable with the principle of non-retroactivity in the application of law as stipulated in the Law on Promulgation of Legal Documents.

In addition, comparing the benefits and costs, the specific time regulation that all enterprises established before the effective date of this Law must provide information on beneficial owners of the enterprise to the Business Registration Authority for storage and sharing of information when necessary is not an optimal solution in the context that information collection and provision can be done when requested by competent state agencies.

Furthermore, the number of enterprises providing additional information about beneficial owners to the Business Registration Authority has been increasingly complete over time (on average, about 35% of enterprises register changes to business registration contents every year).

Shift from pre-control to post-control

Clarifying the addition of civil servants who are allowed to participate in establishing and managing enterprises, according to Minister Nguyen Van Thang, accepting the opinions of a number of National Assembly deputies requesting a review to ensure that the regulations on subjects of establishment, capital contribution and enterprise management in the Enterprise Law are consistent with the Law on Science, Technology and Innovation and Resolution No. 193/2025/QH15, the draft Law has amended Point b, Clause 2 and Point b, Clause 3, Article 17 of the Enterprise Law in the direction of stipulating that subjects who are not allowed to establish, contribute capital and manage enterprises include civil servants and public employees according to the provisions of the Law on Cadres, Civil Servants and the Law on Public Employees, except in cases where it is implemented in accordance with the provisions of the law on science, technology, innovation and national digital transformation.

Regarding the content of regulations on private bond issuance by non-public companies, some National Assembly deputies proposed to consider not stipulating in the draft Law specific conditions for enterprises when issuing private bonds, and at the same time consider regulations similar to the Securities Law in the direction of assigning the Government to regulate this issue in detail.

Regarding this content, in Submission No. 286/TTr-CP and in the process of explaining the opinions of National Assembly deputies, the Government clarified the necessity of regulating this content and proposed to keep the provisions in the draft Law.

He explained that in Notice No. 2001/TB-VPQH, the National Assembly Standing Committee agreed to add to the draft Law the regulation on the debt-to-equity ratio as one of the conditions for issuing individual bonds of companies that are not public companies in order to increase the financial capacity of the issuing enterprise and limit the risks of corporate bond payment for both the issuing enterprise and the investor.

Regarding the content of the proposal to clarify the impact of this regulation on the management and operation of the Government to ensure it is consistent with reality, and at the same time review and adjust the technique to ensure clarity on the specific legal provisions applicable to the conditions for issuing individual bonds of state-owned enterprises, enterprises issuing bonds to implement real estate projects, credit institutions, insurance enterprises, reinsurance enterprises, insurance brokerage enterprises, securities companies, securities investment fund management companies are excluded entities, not complying with the provisions of the Enterprise Law, the Government has reviewed, accepted and clarified the specific contents in the Appendix to the Report.

In addition, Mr. Thang said that the Government accepted the opinions of the Economic and Financial Committee and a number of National Assembly deputies to complete the draft Law to clarify the responsibility of the Provincial People's Committee in organizing business registration, promulgating a process for checking the content of business registration in the area to ensure publicity, transparency, in accordance with the policy of "strongly shifting from pre-inspection to post-inspection associated with strengthening inspection and supervision" stated in Resolution 68-NQ/TW of the Politburo on private economic development, in accordance with the Law on Organization of Local Government./.

According to VNA

Source: https://baothanhhoa.vn/chinh-thuc-thong-qua-luat-sua-doi-bo-sung-mot-so-dieu-cua-luat-doanh-nghiep-252372.htm

Comment (0)