At a press conference on the morning of July 8, the State Bank of Vietnam (SBV) announced that credit for the entire economy by the end of June 2025 reached more than 17.2 million billion VND, an increase of 9.9% compared to the end of 2024, mainly focusing on priority areas and production and business.

According to Deputy Governor of the State Bank of Vietnam Pham Thanh Ha, in the first months of 2025, global economic growth slowed down, affected by many factors, from rapidly changing tariff policies to increasing geopolitical tensions.

Early in the morning of July 8, Vietnam time, the US announced a tax rate of 25-40% for 14 countries, effective from August 1. The US also warned that it would continue to increase taxes if these countries retaliate, showing that the global economy still has many uncertainties.

Although inflation has cooled to the target level, there is still a risk of it rising again.

Deputy Governor Pham Thanh Ha said that potential risks in the world financial and monetary markets put pressure on the management of domestic monetary policy, exchange rates, and interest rates as well as the implementation of the goal of supporting economic growth of 8% or more in 2025.

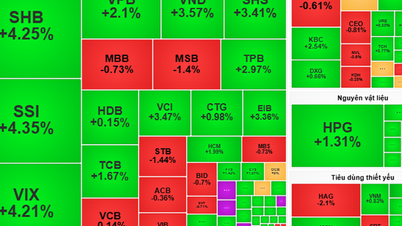

The State Bank of Vietnam expects credit growth for the entire system in 2025 to be about 16%, flexibly adjusted according to the actual situation, based on the growth and inflation targets set by the National Assembly and the Government.

In the first 5 months of 2025 compared to the same period in 2024, non-cash payment transactions increased by 45.44% in quantity and 25.21% in value; via the Internet channel increased by nearly 47.09% in quantity and 34.46% in value; via mobile phone channel increased by 39.9% in quantity and 23.22% in value; transactions via QR Code increased by 76.62% in quantity and 179.14% in value...

At credit institutions and payment intermediaries, as of June 27, more than 119 million individual customer profiles (CIFs) had been compared and updated with biometric information via chip-embedded ID cards or the VNeID application (reaching 100% of the total number of individual accounts generating transactions on digital channels).

In addition, more than 1.1 million institutional customer profiles have been biometrically verified (reaching more than 100% of the total number of institutional payment accounts generating transactions on digital channels). At the same time, contributing to the elimination of nearly 86 million "dead" accounts.

After a period of cleaning the customer database and applying biometric information matching solutions, compared to the same period in 2024, the number of individual customers who were scammed and lost money decreased by 57%; the number of individual accounts receiving scammed money decreased by 47%.

According to the orientation for the last 6 months of the year, the State Bank continues to direct credit institutions to reduce operating costs, increase the application of information technology, digital transformation and other solutions to reduce lending interest rates, and at the same time direct credit institutions to direct credit to production and business sectors and priority sectors.

Credit for priority sectors (by the end of May 2025): - Credit for the agricultural and rural sectors increased by 5.31% compared to the end of 2024 and accounted for 23.16% of outstanding credit in the economy (in the same period of 2024, it increased by 2.57% compared to the end of 2023; in the end of 2024, it increased by 11.27% compared to the end of 2023). Of which, credit for high-tech agriculture decreased by 4.07% compared to the end of 2024, accounting for 0.64% of outstanding loans for agriculture and rural areas. - Credit for small and medium enterprises increased by 5.71% compared to the end of 2024, accounting for 17.51% of outstanding credit in the economy (in the same period of 2024, it decreased by 0.15% compared to the end of 2023; at the end of 2024, it increased by 10.69% compared to the end of 2023). - Export credit (excluding corporate bond investment) increased by 2.91% compared to the end of 2024, accounting for 2.06% of outstanding credit in the economy (in the same period of 2024, it decreased by 0.89% compared to the end of 2023; at the end of 2024, it increased by 8.42% compared to the end of 2023). - Credit for supporting industries increased by 15.69% compared to the end of 2024, accounting for 3.24% of outstanding credit in the economy (in the same period of 2024, it increased by 9.67% compared to the end of 2023; in the end of 2024, it increased by 24.72% compared to the end of 2023). - Credit for high-tech enterprises increased by 17.59% compared to the end of 2024, accounting for 0.43% of outstanding credit in the economy (in the same period of 2024, it increased by 18.16% compared to the end of 2023; at the end of 2024, it increased by 34.2% compared to the end of 2023). |

Source: https://vietnamnet.vn/so-luong-tai-khoan-ca-nhan-nhan-tien-lua-dao-giam-gan-50-2419280.html

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)