Circular No. 12/2025/TT-BNV detailing a number of articles of the Law on Social Insurance on compulsory social insurance

Circular 12/2025/TT-BNV details a number of articles of the Law on Social Insurance on compulsory social insurance, including: conditions for receiving monthly pension or survivor's allowance; settlement of sickness benefits; conditions for convalescence and health recovery after illness; maternity benefits; conditions for convalescence and health recovery after maternity; retirement regime; survivor's regime...

Sick leave

About the case of enjoying sick leave

According to the Circular, cases considered for settlement of sick leave benefits include:

1. Cases as prescribed in Clause 1, Article 42 of the Law on Social Insurance.

2. Female employees return to work before the end of their maternity leave period when giving birth as prescribed in Clause 1, Article 53 of the Law on Social Insurance; the father or the direct caregiver does not take leave as prescribed in Clause 6, Article 53 of the Law on Social Insurance; female employees who are surrogate mothers, the husband of the female employees who are surrogate mothers or the direct caregiver does not take leave as prescribed in Article 55 of the Law on Social Insurance; employees who are temporarily suspended from paying into the pension and death benefit fund as prescribed in Clause 37 of the Law on Social Insurance and fall into one of the cases prescribed in Clause 1, Article 42 of the Law on Social Insurance.

About sick leave time

The maximum period of sick leave in 2025 as prescribed in Clause 1, Article 43 of the Law on Social Insurance does not include the period of sick leave in case of starting sick leave due to illness on the list of illnesses requiring long-term treatment before July 1, 2025.

The maximum period of sick leave in a year as prescribed in Clause 1, Article 43 of the Law on Social Insurance does not depend on the time the employee starts participating in social insurance.

The maximum period of sick leave in a year for employees working in arduous, toxic, dangerous or especially arduous, toxic, dangerous occupations or jobs or working in areas with particularly difficult socio -economic conditions, is based on the occupation, job or workplace of the employee at the time the employee takes sick leave.

In case an employee is on leave in the cases specified in Clause 1, Article 42 of the Law on Social Insurance and the leave period coincides with the leave period prescribed by the law on labor or with full pay as prescribed by other specialized laws or with maternity leave or health recovery as prescribed by the law on social insurance, the overlapping period shall not be counted for sick leave; the leave period that does not coincide with the leave period prescribed by the law on labor or with full pay as prescribed by other specialized laws or with maternity leave or health recovery as prescribed by the law on social insurance shall be counted for sick leave as prescribed.

In case an employee has sick leave from the end of the previous year to the beginning of the following year, the sick leave of a year will be counted towards the sick leave of that year.

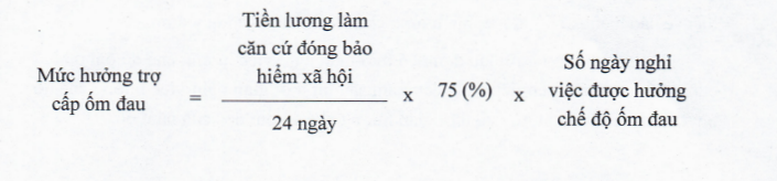

About how to calculate sick leave benefits

1. The level of sickness benefits for employees prescribed in Clause 1, Article 43 and Article 44 of the Law on Social Insurance is calculated as follows:

In there:

a) Salary is the basis for social insurance payment according to the provisions of Clause 1, Article 45 of the Law on Social Insurance.

The month of re-participation as prescribed in Point b, Clause 1, Article 45 of the Law on Social Insurance is the month of re-participation in social insurance after the employee terminates the labor contract, work contract or quits the job as prescribed by law.

b) The number of days off for sick leave is calculated based on working days, excluding holidays, Tet holidays, weekly days off, and does not include time that overlaps with leave time prescribed by labor laws or paid leave under other specialized laws or maternity leave or health recovery leave under social insurance laws.

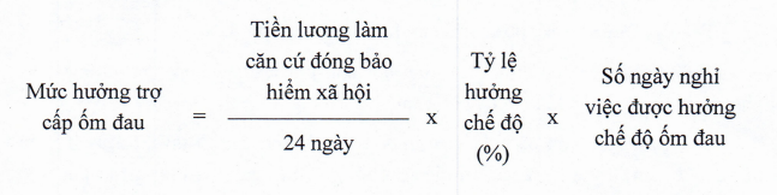

2. The level of sickness benefits for employees as prescribed in Clause 2, Article 43 of the Law on Social Insurance is calculated as follows:

In there:

a) Salary used as the basis for social insurance payment as prescribed in Clause 1, Article 45 of the Law on Social Insurance.

b) The benefit rate (%) is calculated at 65% if the employee has paid compulsory social insurance for 30 years or more; at 55% if the employee has paid compulsory social insurance for 15 years to less than 30 years; at 50% if the employee has paid compulsory social insurance for less than 15 years.

c) The number of days off for sick leave is calculated based on working days, excluding holidays, Tet holidays, weekly days off, and does not include time that overlaps with leave time prescribed by labor laws or paid leave under other specialized laws or maternity leave or health recovery leave under social insurance laws.

3. The level of sickness benefits for employees receiving sickness benefits shall not be adjusted when the Government adjusts the basic salary, reference salary, and regional minimum salary.

4. The working day used as the basis for determining the sick leave period of an employee is the normal working hours in a day that the employee must work for the employer according to the labor contract and labor regulations or regulations of law. Particularly for the subjects specified in Clause 2, Article 3 of Decree 158/2025/ND-CP and Point n, Clause 1, Article 2 of the Law on Social Insurance, the working day used as the basis for determining the sick leave period is the normal working hours in a day registered by the employee with the social insurance agency when registering to participate in compulsory social insurance, but not exceeding 08 hours.

Retirement mode

About pension conditions

1. The time spent doing arduous, toxic, dangerous or especially arduous, toxic, dangerous jobs or working in areas with particularly difficult socio-economic conditions, including the time spent working in areas with regional allowance coefficient of 0.7 or higher before January 1, 2021 or working in underground coal mining (hereinafter referred to as doing occupations, jobs or working in areas with particularly difficult socio-economic conditions) prescribed in Points b, c, Clause 1, Point b, Clause 2, Article 64 and Point c, Clause 1, Point b, Clause 2, Article 65 of the Law on Social Insurance as a basis for considering pension eligibility conditions is determined as follows:

a) For employees who are working in a profession, job or working in an area with particularly difficult socio-economic conditions and have to take time off work for treatment and rehabilitation due to a work-related accident or occupational disease (the employer pays full salary and pays compulsory social insurance), this time is counted as time working in a profession, job or working in an area with particularly difficult socio-economic conditions.

b) For employees who are doing a job or working in an area with particularly difficult socio-economic conditions and take maternity leave, and the period of maternity leave is counted as the period of compulsory social insurance payment, this period is counted as the period of doing a job or working in an area with particularly difficult socio-economic conditions.

c) For employees who are doing a job or working in an area with particularly difficult socio-economic conditions and are sent to work, study or cooperate in labor without doing a job or working in an area with particularly difficult socio-economic conditions, this time is not counted as time doing a job or working in an area with particularly difficult socio-economic conditions.

d) For employees who are working in a profession, job or in an area with particularly difficult socio-economic conditions and continue to make one-time payments for the remaining months of up to 06 months to be eligible for pension, this period will not be counted as the time working in a profession, job or in an area with particularly difficult socio-economic conditions.

2. Employees who meet the retirement age requirements but have a maximum of 06 months of compulsory social insurance contributions to qualify for a pension, are allowed to continue paying one-time contributions for the remaining months at a monthly rate equal to the total contributions of the employee and the employer before the employee quits the job to the retirement and death benefit fund as prescribed in Clause 7, Article 33 of the Law on Social Insurance and are specified in detail as follows:

a) Subjects who meet the retirement age requirements as prescribed in Point a and Point d, Clause 1, Point a and Point c, Clause 2, Article 64 of the Law on Social Insurance must have a compulsory social insurance payment period of from 14 years and 6 months to less than 15 years;

b) Subjects who meet the retirement age requirements as prescribed in Article 65 of the Law on Social Insurance must have paid compulsory social insurance for at least 19 years and 6 months to less than 20 years;

c) The earliest time to continue paying one-time for the missing months is the month immediately preceding the month eligible for pension according to regulations.

Calculate lump sum retirement benefit

In case an employee has met the conditions for receiving a pension according to regulations and continues to pay social insurance, the one-time subsidy upon retirement for a period of social insurance payment of more than 35 years for men and more than 30 years for women is calculated as follows:

1. Each year of social insurance payment exceeding 35 years for men and 30 years for women before reaching retirement age as prescribed is calculated at 0.5 times the average salary used as the basis for social insurance payment.

2. Each year of social insurance payment of more than 35 years for men and more than 30 years for women after reaching retirement age as prescribed is calculated as 02 times the average salary used as the basis for social insurance payment.

About retirement time

1. The time to receive pension for employees who have retired and met the requirements on social insurance payment period is calculated from the month following the month of reaching retirement age as prescribed. In case the employee continues to work and pay compulsory social insurance after reaching retirement age and meeting the requirements on social insurance payment period as prescribed, the time to receive pension is calculated from the month following the month of termination of the labor contract or termination of work.

a) In case the employee is entitled to pension due to reduced working capacity and meets the age and social insurance payment period requirements, the pension payment date is calculated from the month following the month in which the conclusion of reduced working capacity is made. In case the employee is concluded to have reduced working capacity before the month in which he/she reaches the prescribed retirement age, the pension payment date is calculated from the month in which the conclusion of reduced working capacity is made.

b) In case the date and month of birth cannot be determined (only the year of birth or month and year of birth are recorded), the time of receiving pension shall be calculated from the month following the month of reaching the prescribed retirement age. The determination of the employee's age shall be implemented according to the provisions of Clause 2, Article 12 of Decree No. 158/2025/ND-CP.

c) The earliest time to receive pension for employees who receive pension according to the provisions of Article 64 of the Law on Social Insurance and have paid social insurance for 15 years to less than 20 years is from the date the Law on Social Insurance takes effect.

2. The time to receive pension in the case specified in Clause 7, Article 33 of the Law on Social Insurance is calculated from the month following the month of full payment for the missing months.

3. The time to receive pension in cases where there are no longer enough original documents showing the working time in the public sector before January 1, 1995 is the time to receive pension stated in the settlement document of the social insurance agency.

Snow Letter

Source: https://baochinhphu.vn/quy-dinh-moi-nhat-ve-bao-hiem-xa-hoi-bat-buoc-102250704194218536.htm

![[Photo] Impressive display booths of provinces and cities at the Exhibition 80 years of the Journey of Independence - Freedom - Happiness](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/cd63e24d8ef7414dbf2194ab1af337ed)

![[Photo] Prime Minister Pham Minh Chinh attends the 80th anniversary of the founding of Voice of Vietnam Radio Station](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/abdcaa3d5d7f471abbe3ab22e5a35ec9)

![[Photo] General Secretary To Lam attends the 55th anniversary of the first television program broadcast](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/8b8bd4844b84459db41f6192ceb6dfdd)

![[Highlight] VIMC's mark at the National Achievement Exhibition](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/7/932133a54d8b4becad48ef4f082f3eea)

![[COMING UP] Workshop: Resolving concerns for Business Households about eliminating lump-sum tax](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/7/5627bb2d0c3349f2bf26accd8ca6dbc2)

Comment (0)