World gold prices recovered slightly in the first session of the week on July 7, after US President Donald Trump announced new tariffs on imported goods from 14 countries starting August 1. This move boosted demand for safe havens, although the strong USD still put pressure on this precious metal.

During the session, spot gold prices fell more than 1% at one point due to the increase in the USD, but then recovered and only fell 0.1%, trading at 3,332.62 USD/ounce at 17:49 GMT on July 7 (0:49 on July 8 Vietnam time).

US gold futures were almost flat, closing at $3,342.8 an ounce.

The US dollar rose 0.4% against a basket of major currencies, making gold - which is priced in dollars - more expensive for buyers holding other currencies.

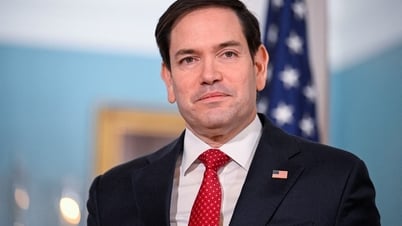

Tai Wong, an independent metals trader, said gold prices were rising in response to President Trump’s announcement of new tariffs on 14 countries starting August 1. However, other markets reacted in the opposite direction, with the stock market falling slightly.

Previously, on July 7, through the social network account Truth Social, President Trump announced new tariffs on 14 countries, including Japan, South Korea, Indonesia, Malaysia, Bangladesh, Thailand, Kazakhstan, South Africa, Laos, Myanmar and several other countries. According to President Trump, the new tariffs applied to the above countries will range from 25% to 40% and will take effect from August 1, 2025.

Countries with new tariffs lower than the tariffs President Trump announced on April 2, 2025 are Tunisia at 25% (previous tariff was 28%), Bangladesh 35% (37%), Serbia 35% (37%), Bosnia and Herzegovina 30% (35%), Kazakhstan 25% (27%), Laos 40% (48%), Myanmar 40% (44%), Cambodia 36% (49%).

Meanwhile, countries with new tariffs similar to the one announced by the US President on April 2, 2025 are South Korea (25%), Indonesia (32%), South Africa (30%) and Thailand (36%). Meanwhile, countries with new tariffs higher than the old ones are Japan 25% (24%) and Malaysia 25% (24%).

President Trump posted a letter on the social network Truth Social to the leaders of the countries and warned that if the countries responded by increasing import tariffs, the US Government would continue to raise the tariffs higher. However, President Trump said he was willing to lower the new tariffs if the countries changed their trade policies.

Major US stock indexes fell across the board after the Trump administration announced new tariffs. Investors are now awaiting further announcements from the White House on trade negotiations.

Minutes of the US Federal Reserve's latest meeting and speeches by several Fed officials will be released this week, providing further clues about the central bank's monetary policy direction.

In another development, the People's Bank of China (PBoC, the central bank) added gold to its foreign exchange reserves in June 2025 – the eighth consecutive month.

Bank of America said central banks are buying gold to diversify their reserves, reduce their dependence on the US dollar, and hedge against inflation and economic instability. Bank of America predicts this trend will continue.

In Vietnam, in the early morning of July 8, Saigon Jewelry Company listed the price of SJC gold bars at 118.50-120.50 million VND/tael (buy-sell).

Source: VNA

Source: https://baophutho.vn/gia-vang-phuc-hoi-sau-thong-bao-ap-thue-quan-moi-cua-tong-thong-my-235707.htm

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3aaff46372704918b3567b980220272a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with First Secretary and President of Cuba Miguel Diaz-Canel Bermudez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/c6a0120a426e415b897096f1112fac5a)

![[Photo] Lao President Thongloun Sisoulith and President of the Cambodian People's Party and President of the Cambodian Senate Hun Sen visit the 95th Anniversary Exhibition of the Party Flag Lighting the Way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3c1a640aa3c3495db1654d937d1471c8)

Comment (0)