Domestic gold price today 7/11/2025

As of 4:30 a.m. on July 11, 2025, the domestic gold bar price is based on the closing price yesterday, July 10. Specifically:

DOJI Group listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy - sell), an increase of 200 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.8-120.8 million VND/tael (buy - sell), an increase of 200 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.6-120.6 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.8-120.8 million VND/tael (buy - sell), the price increased by 200 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.1-120.8 million VND/tael (buy - sell), gold price increased 200 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 11, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.2-117.2 million VND/tael (buy - sell); the price increased by 200,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell); the gold price increased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 11, 2025 is as follows:

| Gold price today | July 11, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.8 | 120.8 | +200 | +200 |

| DOJI Group | 118.8 | 120.8 | +200 | +200 |

| Red Eyelashes | 119.6 | 120.6 | +200 | +200 |

| PNJ | 118.8 | 120.8 | +200 | +200 |

| Bao Tin Minh Chau | 118.8 | 120.8 | +200 | +200 |

| Phu Quy | 118.1 | 120.8 | +200 | +200 |

| 1. DOJI - Updated: 11/7/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,800 ▲200K | 120,800 ▲200K |

| AVPL/SJC HCM | 118,800 ▲200K | 120,800 ▲200K |

| AVPL/SJC DN | 118,800 ▲200K | 120,800 ▲200K |

| Raw material 9999 - HN | 108,100 ▲200K | 109,200 ▼280K |

| Raw material 999 - HN | 108,000 ▲200K | 109,100 ▼280K |

| 2. PNJ - Updated: 11/7/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,300 ▲200K | 117,200 ▲200K |

| HCMC - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Hanoi - PNJ | 114,300 ▲200K | 117,200 ▲200K |

| Hanoi - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Da Nang - PNJ | 114,300 ▲200K | 117,200 ▲200K |

| Da Nang - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Western Region - PNJ | 114,300 ▲200K | 117,200 ▲200K |

| Western Region - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Jewelry gold price - PNJ | 114,300 ▲200K | 117,200 ▲200K |

| Jewelry gold price - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Jewelry gold price - Southeast | PNJ | 114,300 ▲200K |

| Jewelry gold price - SJC | 118,800 ▲200K | 120,800 ▲200K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,300 ▲200K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,300 ▲200K | 117,200 ▲200K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,300 ▲200K | 117,200 ▲200K |

| Jewelry gold price - Jewelry gold 999.9 | 113,800 ▲300K | 116,300 ▲300K |

| Jewelry gold price - Jewelry gold 999 | 113,680 ▲300K | 116,180 ▲300K |

| Jewelry gold price - Jewelry gold 9920 | 112,970 ▲300K | 115,470 ▲300K |

| Jewelry gold price - Jewelry gold 99 | 112,740 ▲300K | 115,240 ▲300K |

| Jewelry gold price - 750 gold (18K) | 79,880 ▲230K | 87,380 ▲230K |

| Jewelry gold price - 585 gold (14K) | 60,690 ▲180K | 68,190 ▲180K |

| Jewelry gold price - 416 gold (10K) | 41,030 ▲120K | 48,530 ▲120K |

| Jewelry gold price - 916 gold (22K) | 104,130 ▲270K | 106,630 ▲270K |

| Jewelry gold price - 610 gold (14.6K) | 63,590 ▲180K | 71,090 ▲180K |

| Jewelry gold price - 650 gold (15.6K) | 68,250 ▲200K | 75,750 ▲200K |

| Jewelry gold price - 680 gold (16.3K) | 71,730 ▲200K | 79,230 ▲200K |

| Jewelry gold price - 375 gold (9K) | 36,260 ▲110K | 43,760 ▲110K |

| Jewelry gold price - 333 gold (8K) | 31,030 ▲100K | 38,530 ▲100K |

| 3. SJC - Updated: 11/7/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,800 ▲200K | 120,800 ▲200K |

| SJC gold 5 chi | 118,800 ▲200K | 120,820 ▲200K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,800 ▲200K | 120,830 ▲200K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 ▲200K | 116,700 ▲200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 ▲200K | 116,800 ▲200K |

| Jewelry 99.99% | 114,200 ▲200K | 116,100 ▲200K |

| Jewelry 99% | 110,450 ▲198K | 114,950 ▲198K |

| Jewelry 68% | 72,205 ▲136K | 79,105 ▲136K |

| Jewelry 41.7% | 41,668 ▲83K | 48,568 ▲83K |

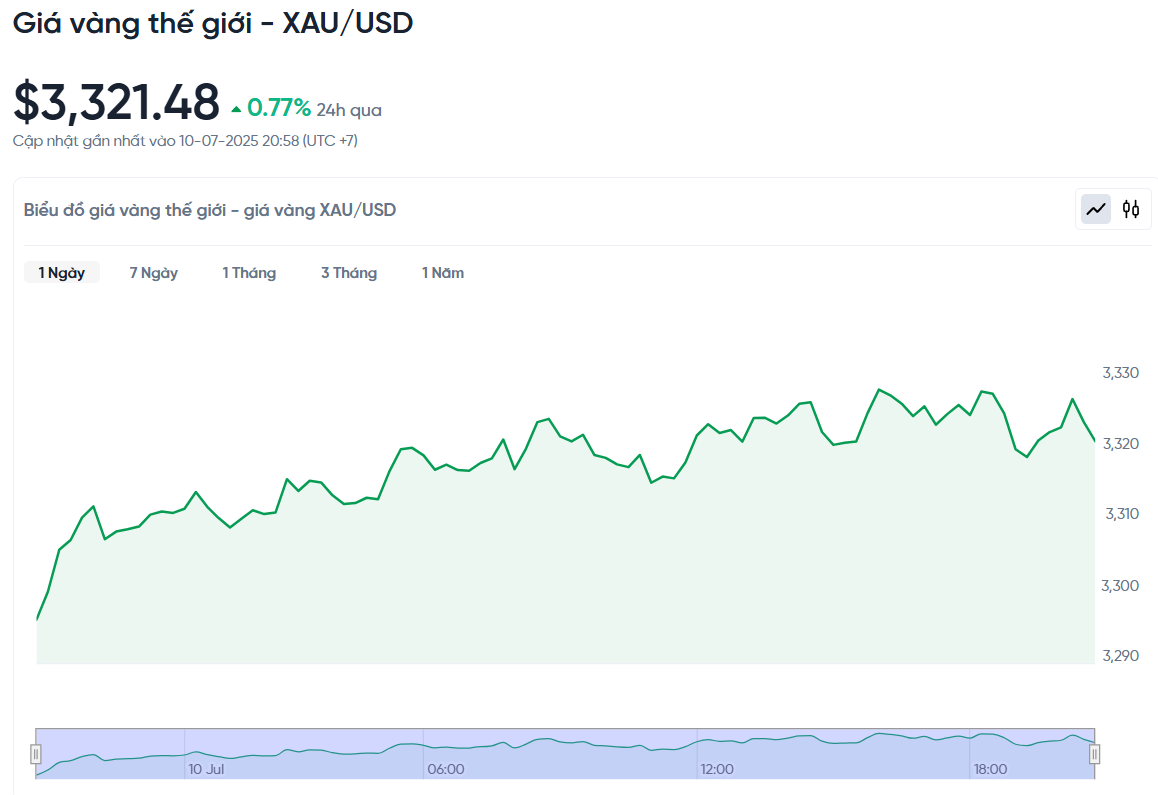

World gold price today 7/11/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 11, Vietnam time, was 3,321.24 USD/ounce. Today's gold price increased by 25.33 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,290 VND/USD), the world gold price is about 108.7 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 12.1 million VND/tael higher than the international gold price.

Gold prices rose slightly as investors sought the precious metal as a safe haven amid rising trade tensions, but gains were limited by a stronger US dollar.

Specifically, spot gold prices increased by 0.77%, while gold futures in the US also increased by 0.4% to 2,335.1 USD/Ounce.

One factor holding back gold prices was a 0.2% gain in the U.S. dollar index. As the dollar strengthens, gold becomes more expensive for investors using other currencies, reducing its appeal.

"Gold and other metals have been rising partly due to the impact of the US imposing high tariffs on imported copper," said Daniel Pavilonis, market analyst at RJO Futures. However, he also said that gold is unlikely to rise significantly unless there are more serious geopolitical tensions.

Recently, US President Donald Trump announced plans to impose a 50% tax on imported copper and goods from Brazil, effective from August 1. This raised concerns about a new trade war, causing many investors to seek gold as a safe asset.

"Emerging economies are increasingly interested in gold due to its non-third party nature, especially amid rising geopolitical risks," said Paul Wong, strategist at Sprott Asset Management.

Meanwhile, minutes from the US Federal Reserve's June meeting showed that only a few officials supported cutting interest rates this month, while the majority remained concerned about inflationary pressures caused by tariffs.

New data showed a surprise drop in US jobless claims, suggesting that businesses are still trying to retain employees despite signs of a weakening labour market.

Besides gold, spot silver prices rose 1.4% to $36.82 an ounce, while platinum rose 0.3% to $1,350.95. In particular, palladium rose sharply by 3.5% to $1,144.40. Paul Wong said that breaking through the $35 an ounce threshold could pave the way for silver to reach its target of $40 in the near future.

Gold Price Forecast

Technically, August gold futures are in an uptrend with the bulls in the driver’s seat. Their next target is to push the price above the strong resistance at $3,400 an ounce. On the other hand, the bears are hoping to push the price below the important support zone at $3,200.

In the current session, gold prices may face initial resistance at $3,340, followed by the weekly high at $3,355.60. If there is a correction, the nearest support level is at $3,321.40 (last night's low) and then $3,300. According to the Wyckoff rating scale, the market is currently at 6.5/10, indicating that the trend is still tilted to the bullish side.

Gold prices unexpectedly rose to a session high after the US announced better-than-expected labor market data. Specifically, the number of Americans filing for unemployment benefits for the first time in the week ending July 5 was only 227,000, lower than the forecast of 235,000 by economists. The previous week's figure was also revised down from 232,000 to 232,000.

Although gold prices were under pressure during the session, positive signals from the labor market helped the precious metal regain momentum, showing that investors are still weighing the economic outlook against the need to find a safe haven.

Gold prices could benefit from the rising US budget deficit and financial market turmoil, even if there is no major crisis in the near future, according to the World Gold Council (WGC).

Gold prices have recently fallen mainly due to profit-taking after nearly two years of strong growth, along with signs of easing geopolitical tensions in the Middle East. Some forecasts suggest that gold may temporarily fall below the $3,000/ounce mark before recovering in 2026-2027.

However, the US financial situation is causing many concerns. With the passage of Bill 3B, the country could face an additional $3.4 trillion in debt, bringing the total public debt this decade to $36.2 trillion. Unless the US economy achieves the high growth expected by the Trump administration, the debt pressure will continue to be a heavy burden.

WGC experts say these uncertainties are causing global capital flows to shift. A weaker US dollar and rising Treasury yields have helped push gold prices higher. When financial pressures increase, bond markets can be volatile, which in turn drives demand for gold as a safe haven.

Investors are also awaiting the minutes of the latest US Federal Reserve monetary policy meeting and comments from central bank officials this week. If the Fed decides to cut interest rates earlier than expected, the US dollar could fall, creating new momentum for gold prices.

Source: https://baonghean.vn/gia-vang-hom-nay-11-7-2025-gia-vang-trong-nuoc-va-the-gioi-theo-chieu-gia-dong-tang-cao-10302036.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)