Two big risks for stocks

According to the assessment of ACB Securities Company (ACBS), from now until the end of 2025, the world economy will continue to be under pressure to face two major risks: First is geopolitical tensions and polarization, leading to the risk of escalating trade wars, directly affecting the supply chain, threatening growth. Second is the tight monetary policy of developed countries with interest rates maintained at high levels, while many countries are facing the problem of increasing public debt.

A hot spot in the economic picture is the new US tariff policy announced on April 2, 2025, initiated by the Donald Trump administration. This policy has caused many major organizations such as the IMF and OECD to lower their global economic growth forecasts. Specifically, the IMF adjusted the forecast to 2.8% (down 0.4 percentage points), while the OECD also reduced it from 3.3% to 2.9%.

ACBS believes that the biggest risk from US tariff policy is the unpredictability of decisions. Negotiations to find common ground are often lengthy, so this unstable environment will likely continue at least until the end of President Trump's term.

In that context, the cash flow in the global financial market is shifting to safer investment channels such as gold, short-term savings funds or stock markets in regions such as the EU, Japan or Germany - where stocks are attractively priced. At the same time, the USD is also weakening slightly compared to other strong currencies, while the yield on US government bonds remains high due to concerns about budget deficits and public debt.

Vietnam is strong internally but under double pressure from the outside

In the face of global developments, the Vietnamese economy is also not immune to the impact, especially in the tariff story. Although recent negotiations show that Vietnam is maintaining an advantage with a preferential tax rate of 20% for official exports, a tax of up to 40% for transit goods - combined with an open economic model and a large proportion of FDI enterprises - puts Vietnam in the group of countries vulnerable when global trade encounters difficulties.

However, ACBS believes that Vietnam's growth foundation remains quite solid thanks to the Government's efforts to strengthen internal resources and diversify diplomatic relations, promote the private economic sector and encourage new technology industries such as artificial intelligence. In addition, extensive participation in free trade agreements will also be a springboard for the economy to develop sustainably in the long term.

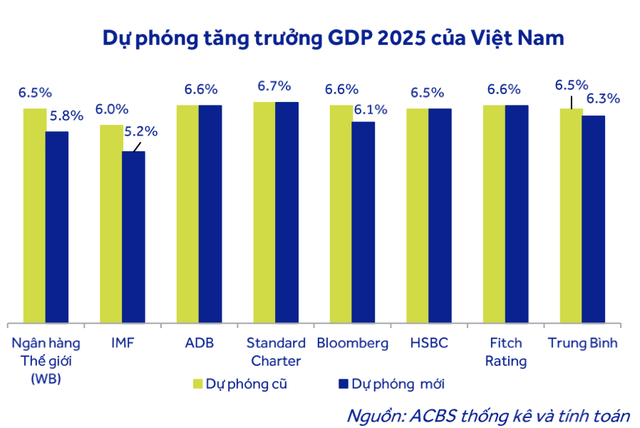

In the short term, although there are many bright spots such as promoted public investment, recovered domestic consumption and continued positive FDI flows, external uncertainties can still affect the growth rate. Many international organizations have adjusted Vietnam's GDP growth forecast for 2025 to an average of 6.3%; the IMF alone forecasts only 5.2%. ACBS also lowered its GDP growth forecast to 6.5 - 7% (previously 7 - 7.5%).

The stock market still has many positive points.

Regarding the financial market, ACBS believes that the process of upgrading the Vietnamese stock market is still on track. Since the end of 2024, new regulations on non-prefunding transactions have been applied. The information technology system for managing and operating transactions on the Vietnamese stock market (KRX) has also officially come into operation since May 2025. With these changes, Vietnam is highly likely to be upgraded by FTSE to a secondary emerging market in the September 2025 review period - which will help attract more cash flows from foreign institutional investors, creating momentum for market growth in the medium and long term.

Based on the macro outlook and policy support factors, ACBS has raised its forecast for after-tax profit growth of listed companies (accounting for more than 50% of capitalization on HOSE) in 2025 to 11.6% year-on-year. With reasonable valuations (P/E fluctuating around the 3-year average), ACBS expects the VN-Index to fluctuate between 1,350 and 1,500 points. Another positive signal is that market liquidity is expected to increase by 20% compared to 2024, thanks to strong participation from foreign investors.

From an investment strategy perspective, ACBS said it will focus on investing in sectors that are likely to maintain stability and growth in the current uncertain context. Specifically, these groups include: banking, consumer, public investment, technology, chemicals - fertilizers and civil real estate.

Meanwhile, industries such as textiles, seafood, wood, rubber (export-related); industrial park real estate and logistics are considered vulnerable to negative impacts from the new US tax policy, so they need to be monitored and carefully considered before investing.

Source: https://phunuvietnam.vn/dong-tien-giua-khung-hoang-thue-quan-the-gioi-co-phieu-nao-sang-gia-nua-cuoi-nam-20250714170017988.htm

Comment (0)