Ensure resources to carry out key tasks

Along with effective budget revenue management, the Ministry of Finance has proactively organized and managed budget expenditures closely and effectively, within the scope of the National Assembly's approved budget. One of the important highlights is the thorough saving of regular expenditures, especially the increase compared to 2024 to create resources for salary reform.

Specifically, the Ministry of Finance requires ministries, sectors and localities to save at least 10% of the increased regular expenditure in the 2025 budget and continue to save another 10% of regular expenditure in the last 7 months of the year. The expected savings of about 7,200 billion VND will be used to invest in the Lao Cai - Hanoi - Hai Phong railway line.

Notably, the Ministry of Finance has submitted to the Government a Resolution on saving regular expenditures, and proposed to cut expenditures that are not really urgent. Regular expenditure estimates that were assigned at the beginning of the year but have not been allocated by June 30, 2025 will also be revoked, except for priority areas such as national defense, security, science and technology, innovation, digital transformation, law making and organizational restructuring.

The allocation and enhancement of resources for public investment continue to be promoted to implement the Conclusions and Resolutions of the Central Committee, the Politburo and the National Assembly on promoting economic growth. The Ministry of Finance also directed the review and removal of obstacles in the disbursement of public investment capital, aiming for a GDP growth target of 8% or more in 2025.

According to the Ministry of Finance, the accumulated budget expenditure in the first 6 months of 2025 is estimated at VND 1,102.1 trillion, equivalent to 43.2% of the estimate, up 38.5% over the same period. Of which, development investment expenditure is estimated at VND 268.1 trillion, equivalent to 33.9% of the estimate decided by the National Assembly, up 42.3% over the same period; the disbursement rate is estimated at 32.5% of the plan assigned by the Prime Minister. This figure is higher than the same period in 2024 when disbursement reached about 28.2% of the plan assigned by the Prime Minister.

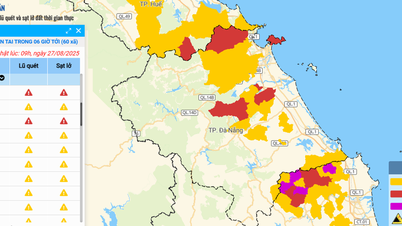

The state budget continues to ensure expenditures for administrative reform, payment of benefits to cadres, civil servants and public employees during organizational restructuring, as well as important tasks such as national defense, security, natural disaster and epidemic prevention and social security.

Statistics from the Ministry of Finance show that regular expenditures are estimated at 776 trillion VND, equal to 49.5% of the estimate, ensuring the operation of the state apparatus, national defense, security, taking care of beneficiaries of salaries, pensions and social allowances from the state budget, timely payment of regimes and policies for beneficiaries when reorganizing the apparatus, and effectively implementing social security policies.

In particular, the central budget has spent about 7.9 trillion VND from the reserve, supplementing ministries and central agencies to carry out important and urgent tasks and supporting localities in carrying out tasks of supporting plant varieties, livestock, aquatic products, and restoring production in areas damaged by natural disasters and epidemics according to regulations.

In addition, the Ministry of Finance has issued 10,300 tons of national reserve rice according to the Prime Minister's Decision to overcome the consequences of natural disasters, epidemics, and provide relief and hunger relief for people during the Lunar New Year and the early year's crop gap.

Taking advantage of the room for state budget deficit and public debt

In order to promptly respond to urgent tasks, the Ministry of Finance has recently submitted to the National Assembly a number of important proposals such as: Supplementing the central budget estimate to implement the salary policy according to Decree 178/2024/ND-CP (amended in Decree 67/2025/ND-CP); transferring unallocated regular expenditure sources in 2024 to 2025 to implement tuition exemption and tasks arising from organizational restructuring; at the same time, ensuring a minimum expenditure of 3% of the total state budget for science, technology, innovation and digital transformation, in the spirit of Resolution 57-NQ/TW of the Politburo.

In the process of implementing the policy of rearranging administrative units, the Ministry of Finance has also issued many specific guiding documents related to the handling of budgets, public assets and finances at all levels. At the same time, the Ministry has also submitted to the Government to report to the National Assembly for consideration and decision on re-determining the local budget revenue and expenditure estimates for 2025 after completing the rearrangement of provincial-level administrative units.

In Resolution No. 192/2025/QH15 dated February 19, 2025 on supplementing the 2025 socio-economic development plan with a growth target of 8% or more, the National Assembly resolved to allow, if necessary, the adjustment of the state budget deficit to about 4-4.5% of GDP to mobilize resources for development investment; public debt, government debt, and foreign debt of the country may reach or exceed the warning threshold of about 5% of GDP.

On that basis, the Ministry of Finance has submitted to the Prime Minister the Plan for public debt repayment in 2025 and the 3-year public debt management program for the period 2025-2027. State budget deficit, public debt, contingent debt obligations of the state budget, and local government debt are enhanced to be actively, flexibly and effectively managed and controlled; taking advantage of the space for state budget deficit and public debt to mobilize more resources for development investment. At the same time, continue to implement solutions to restructure the public debt portfolio in a safe and sustainable direction.

According to the Ministry of Finance, the cumulative interest payment for the first 6 months is estimated at VND55.7 trillion, equivalent to 50.4% of the estimate. Debt repayment has been fully and timely implemented as committed, contributing to strengthening the national credit rating.

The balance of the central budget and local budgets is ensured, meeting the tasks of state budget expenditure according to the estimate. By June 30, 2025, 201.4 trillion VND of government bonds had been issued, with an average term of 9.8 years and an average interest rate of 2.92%/year, ensuring timely payment of principal of maturing central budget loans and contributing to the orientation of market interest rates.

Source: https://baolaocai.vn/dieu-hanh-chi-ngan-sach-linh-hoat-dam-bao-nguon-luc-cho-cai-cach-phat-trien-post648174.html

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

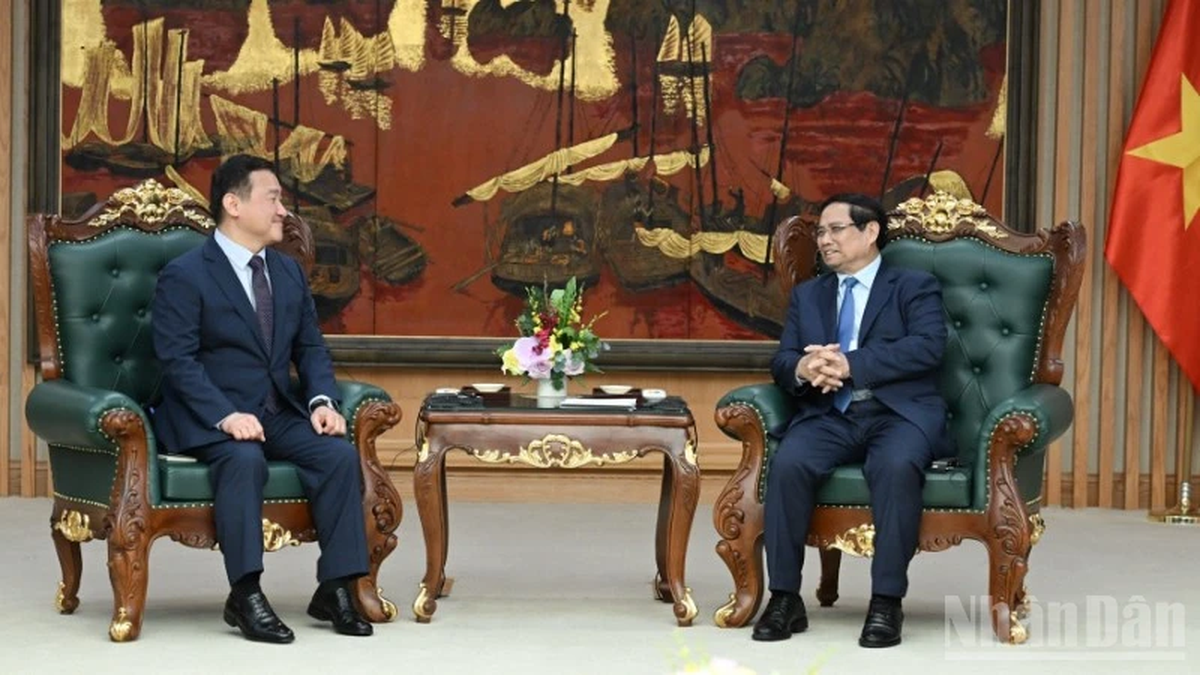

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)