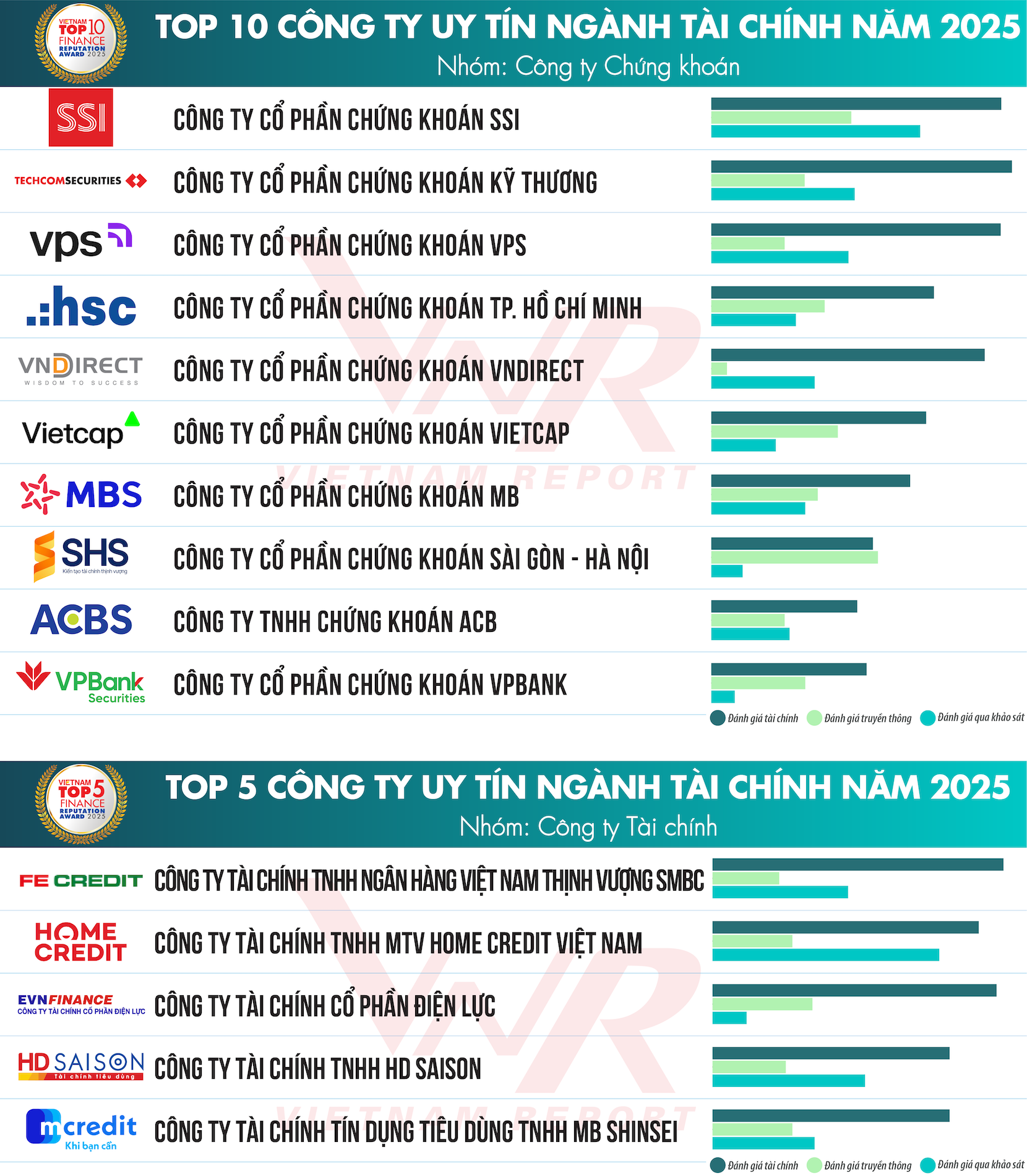

Top 10 prestigious companies in the Finance industry are built on scientific and objective principles with three main criteria: Financial capacity shown in the most recent financial report; Media reputation assessed by Media Coding method; Survey of research subjects and stakeholders.

Strategic Recovery - Steady Steps to Transformation

According to the General Statistics Office, Vietnam's economic growth in 2024 will reach 7.09%, of which finance, banking and insurance activities will account for 4.83% of GDP structure, contributing 0.43 percentage points to the growth rate of total added value of the whole economy. In the first quarter of 2025, the industry will continue to grow by 6.83%, contributing 0.41 percentage points, affirming its important role in the context of complex fluctuations in the world economy.

The core of the financial system is not only commercial banks but also extends to non-bank credit institutions such as securities companies and financial companies. Outstanding credit of financial companies exceeded VND320,000 billion in 2024, up 6.67% compared to the beginning of the year. For securities companies, outstanding margin loans in 2024 are estimated at about VND240,000 billion, up 33% compared to the previous year; in the first quarter of 2025, the outstanding debt reached VND273,000 billion, equivalent to an increase of 13.7% in just the first three months of the year.

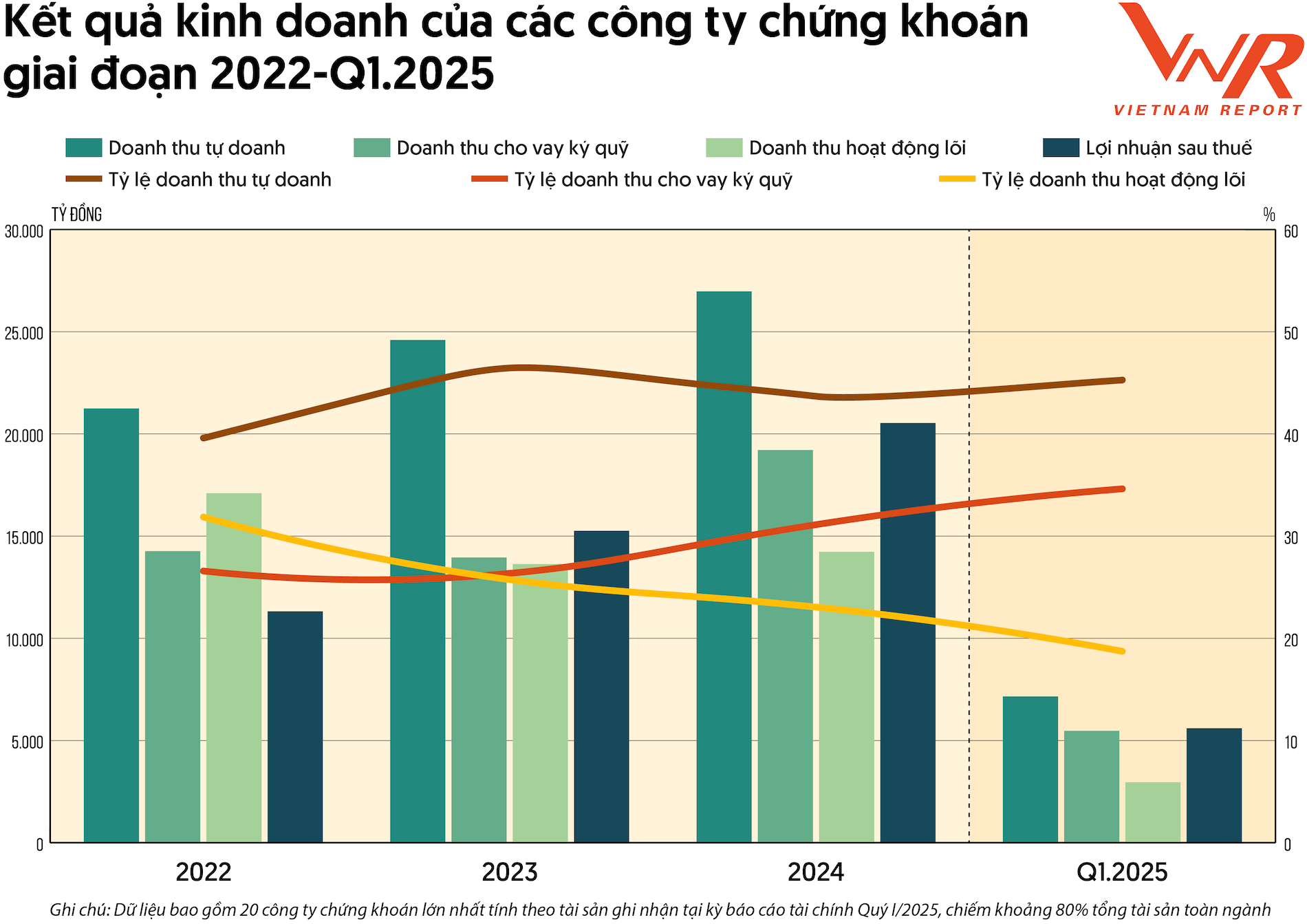

The year 2024 marks a period of strong and promising recovery for the Vietnamese securities industry. According to statistics from Vietnam Report with the 20 largest securities companies in the first quarter of 2025 (accounting for about 80% of the total assets of the industry), total operating income in 2024 increased by 16.6%. In particular, proprietary trading revenue is the largest pillar in the total income structure, followed by margin lending. In contrast, revenue from brokerage activities - once the "backbone" of the traditional model - has continuously declined in both absolute value and proportion, clearly reflecting the trend of fierce competition in the industry. Focusing on high value-added service segments helps securities companies maintain a high growth rate, but also poses risks when the market adjusts strongly in the face of geopolitical fluctuations.

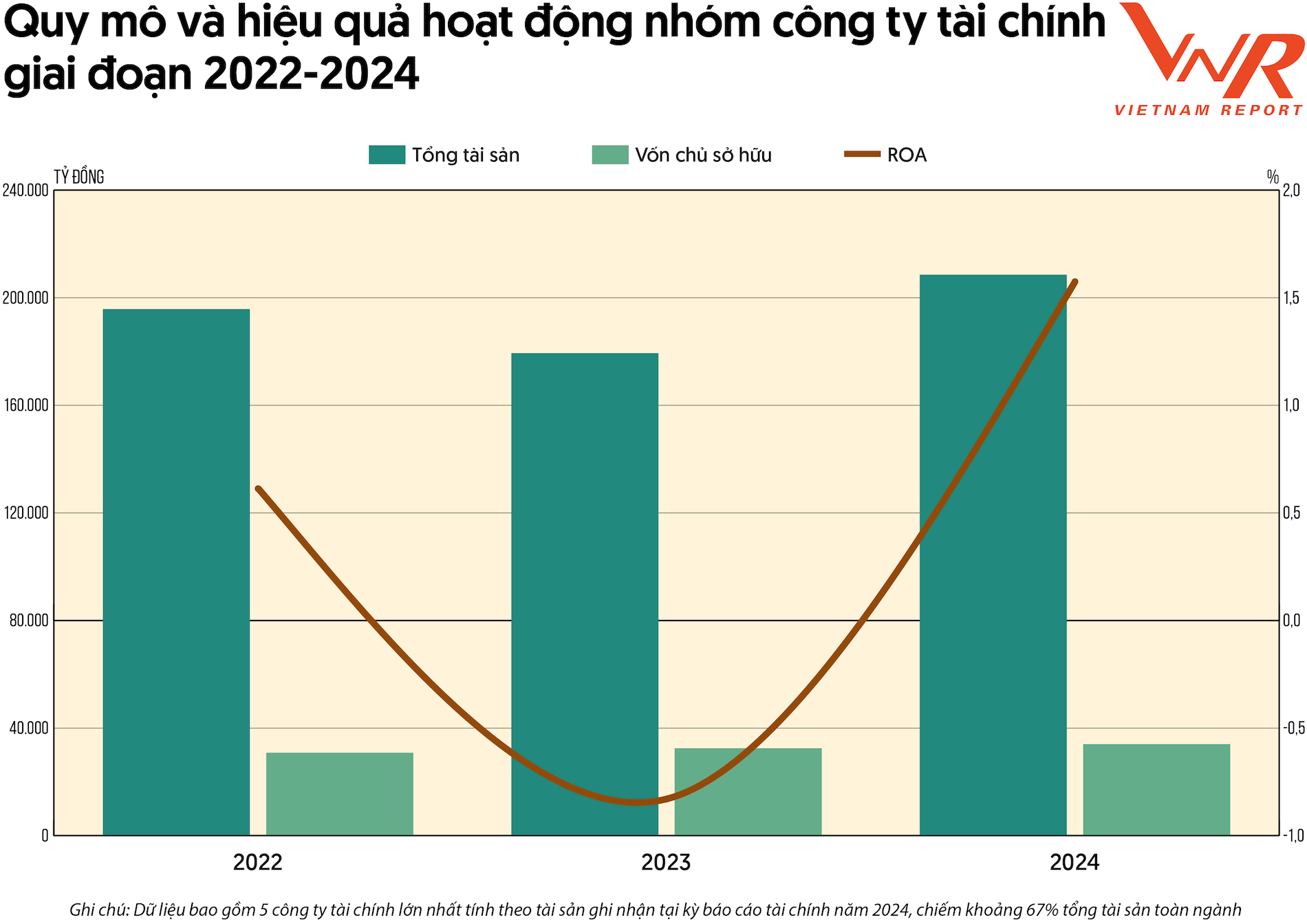

Financial companies also made a strong transformation in 2024. According to Vietnam Report's statistics of the 5 largest financial companies by assets in the 2024 reporting period (accounting for about 2/3 of the total assets of the industry), the group's total assets increased sharply again, up 16.3% compared to 2023. The return on assets (ROA) efficiency index reached 1.6% in 2024, an impressive recovery compared to the previous year (-0.8%), and was the highest level in the past three years thanks to the orientation of digital transformation, expanding customer segments and better control of bad debt.

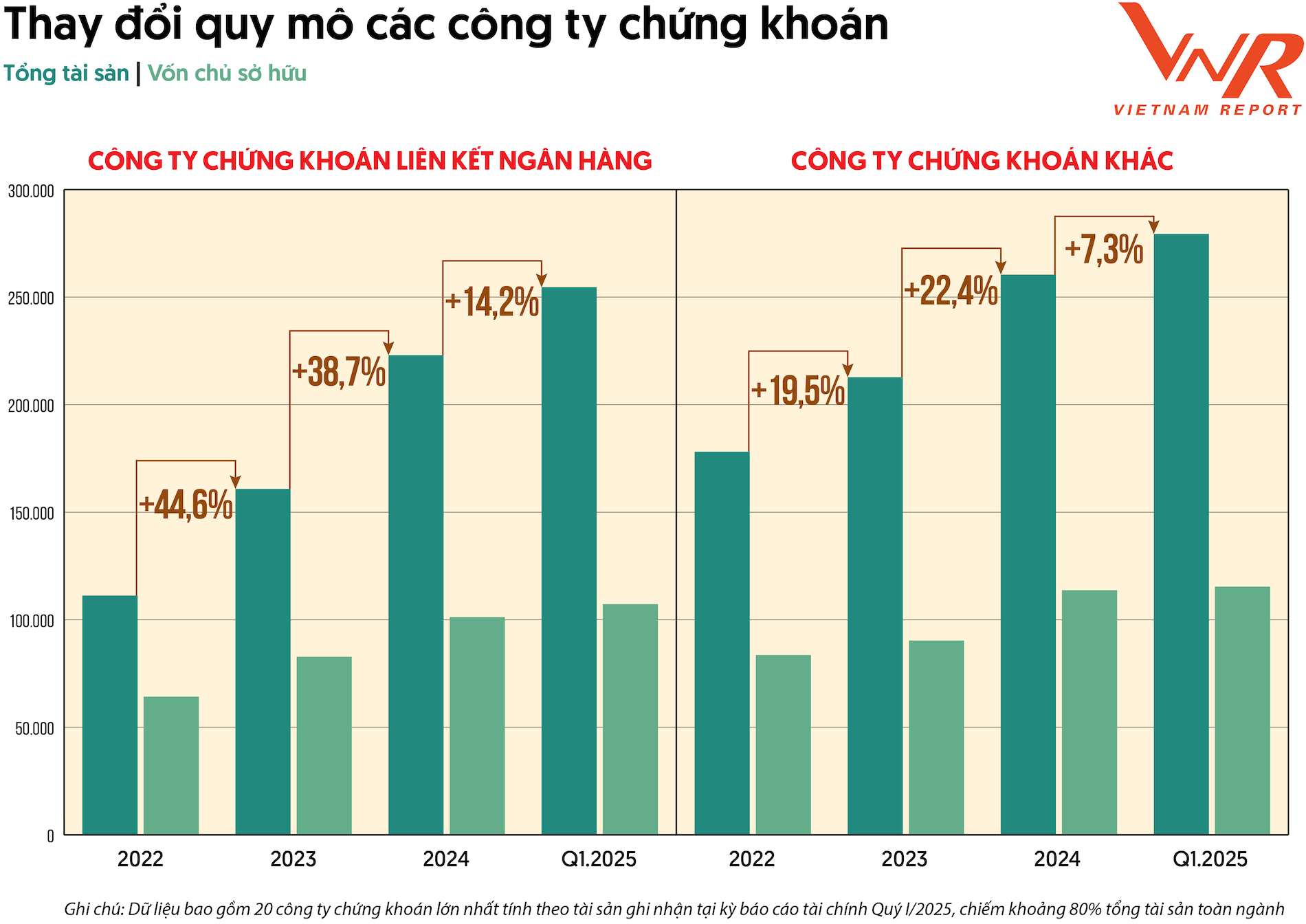

In the context of a recovering stock market and fierce competition, the need for capital increase of securities companies has become more urgent. In particular, thanks to a strong financial "background", the group of bank-affiliated securities companies has recorded outstanding growth: From 2022 to the first quarter of 2025, total assets increased by nearly 129%, equity increased by nearly 67%. Capital increase helps companies expand operations, invest in technology and consolidate their position in the market. The banking ecosystem also creates advantages in integrated services, expands customer base and enhances comprehensive competitiveness.

Build reputation, strengthen customer trust

The financial industry is entering a new era, where “openness” is not just a slogan, but a vital requirement. Openness in thinking, policy and technology is becoming the main driving force for development, connection and innovation. For Vietnam, this means removing old barriers, accepting competition, proactively creating a modern and sustainable financial ecosystem. From developing a regional financial center, experimenting with decentralized finance to popularizing digital financial services and promoting green finance, each step is a testament to the strong transformation journey of the Vietnamese financial industry in the era of integration.

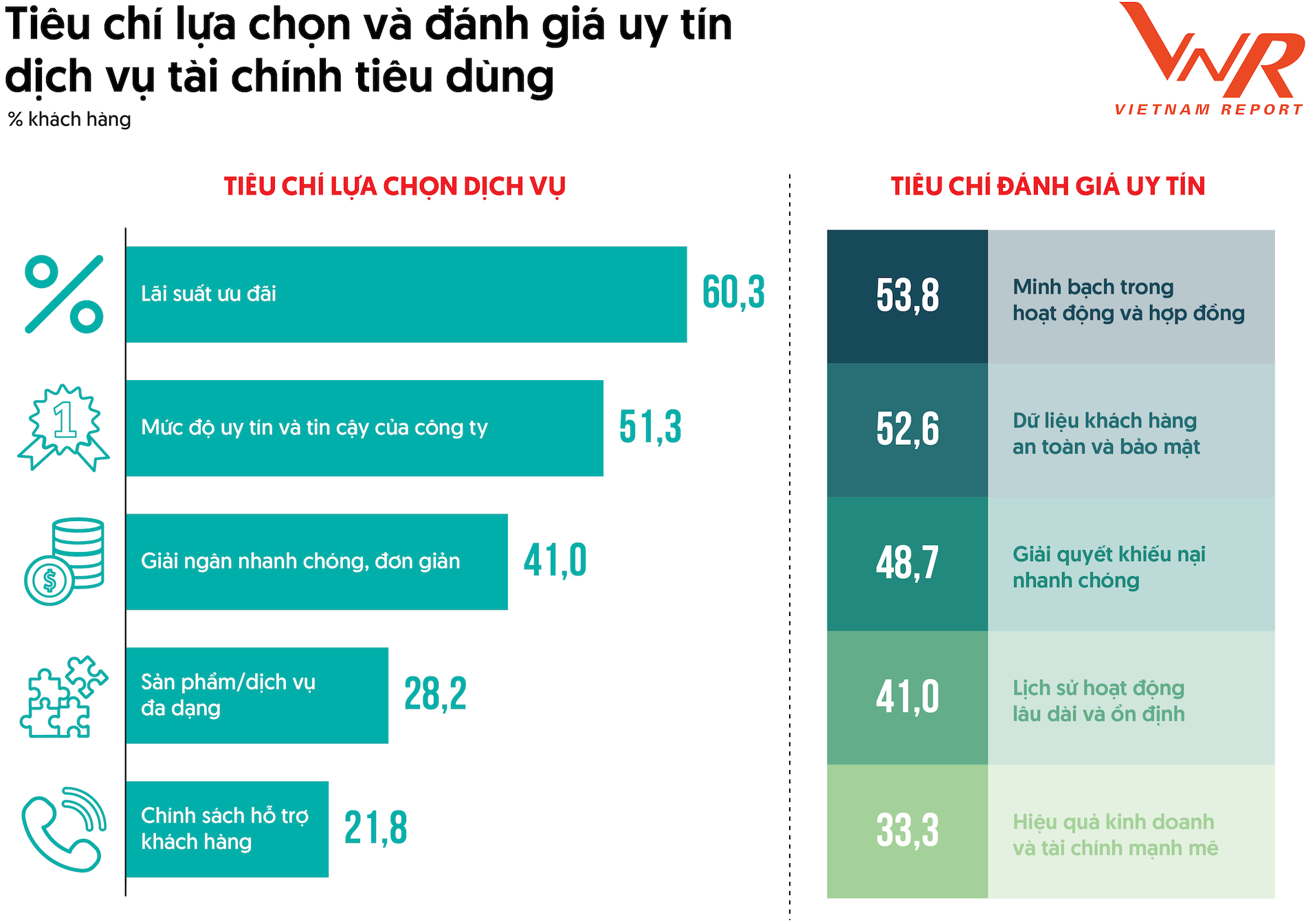

On that journey, brand reputation is not only a valuable intangible asset, but also a great competitive advantage. According to a survey by Vietnam Report, in addition to preferential interest rates, the company's reputation and reliability are also key factors for customers to choose the service. Among them, the most highly rated criteria are Transparency in operations and contracts, Safe and secure customer data, Quick complaint resolution, etc.

From a media perspective, Media Coding data shows that topic groups such as Finance/Business Results (19.1%), Stocks (15.7%), Image/PR/Scandals (9.4%) and Products/Services (8.8%) continue to lead in terms of public attraction. Notably, Finance is a rare field where the topic Market Position (6%) appears in the top 5 most media-attracting topics. This is not just a ranking, but an indication of the ability of companies to maintain stability, adapt to fluctuations and lead the market.

In general, growth is not only measured by asset size or profit, but also by brand reputation and market trust. The Top 10 Most Reputable Companies in the Finance Industry ranking clearly reflects this shift - when internal capacity, communication effectiveness and customer reviews combine to create sustainable advantages. This is the foundation for the Vietnamese financial industry to firmly integrate and lead growth in the new era.

(Source: Vietnam Report)

Source: https://vietnamnet.vn/top-10-cong-ty-uy-tin-nganh-tai-chinh-nam-2025-2415427.html

Comment (0)