According to the State Bank, by the end of April, people's savings reached a record level of more than 7.53 million billion VND - Photo: LE THANH

In just 4 months, people have deposited nearly half a million billion dong in savings into banks.

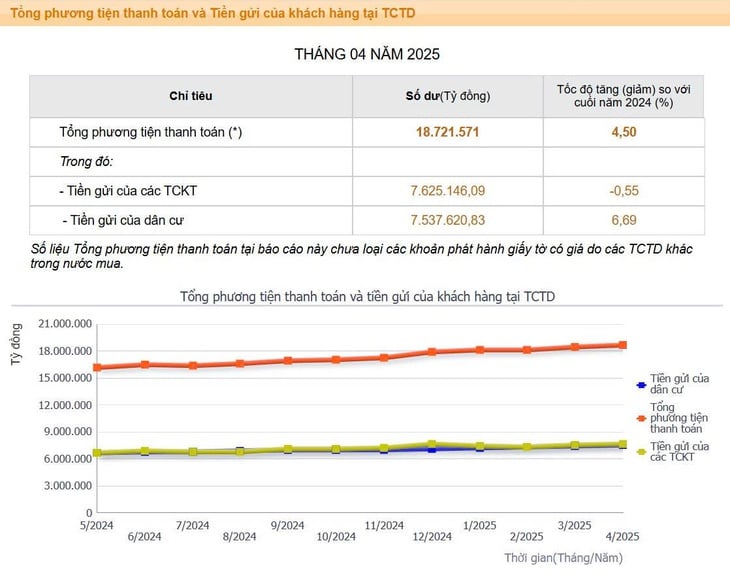

According to the latest statistics from the State Bank, by the end of April, people's savings in banks had reached 7,537 trillion VND. Thus, compared to the end of last year, the total amount of people's savings in the banking system increased by 6.69%, equivalent to nearly 500,000 billion VND.

Compared to the same period last year, this year's deposit growth rate is 3 times higher. The balance of savings deposited by people in banks increased by 857,000 billion VND.

Regarding institutional deposits, the State Bank also reported that the amount of deposits decreased slightly compared to the end of last year, but remained at 7.6 million billion VND.

Meanwhile, deposit interest rates were kept stable by many commercial banks. For some terms and deposit amounts, mobilization interest rates decreased slightly by 0.1-0.3%/year compared to the beginning of the year, depending on the bank.

Savings interest rates tend to decrease slightly

According to Tuoi Tre Online , in the group of state-owned commercial banks, the savings interest rate table in early July remained stable compared to the same period in June.

The highest interest rate of 4.8%/year is applied at the counter by BIDV, VietinBank, and Agribank for individual customers with long-term deposits of 24 months or more. The 6 and 9-month terms are continued to be listed by this banking group at 3.0%/year.

As for the joint stock commercial group, interest rates have increased and decreased in opposite directions, but the slight downward trend is clear. For example, VPBank , with deposits of 300 million VND or more for 6 months, from July 1, the interest rate will only be 5.4%/year instead of 5.7%/year.

NCB also reduced interest rates by 0.1%/year for traditional savings products and An Khang term deposits and An Phat Loc deposit certificates with terms of 18 months, 24 months and 84 months, with interest payment method of 6 months.

Interest rates of 6%/year or higher are quite rare in the market. reactive, Bac A Bank listed an interest rate of 6.1%/year for savings deposits of over 1 billion VND, with terms from 18-36 months.

HDBank pays interest at the end of the term at 6%/year for a term of 18 months. HDBank lists an interest rate of 6.1%/year for online savings deposits with a term of 18 months.

The State Bank also reported that the total balance of non-term deposits of people in payment accounts by the end of the first quarter was more than 1.3 million billion VND. The total balance has increased continuously over the past 3 years. Compared to the end of 2024, the balance increased by 56,241 billion VND.

Source: https://tuoitre.vn/tien-tiet-kiem-duoc-gui-vao-ngan-hang-vuot-15-trieu-ti-dong-20250706104454921.htm

Comment (0)