Agriculture insurance helps farmers compensate for some of the losses caused by risks that occur during the farming process. In the photo: Farmers in An Giang province control drones to fertilize rice.

Lack of flexibility, not attractive

Agricultural insurance is an important economic and technical tool to reduce risks in production and increase farmers' resilience to the impacts of natural disasters and epidemics. However, after more than 6 years of implementation under Decree No. 58/2018/ND-CP on Agricultural Insurance, the results achieved are still very limited, both in scale and spread.

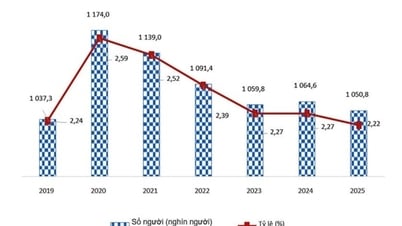

According to the Department of Economic Cooperation and Rural Development under the Ministry of Agriculture and Environment , synthesizing reports from localities, nationally there are less than 17,000 farming households participating in agricultural insurance, insurance premium revenue is only about 6.9 billion VND, compensation payment is 198 million VND. The scale of households participating in insurance has decreased sharply, from more than 16,000 households in the period of 2019-2021 to 3,630 households since 2022 to present. Insurance products for aquaculture and some new crops such as rubber, coffee, pepper, etc. have not yet been implemented in practice, although they have been expanded in current regulations. The main reason is that insurance companies are still hesitant, agricultural insurance operations are complicated, and lack flexibility. The agricultural insurance model has not yet been closely integrated with credit, production chains or digital technology.

According to Mr. Le Duc Thinh, Director of the Department of Economic Cooperation and Rural Development, insurance products for aquatic products and some new crops such as rubber, coffee, pepper, etc. have not yet been implemented in practice, although they have been expanded in current regulations. The main reason is that insurance companies are still hesitant: agricultural insurance operations are complicated, lack flexibility, and are not attractive to international reinsurers; at the same time, there are still many barriers in terms of data, human resources and service networks in the area.

The above reality reflects a significant gap between policy design and implementation conditions. Enterprises do not propose new products due to low economic efficiency, high risks, cumbersome procedures and especially lack of technical data and loss monitoring and confirmation tools. As a result, from 2022 to now, almost no locality has implemented agricultural insurance products, although many provinces and cities have issued a list of locations and subjects eligible for support. The above figures and reality show that the current policy is not attractive enough, failing to meet the expectations of both suppliers and beneficiaries. The agricultural insurance model has not been closely integrated with credit, production chains or digital technology, essential pillars to form a modern, sustainable and effective agricultural insurance ecosystem.

The main role of agricultural insurance is to help minimize risk damage. The agricultural sector is strongly affected by natural disasters such as floods, droughts, storms, epidemics, pests and market fluctuations... At that time, agricultural insurance helps organizations and individuals to compensate for some of the damage caused by risks occurring in the production and business process. However, in reality, in many localities, farmers are not fully aware of the risks: natural disasters, epidemics... so they do not really want to participate in agricultural insurance. Some farmers are interested but are not bold enough to participate in insurance and there are not many insurance products for farmers to have more options.

According to Mr. Tran Minh Hieu, representative of the Department of Insurance Management and Supervision (Ministry of Finance), currently, there are not many insurance companies participating in providing services because agricultural insurance is a complex, high-risk business, with a wide scope across the country, requiring insurance companies to have large financial capacity, a team of competent and experienced staff, and a network reaching out to the bases. In addition, agricultural insurance is a new and complicated product, the organization and implementation in some localities and establishments is still confusing, the approval of supported subjects is slow and untimely. Agricultural insurance is a new product, so people have not yet learned about it, and do not have the habit of participating in insurance. Insurance companies have difficulty with data sources. Natural disaster data only stops at general data for the whole province, without detailed data for each district and commune, causing difficulties in risk assessment, insurance construction and pricing.

Remove the "bottlenecks"

To expand the agricultural insurance market, experts suggest that it is necessary to complete the legal framework and propose amendments and supplements to Decree No. 58/2018/ND-CP to ensure consistency with the Law on Insurance Business (amended) and to be consistent with the development practices of modern agriculture.

According to Mr. Le Duc Thinh, Director of the Department of Economic Cooperation and Rural Development, to restart and expand the agricultural insurance market, it is necessary to focus on perfecting the legal framework, reviewing and simplifying procedures, appraisal and compensation processes, creating conditions for insurance companies to proactively design products. It is necessary to encourage insurance companies and international reinsurance partners to build flexible product packages, based on risk data and specific needs of each industry: rice, seafood, industrial crops, etc.

In addition, according to Mr. Le Duc Thinh, it is necessary to pilot new models in the Mekong Delta through public-private partnerships, pay attention to investing in digital agricultural database systems, standardizing farming processes and damage measurement frameworks. Train local officials, cooperatives and insurance companies on loss assessment, risk assessment and application of remote monitoring technology. It is necessary to connect the State, enterprises, international organizations, industry associations, banks and farmers to integrate insurance with credit, chain production and digital transformation.

According to Mr. Bui Gia Anh, General Secretary of the Vietnam Insurance Association, agricultural insurance is not only a simple financial tool but also an important pillar to help agricultural production organizations and individuals be more stable in the face of risk fluctuations, especially in the context of increasingly complex climate change. Therefore, the State and relevant ministries and branches need to continue to improve the legal framework on agricultural insurance, creating favorable conditions for agricultural production organizations and individuals and enterprises to access it easily. It is necessary to pay attention to building accurate information databases on the agricultural insurance market, including market information, actual payment data, loss data, natural disasters, and epidemics by locality and industry.

Mr. Bui Gia Anh said that it is important to designate an agency or management unit to provide such database information, which will help insurance companies feel more secure in researching and participating in the insurance market. State management agencies need to combine organizing propaganda, training, and improve the capacity of staff working in the agricultural sector in the locality. Agricultural insurance is extremely important, contributing to the implementation of State policies, continuing to develop agriculture, farmers, and rural areas. Therefore, there needs to be an appropriate mechanism to promote the strengths of the entire political system, ministries, branches, and local authorities to develop agriculture. There needs to be strong participation of the entire political system to propose to the Government specific goals and solutions for stronger changes in the agricultural insurance sector.

Article and photos: MINH HUYEN

Source: https://baocantho.com.vn/tai-khoi-dong-bao-hiem-nong-nghiep-theo-chuoi-gia-tri-nganh-hang-a188212.html

Comment (0)