A consortium led by Japan Industrial Partners has acquired nearly 78% of Toshiba shares, paving the way for a full takeover and delisting.

Japanese electronics giant Toshiba said on September 21 that a nearly $14 billion takeover bid by a consortium led by Japan Industrial Partners (JIP) had been successful. They bid for Toshiba shares in early August and now own 78.65% of the shares. This will pave the way for a full takeover to control Toshiba.

Toshiba also said it would complete its delisting from the Tokyo Stock Exchange. The JIP deal would put control of Toshiba in the hands of domestic investors, after years of fighting with foreign shareholders.

In March, Toshiba accepted a 2 trillion yen ($13.5 billion) takeover offer from JIP. While some shareholders were unhappy with the price, Toshiba said it saw no prospect of receiving a higher offer.

"We would like to express our deep gratitude to our shareholders for understanding our situation. With the new shareholders, Toshiba will take a big step towards a new future," said Toshiba CEO Taro Shimada.

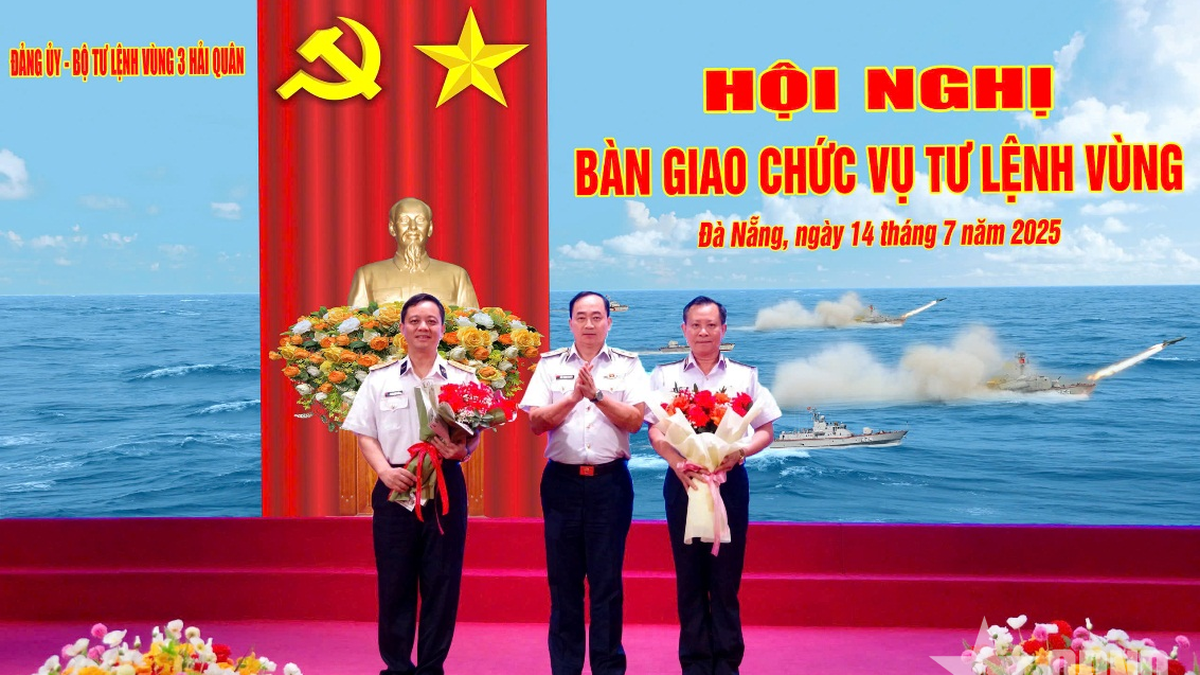

Outside the Toshiba building in Kawasaki (Japan). Photo: Reuters

JIP is a private equity firm. They are not well known outside of Japan. However, JIP has been involved in many spin-offs of large Japanese corporations. They bought Olympus’s camera division and Sony’s laptop division. JIP plans to keep CEO Shimada and his team.

The JIP deal could end years of turmoil at Toshiba, which has been rocked by a series of scandals that have led to its decision to sell itself. Toshiba's board, the Japanese government and major foreign shareholders are at odds over the company's future. Investors want to maximize profits, while the Japanese government prioritizes keeping sensitive businesses and technologies out of foreign hands.

Toshiba has said that it has a complex stakeholder structure and many shareholder groups with different views. This has affected its business to some extent. Therefore, a stable shareholder structure will help the company pursue its long-term strategy.

Toshiba has been hit by a series of crises over the past eight years, starting with an accounting scandal in 2015. This has led to a profit deficit and the company has had to undergo a comprehensive restructuring.

By early 2017, Toshiba had repeatedly missed its financial reporting deadline due to troubles with its nuclear power division in the US. Projects in this division were both over budget and behind schedule. Investing in the nuclear power division in the US caused Toshiba to lose $6.3 billion and was on the brink of being delisted. The company was forced to sell its golden goose, its memory chip division, to foreign investors.

Early last year, shareholders rejected the board's proposal to split Toshiba, forcing Toshiba to look for other options and eventually settle on a sale to JIP.

Ha Thu (according to Reuters, Kyodo News)

Source link

Comment (0)