Silver prices weaken

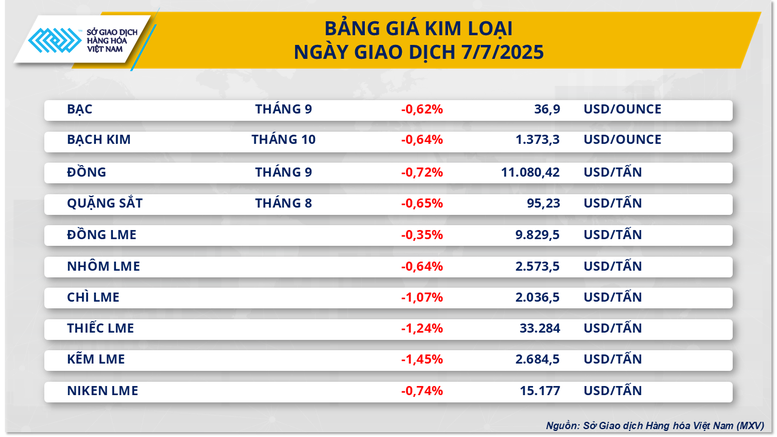

At the end of yesterday's trading session, the metal group recorded overwhelming selling pressure across all 10 commodities. For the precious metals group, silver prices fell more than 0.6% to $36.9/ounce. According to MXV, the pressure on silver prices mainly came from the rising USD, along with concerns about consumption prospects in the international market.

The Dollar Index rose 0.31% to 97.48 yesterday. The strengthening of the US dollar has made commodities priced in this currency, such as silver, more expensive for investors using other currencies, causing silver prices to fall.

As soon as the trading session opened, the demand for safe haven silver decreased after the Trump administration announced that it would delay the reciprocal tariff to August 1. However, market sentiment quickly turned volatile when, later in the day, President Trump continued to announce a 25% import tariff on goods from Japan and South Korea. He also warned that he would impose additional tariffs if the two countries responded by increasing tariffs on US goods.

The US move is particularly notable because Japan and South Korea are key US auto trade partners, and the heavy tariffs have raised concerns about the negative impact on silver demand in the automotive electronics sector.

According to the Japanese Ministry of Finance , in 2024 alone, the country exported goods worth about $148 billion to the US. This figure accounts for nearly 20% of the country's total exports, making the US Japan's largest export market. Of which, automobiles and auto parts account for nearly 34% of the total export value.

Meanwhile, according to the Korea International Trade Association (KITA), South Korea's exports to the US will reach $127.8 billion in 2024. The automotive sector alone accounts for $34.7 billion, or 27.2% of total exports. These concerns put downward pressure on silver prices in yesterday's trading session, reflecting investors' cautious sentiment about the prospect of silver consumption in the industrial sector.

Silver's decline has been somewhat contained as defensive demand in the market remains present.

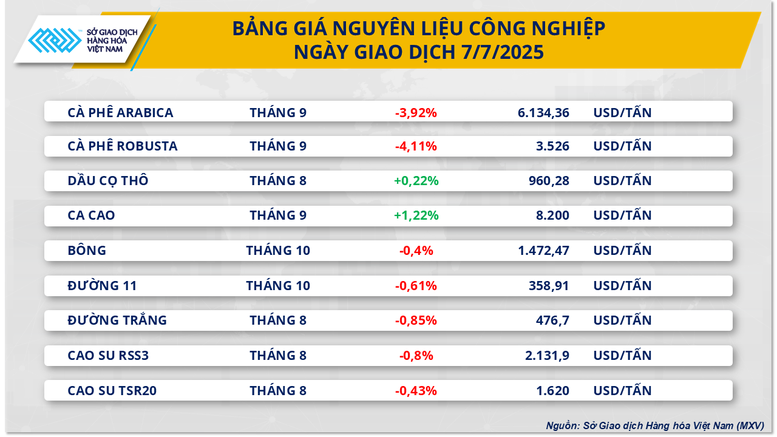

Not out of the general trend, the industrial raw material market also recorded overwhelming selling pressure with 7/9 items closing in red. In particular, Arabica coffee prices continued to decrease for the 5th consecutive session to the lowest level in the past 8 months, closing at 6,134 USD/ton, equivalent to a decrease of nearly 4%. Robusta coffee prices also lost more than 4.1% to 3,526 USD/ton.

According to data from ICE EU, net long positions by hedge funds fell to 37.53% in the trading week ending July 1, bringing the total net long position down to 1,002 contracts, equivalent to about 167,000 bags of coffee. The sell-off was largely driven by expectations that global supplies will increase in the second half of the year thanks to a new harvest in Brazil, which will put downward pressure on coffee prices.

Source: https://baochinhphu.vn/luc-ban-ap-dao-gia-kim-loai-va-ca-phe-dong-loat-giam-102250708104442557.htm

Comment (0)