At the regular press conference for June this afternoon (July 3), Deputy Governor of the State Bank of Vietnam (SBV) Pham Thanh Ha answered questions related to credit growth data from the beginning of the year until now, with outstanding debt of the entire economy increasing by a record of more than 1 quadrillion VND.

He said that as of June 26, the total outstanding debt of the entire system reached over 16.9 million billion VND, an increase of 8.3% compared to the end of 2024, an increase of 18.87% compared to the same period. "This is the highest credit growth rate since 2023," he emphasized. The State Bank of Vietnam has set a credit growth target of 16% this year, adjusted according to the actual situation.

According to the representative of the State Bank, the credit structure is suitable for the economic structure, meeting the credit needs of people and businesses, in which the agriculture, forestry and fishery sector accounts for 6.37%. The processing and manufacturing industry accounts for 12.84%; the construction industry accounts for 7.53%, the wholesale and retail industry accounts for 23.74%.

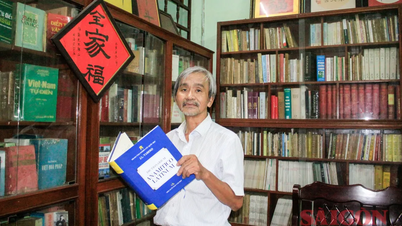

Deputy Governor of the State Bank Pham Thanh Ha (Photo: VGP).

Some sectors with a large proportion in the total outstanding credit in the economy continued to grow well. Among them, sectors that contributed to promoting growth, such as agriculture , rural areas and small and medium enterprises continued to be the sectors with a large proportion in the total outstanding credit of the economy, at 23.16% and 17.51%, respectively.

The supporting industry sector and high-tech enterprises have credit growth rates twice as high as the average of the economy, at 15.69% and 17.59%, respectively.

In addition, credit institutions have actively disbursed credit programs under the direction of the Government and the Prime Minister. A number of other programs such as social housing loans; loans for young people under 35 years old to buy, rent, or hire-purchase social housing, a VND500,000 billion credit program for businesses investing in infrastructure, digital technology , and policy credit programs... are also being actively implemented by credit institutions.

To achieve multiple goals, both controlling inflation, stabilizing the macro-economy, and boosting credit growth to support economic growth according to the Government's targets, in the last months of the year, the State Bank will continue to implement credit management solutions in accordance with macroeconomic developments, inflation, and the economy's capital absorption capacity.

At the same time, this agency also promptly deployed solutions to remove difficulties, creating favorable conditions for people and businesses to access bank credit capital.

Source: https://dantri.com.vn/kinh-doanh/hon-1-trieu-ty-dong-duoc-bom-ra-nen-kinh-te-pho-thong-doc-thong-tin-gi-20250703192931596.htm

![[Photo] President Luong Cuong receives Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/7accfe1f5d85485da58b0a61d35dc10f)

![[Photo] Hanoi is ready to serve the occasion of the 80th National Day Celebration on September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/c838ac82931a4ab9ba58119b5e2c5ffe)

Comment (0)