Domestic gold price today 7/14/2025

As of 4:30 a.m. on July 14, 2025, the domestic gold bar price is based on the closing price yesterday, July 13. Specifically:

The price of SJC gold bars listed by DOJI Group is at 119.5-121.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday but increased by 600 thousand VND/tael in both buying and selling directions compared to last Monday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.5-121.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. This week's gold price increased by 600 thousand VND/tael in both buying and selling directions compared to the beginning of last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.5-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price decreased by 300 thousand VND/tael for both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.5-121.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday, increasing 600 thousand VND/tael in both buying and selling directions compared to the beginning of last week.

SJC gold price at Phu Quy is traded by businesses at 118.8-121.5 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, increased by 600 thousand VND/tael in both buying and selling directions compared to the beginning of last week.

As of 4:30 a.m. on July 14, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116-119 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price increased by 500 thousand VND/tael in buying direction - increased by 1.5 million VND/tael in selling direction compared to the beginning of last week.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell); the gold price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 500 thousand VND/tael in both buying and selling directions compared to last Monday.

The latest gold price list today, July 14, 2025 is as follows:

| Gold price today | July 14, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.5 | 121.5 | - | - |

| DOJI Group | 119.5 | 121.5 | - | - |

| Red Eyelashes | 119.5 | 120.5 | - | - |

| PNJ | 119.5 | 121.5 | - | - |

| Bao Tin Minh Chau | 119.5 | 121.5 | - | - |

| Phu Quy | 118.8 | 121.5 | - | - |

| 1. DOJI - Updated: 7/14/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,500 | 121,500 |

| AVPL/SJC HCM | 119,500 | 121,500 |

| AVPL/SJC DN | 119,500 | 121,500 |

| Raw material 9999 - HN | 108,900 | 110,000 |

| Raw material 999 - HN | 108,800 | 109,900 |

| 2. PNJ - Updated: July 14, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 115,200 | 118,200 |

| HCMC - SJC | 119,500 | 121,500 |

| Hanoi - PNJ | 115,200 | 118,200 |

| Hanoi - SJC | 119,500 | 121,500 |

| Da Nang - PNJ | 115,200 | 118,200 |

| Da Nang - SJC | 119,500 | 121,500 |

| Western Region - PNJ | 115,200 | 118,200 |

| Western Region - SJC | 119,500 | 121,500 |

| Jewelry gold price - PNJ | 115,200 | 118,200 |

| Jewelry gold price - SJC | 119,500 | 121,500 |

| Jewelry gold price - Southeast | PNJ | 115,200 |

| Jewelry gold price - SJC | 119,500 | 121,500 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 115,200 |

| Jewelry gold price - Kim Bao Gold 999.9 | 115,200 | 118,200 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 115,200 | 118,200 |

| Jewelry gold price - Jewelry gold 999.9 | 114,600 | 117,100 |

| Jewelry gold price - Jewelry gold 999 | 114,480 | 116,980 |

| Jewelry gold price - Jewelry gold 9920 | 113,760 | 116,260 |

| Jewelry gold price - Jewelry gold 99 | 113,530 | 116,030 |

| Jewelry gold price - 750 gold (18K) | 80,480 | 87,980 |

| Jewelry gold price - 585 gold (14K) | 61,150 | 68,650 |

| Jewelry gold price - 416 gold (10K) | 41,360 | 48,860 |

| Jewelry gold price - 916 gold (22K) | 104,860 | 107,360 |

| Jewelry gold price - 610 gold (14.6K) | 64,080 | 71,580 |

| Jewelry gold price - 650 gold (15.6K) | 68,770 | 76,270 |

| Jewelry gold price - 680 gold (16.3K) | 72,280 | 79,780 |

| Jewelry gold price - 375 gold (9K) | 36,560 | 44,060 |

| Jewelry gold price - 333 gold (8K) | 31,290 | 38,790 |

| 3. SJC - Updated: 7/14/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,500 | 121,500 |

| SJC gold 5 chi | 119,500 | 121,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,500 | 121,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 | 117,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 | 117,600 |

| Jewelry 99.99% | 115,000 | 116,900 |

| Jewelry 99% | 111,242 | 115,742 |

| Jewelry 68% | 72,750 | 79,650 |

| Jewelry 41.7% | 42,002 | 48,902 |

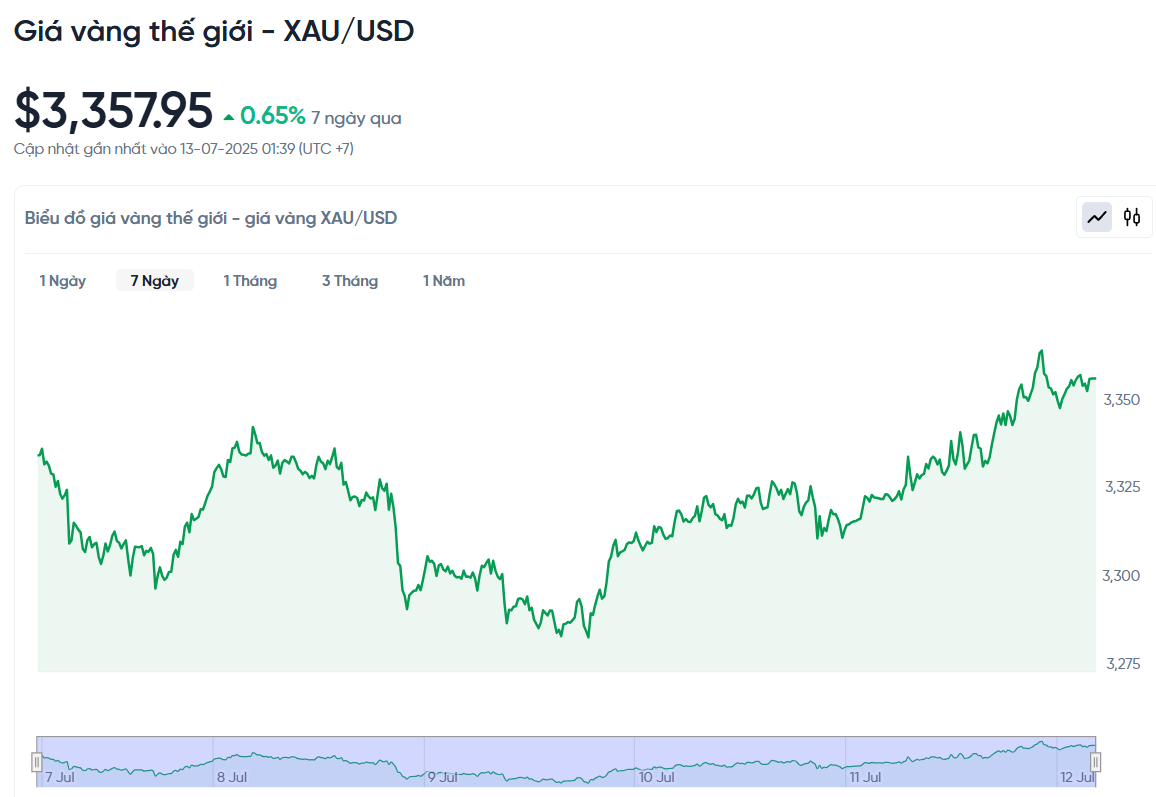

World gold price today July 14, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 14, Vietnam time, was 3,357.95 USD/ounce. Today's gold price is unchanged from yesterday; up 21.72 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,290 VND/USD), the world gold price is about 109.91 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.59 million VND/tael higher than the international gold price.

The price of gold in the world market increased sharply last week, largely due to geopolitical and trade tensions around the world. The relationship between the US and Russia continues to deteriorate, raising concerns about security and economic stability. When major countries are in conflict, many investors often seek gold as a safe haven, helping to protect assets from unpredictable risks.

Another important factor is the new tax policy of the US government. President Donald Trump has just announced plans to impose high tariffs on imported goods from Canada and many other trading partners, many investors have shifted money from stocks to gold, causing gold prices to increase.

In addition to political and commercial factors, some economic signals also affected the price of gold. Although the USD increased slightly, it was not enough to restrain the increase of gold, because the fear of gold still caused a large demand. Crude oil prices remained stable, while US government bond interest rates increased, reflecting concerns about the public debt of the world's largest economy.

According to the World Gold Council (WGC), even without a real financial crisis, the large US budget deficit has caused many people to rush to buy gold to preserve their assets.

A rare phenomenon is taking place as both Eastern and Western economies rush to buy gold, creating a strong momentum for the precious metal, according to Tavi Costa, partner and macro strategist at Crescat Capital.

Costa told Kitco News at the PDAC 2025 conference in Toronto that gold could be in for a major correction relative to historical times. Recent research from Crescat Capital points to the possibility of a spike in gold prices if the U.S. revalues its gold reserves relative to outstanding government bonds.

'The problem is Treasury bonds. There are currently $36 trillion in outstanding bonds, while the US gold reserves account for only about 2% of that. By comparison, that ratio was 17% in the 1970s and nearly 40% in the 1940s,' Costa explains.

According to his calculations, if the US adjusts the rate back to the previous 17%, the price of gold could reach $25,000/ounce. If it returns to 40%, the price of gold could reach $55,000/ounce. Costa emphasized that this is not a price forecast, but only to illustrate the potential for a major change in valuation.

It is worth noting that while central banks around the world are buying gold at a 50-year high since the financial crisis, US gold reserves are at a 90-year low. This disparity may force the US to reconsider its gold policy.

Gold Price Forecast

After a relatively quiet holiday week, the market enters the new week with a series of important economic data that could impact gold prices. Most notably, the June consumer price index (CPI) report will be released on Tuesday, along with the Empire State manufacturing survey.

Next up is the producer price index (PPI) on Wednesday. On Thursday, the market will turn its attention to retail sales, the Philly Fed manufacturing survey and weekly jobless claims. The week will close with housing starts and the University of Michigan consumer sentiment survey on Friday.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is neutral on gold prices next week, saying the main driver for gold remains the volatility of the U.S. dollar around tariff or political announcements, which are difficult to predict.

Analysts at CPM Group issued a buy recommendation on gold on Thursday with an initial price target of $3,375 by August 1. They said gold is in a correction phase after recovering to $3,376 on July 3.

Daniel Pavilonis, senior commodities broker at RJO Futures, elaborated on the impact of the US budget bill on the gold rally. He said the only way to solve the current huge public debt problem is through currency devaluation and inflation. This is one of the main drivers of the current high gold price, along with increased gold purchases by central banks.

Gold has been in a sideways trend for the past few months, Pavilonis said. He initially thought gold had topped out and was headed back toward its 200-day moving average, but tariffs and Russia’s oil-related moves have helped support higher prices.

The metals that have seen the most recent moves are silver, platinum, palladium and copper, which are all linked to artificial intelligence and next-generation computing, Pavilonis said. He predicts that US businesses will increase spending as they shift from globalisation to domestic production, especially in the old industrial areas and the American heartland.

In the short term, Pavilonis does not expect the CPI report or the EU tariff announcement to have a significant impact on gold prices. He predicts that gold will continue to move sideways for the next several months, consolidating in a stable price range before the next strong rally.

Further, Pavilonis believes that the next rally in gold is unlikely to come from a Fed rate cut. Instead, a major geopolitical event could be the trigger for a short-term rally. He notes that the event would have to be large enough to exceed the level of Iran-Israel tensions to have a significant impact on the gold market.

Source: https://baonghean.vn/gia-vang-hom-nay-14-7-2025-bat-dau-tu-muc-121-5-trieu-dong-gia-vang-buoc-vao-tuan-kho-doubt-voi-hang-loat-chi-so-kinh-te-my-10302221.html

![[Maritime News] Treasury Department Targets Diverse Networks Facilitating Iran's Oil Trade](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/14/43150a0498234eeb8b127905d27f00b6)

Comment (0)