Update the latest gold price details today, July 15, 2025 in the domestic market

At the time of the survey at 5:30 p.m. on July 15, 2025, domestic gold prices recorded a downward trend across major brands. This is a notable development in the market, reflecting a strong adjustment in domestic gold prices. Specifically:

In Hanoi , SJC gold price was listed at 119.1 million VND/tael (buy) and 121.1 million VND/tael (sell), down 400 thousand VND/tael in both directions compared to yesterday. DOJI Group also recorded a similar decrease, with buying and selling prices of 119.1 million VND/tael and 121.1 million VND/tael, respectively.

At Mi Hong , SJC gold price remained unchanged at buying price, maintaining 119.5 million VND/tael, but decreased 400 thousand VND/tael at selling price, down to 120.7 million VND/tael.

At PNJ , the gold price has not changed compared to yesterday. The buying price remains at 115.2 million VND/tael, while the selling price stands at 118.2 million VND/tael.

Vietinbank Gold recorded a decrease of 400 thousand VND/tael in selling price, bringing the price down to 121.1 million VND/tael.

Bao Tin Minh Chau also recorded a similar decrease, with buying and selling prices at VND119.1 million/tael and VND121.1 million/tael, respectively.

At Phu Quy , gold price decreased by 400 thousand VND/tael in both directions, with buying price reaching 118.4 million VND/tael and selling price reaching 121.1 million VND/tael.

As of 5:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 115.6-118.5 million VND/tael (buy - sell); down 400,000 VND/tael in both buying and selling directions compared to early this morning. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.8-118.8 million VND/tael (buy - sell); down 400 thousand VND/tael in both buying and selling directions compared to early this morning. The difference between buying and selling prices is at 3 million VND/tael.

Gold price trend forecast today 7/15/2025

The downward trend in gold prices today, July 15, 2025, shows a clear adjustment in the domestic gold market, bringing new signals to investors. This could be an opportunity for investors to consider buying strategies to optimize profits when gold prices are falling.

Gold price list this afternoon July 15, 2025 in the country in detail:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 119.1 | ▼400K | 121.1 | ▼400K |

| DOJI Group | 119.1 | ▼400K | 121.1 | ▼400K |

| Red Eyelashes | 119.5 | - | 120.7 | ▼400K |

| PNJ | 115.2 | - | 118.2 | - |

| Vietinbank Gold | 121.1 | ▼400K | ||

| Bao Tin Minh Chau | 119.1 | ▼400K | 121.1 | ▼400K |

| Phu Quy | 118.4 | ▼400K | 121.1 | ▼400K |

| 1. DOJI - Updated: July 15, 2025 17:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 119,100 ▼400K | 121,100 ▼400K |

| AVPL/SJC HCM | 119,100 ▼400K | 121,100 ▼400K |

| AVPL/SJC DN | 119,100 ▼400K | 121,100 ▼400K |

| Raw material 9999 - HN | 108,500 ▼400K | 109,600 ▼400K |

| Raw material 999 - HN | 108,400 ▼400K | 109,500 ▼400K |

| 2. PNJ - Updated: July 15, 2025 17:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 115,200 | 118,200 |

| HCMC - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Hanoi - PNJ | 115,200 | 118,200 |

| Hanoi - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Da Nang - PNJ | 115,200 | 118,200 |

| Da Nang - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Western Region - PNJ | 115,200 | 118,200 |

| Western Region - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Jewelry gold price - PNJ | 115,200 | 118,200 |

| Jewelry gold price - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Jewelry gold price - Southeast | PNJ | |

| Jewelry gold price - SJC | 119,100 ▼400K | 121,100 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 115,200 |

| Jewelry gold price - Kim Bao Gold 999.9 | 115,200 | 118,200 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 115,200 | 118,200 |

| Jewelry gold price - Jewelry gold 999.9 | 114,600 | 117,100 |

| Jewelry gold price - Jewelry gold 999 | 114,480 | 116,980 |

| Jewelry gold price - Jewelry gold 9920 | 113,760 | 116,260 |

| Jewelry gold price - Jewelry gold 99 | 113,530 | 116,030 |

| Jewelry gold price - 750 gold (18K) | 80,480 | 87,980 |

| Jewelry gold price - 585 gold (14K) | 61,150 | 68,650 |

| Jewelry gold price - 416 gold (10K) | 41,360 | 48,860 |

| Jewelry gold price - 916 gold (22K) | 104,860 | 107,360 |

| Jewelry gold price - 610 gold (14.6K) | 64,080 | 71,580 |

| Jewelry gold price - 650 gold (15.6K) | 68,770 | 76,270 |

| Jewelry gold price - 680 gold (16.3K) | 72,280 | 79,780 |

| Jewelry gold price - 375 gold (9K) | 36,560 | 44,060 |

| Jewelry gold price - 333 gold (8K) | 31,290 | 38,790 |

| 3. SJC - Updated: 7/15/2025 5:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,100 ▼400K | 121,100 ▼400K |

| SJC gold 5 chi | 119,100 ▼400K | 121.120 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,100 ▼400K | 121,130 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,600 ▼400K | 117,100 ▼400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,600 ▼400K | 117,200 ▼400K |

| Jewelry 99.99% | 114,600 ▼400K | 116,500 ▼400K |

| Jewelry 99% | 110,846 ▼396K | 115,346 ▼396K |

| Jewelry 68% | 72,477 ▼272K | 79,377 ▼272K |

| Jewelry 41.7% | 41,835 ▼166K | 48,735 ▼166K |

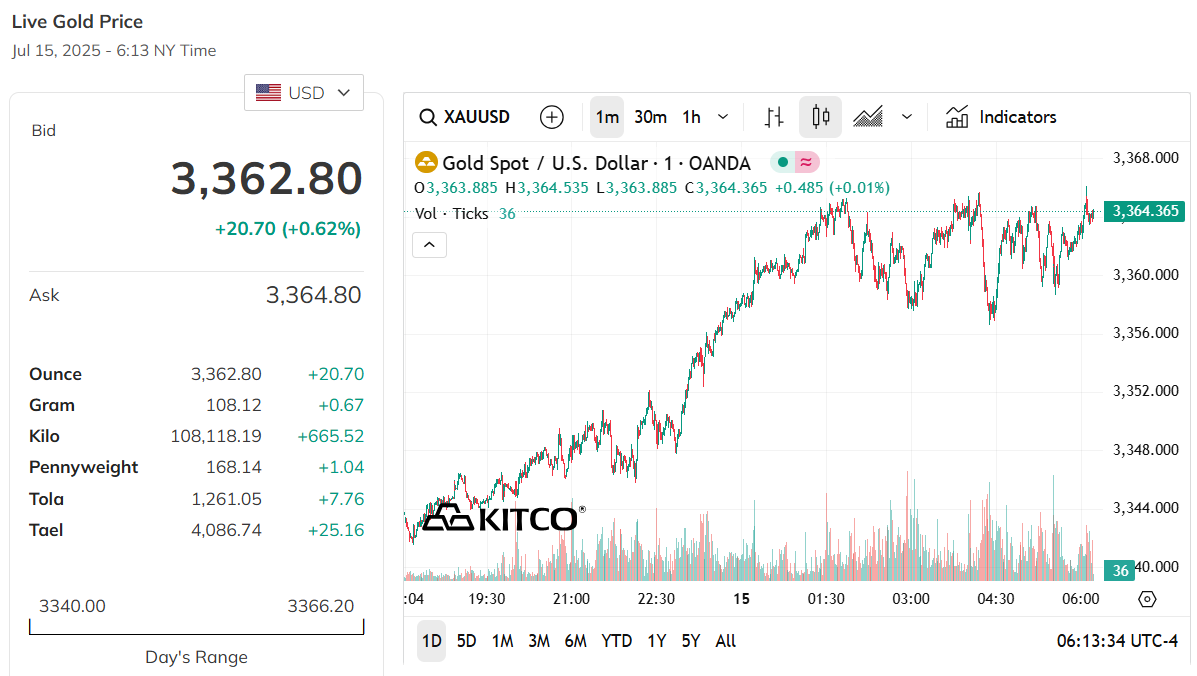

World gold price on July 15, 2025 increased sharply after President Trump announced tax imposition

World gold price, at 5:12 p.m. on July 15, 2025 (Vietnam time), the world spot gold price was at 3,362.8 USD/ounce. Today's gold price increased by 20.7 USD. Converted according to the USD exchange rate at Vietcombank (26,310 VND/USD), world gold is priced at about 110.11 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (119.1-121.1 million VND/tael), the current SJC gold price is about 10.99 million higher than the international gold price.

Gold prices today, July 15, 2025, on the world market increased slightly due to many supporting factors, especially concerns about the global trade war. When investors are worried about economic and political instability, they often turn to gold as a safe place to protect their assets. Spot gold prices on the international market increased by 0.6%, reaching 3,361.99 USD per ounce. Meanwhile, gold futures prices in the US also increased slightly by 0.4%, to 3,371.30 USD per ounce. This means that gold is being chosen by many people to keep money in the context of market fluctuations.

A major factor driving the rise in gold prices today is the slight weakening of the US dollar. When the dollar depreciates, gold becomes cheaper for holders of other currencies, which stimulates demand for gold. Experts say that gold is receiving a lot of support from the market. For example, expectations that the US Federal Reserve (Fed) may cut interest rates in the near future, along with the tariff policies threatened by former US President Donald Trump, are increasing the appeal of gold. These factors make gold a safer choice than other risky assets.

Trade tensions between the US and regions such as the European Union (EU) and Mexico also contributed to the increase in gold prices today. Last weekend, Mr. Trump announced that he would impose a 30% tax on imported goods from the EU and Mexico, raising concerns about a new trade war. The EU has warned that it will retaliate if a trade agreement with the US is not reached. These uncertainties make investors want to hold gold to protect their assets from unpredictable fluctuations.

In addition, investors are also waiting for the US consumer price index (CPI) report, scheduled to be released today. This report may affect the Fed's interest rate policy. If inflation in the US increases, this may make the Fed more cautious in cutting interest rates, thereby affecting gold prices. However, the market currently expects the Fed to cut interest rates by about 48 basis points by the end of this year, starting in October. These factors all make the gold price today, July 15, 2025, continue to attract attention in the world market.

Not only gold, other precious metals such as silver, platinum and palladium also recorded price increases. Silver prices increased by 0.4% to 38.28 USD per ounce, reaching the highest level since September 2011. Experts predict that if gold prices surpass the 3,440 USD per ounce mark, silver prices may reach 40 USD per ounce. Meanwhile, platinum and palladium also increased by 0.8% and 0.2% respectively, showing the attraction of precious metals in the context of the global economy facing many challenges.

News, gold price trends today 7/16/2025

The gold price on July 16, 2025 is forecast to continue to be affected by many global economic and political factors. Currently, the world gold price is at 3,362.8 USD/ounce (as of 5:12 p.m. on July 15, 2025), an increase of 20.7 USD compared to the previous day. Converted according to Vietcombank exchange rate (26,310 VND/USD), the world gold price is about 110.11 million VND/tael, lower than the domestic SJC gold price by about 10.99 million VND/tael.

Concerns about a trade war between the US and regions such as the EU and Mexico are growing. US President Donald Trump recently announced a 30% tariff on goods imported from the EU and Mexico, causing financial markets to fluctuate. In this context, gold has become a safe haven for investors.

The US dollar weakened slightly, making gold more attractive to international investors. When the US dollar is weak, gold is cheaper in other currencies, stimulating demand for gold.

The US Federal Reserve is expected to cut interest rates in the coming months, which increases the appeal of gold, as low interest rates tend to make non-yielding assets like gold more attractive.

The US Consumer Price Index (CPI) report, due on July 15, 2025, could have a major impact on gold prices. If inflation rises, the Fed could change its interest rate strategy, which could impact the gold market.

With the above factors, the gold price on July 16, 2025 is likely to continue to maintain its upward momentum. However, the increase will depend on the latest economic information, especially CPI data and statements from the Fed. If trade tensions escalate or the USD continues to weaken, the gold price may exceed the mark of 3,370 USD/ounce in the international market.

In the context of fluctuating gold prices, investors need to consider carefully before making a decision. For those who want to invest for the long term, gold is still a safe choice. However, if you are looking for short-term profits, keep a close eye on economic and political news to make the right decision.

Source: https://baodanang.vn/du-bao-gia-vang-ngay-mai-16-7-2025-rung-chan-manh-boi-cuoc-chien-thuong-mai-giua-my-eu-3296931.html

Comment (0)