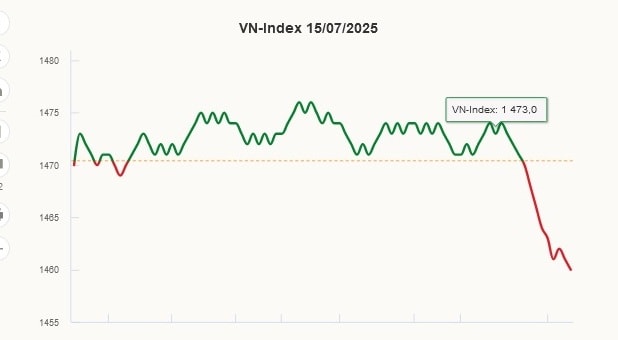

VN-Index increased sharply this morning, approaching the 1,480 point price range, in line with the predictions of many securities companies about a prolonged euphoria. However, the market reversed in the last 30 minutes of the session due to profit-taking pressure rising suddenly in many pillar stocks. The index representing the Ho Chi Minh City Stock Exchange therefore lost nearly 10 points, closing at 1,460 points.

Strong selling pressure caused the number of stocks to decline today by approximately 200, while the number of stocks to increase by less than 140. Red covered the large-cap basket when 25 out of 30 stocks closed below the reference.

Banking stocks weighed down the market the most. VCB lost 1.6% to VND61,400, topping the list of stocks negatively impacting the VN-Index. BID, TCB, VPB, ACB , HDB and TPB also fell more than 1% compared to the reference.

The oil and gas group was under similar profit-taking pressure, causing most of its constituent stocks to reverse from increasing to decreasing. POW lost 1.8%, while the two pillar stocks GAS and PLX lost 0.7% and 0.5%, respectively.

The real estate group had a strong differentiation with many mid- and large-cap stocks such as VIC, VHM, VRE, KDH, NVL closing at a decrease. On the contrary, some small-cap stocks such as LDG and HDC still increased to the maximum limit, closing the session with no sellers.

The securities group had similar developments when BSI, VCI, VDS decreased by 1.2-2.4%, while SSI, VND, VIX, HCM all increased by more than 1%. SBS, a securities stock currently trading on the UPCoM exchange, even increased by the full 14% range.

Thanks to the strong cash flow from foreign investors, SSI is an important pillar, helping the market avoid a deeper decline. This code at one point touched the ceiling price of 31,800 VND, then narrowed the range and closed at 30,500 VND, up 2.5%.

Next on the list of stocks that positively impacted the VN-Index were LPB, MWG, SSB and SAB. The stocks increased sharply in the morning session, but by the afternoon, they were down only 0.1-2%.

Liquidity on the Ho Chi Minh City Stock Exchange reached over VND34,500 billion, about VND3,000 billion higher than the previous session. Cash flow was evenly distributed across many industry groups, so the market had up to 6 codes recording a transaction value of thousands of billions. SSI led the way with 62 million shares successfully transferred, worth VND1,935 billion. The codes ranked after were HPG, SHB , VCI, VND and VIX.

A positive signal is that foreign investors have been diligently buying stocks for 10 consecutive sessions. Foreign investors today disbursed 3,845 billion VND, while selling less than 2,730 billion VND. This group poured a lot of money into stocks DXG, VPB, SSI and SHB.

According to some securities companies, the index's fluctuations when entering the strong resistance zone (1,480 points) are inevitable. Investors are advised to take partial profits and limit new purchases during this period. Disbursement can be considered in the next adjustment phases, but should focus on stocks in leading industries such as banking, securities, and real estate.

HA (according to VnE)Source: https://baohaiphongplus.vn/chung-khoan-dao-chieu-giam-manh-416421.html

Comment (0)