While European and Chinese automakers are aggressively developing plug-in hybrids (PHEVs) to meet increasingly stringent emissions regulations, big names like Toyota and Hyundai are holding back. This difference reflects the global auto industry’s inconsistent approach to the transition to the electric era.

PHEV "Bridge" between past and future

Plug-in hybrid electric vehicles (PHEVs) are considered the “ideal middle ground” solution, combining the best of both worlds : the smooth operation of an electric vehicle in short ranges, and the convenience of an internal combustion engine when traveling long distances. Especially in Europe, where CO2 emission standards are increasingly strict, PHEVs are a suitable choice to reduce the average emissions of the vehicle fleet.

Some car manufacturers such as Audi and Lynk&Co (China) are pursuing the strategy of increasing the pure electric driving range of PHEV models. For example, Lynk&Co 08 PHEV, a model that is likely to be sold in Vietnam, has a pure electric range of up to 200 km. Meanwhile, Audi Q3 PHEV reaches 119 km, equivalent to Mercedes-Benz C-Class or E-Class PHEV, a number considered relatively high compared to the general level.

Toyota and Hyundai ''Keep'' the practical

In contrast, manufacturers from Japan and South Korea take a more cautious approach.

Toyota Europe representative Andrea Carlucci said that extending the electric driving range of PHEVs beyond 100 km is not necessary at the present time. According to him, 100 km is a “reasonable balance point” between cost, efficiency and purpose of use. Equipping large capacity batteries increases costs, entails higher technical requirements without necessarily bringing practical value to users.

Currently, the new generation Toyota RAV4 PHEV reaches 100 km of pure electric range according to WLTP standards, while the Toyota C-HR PHEV stops at 66 km, enough for most daily urban travel needs.

Hyundai has a similar view. The company believes that increasing the electric range of PHEVs will make the vehicle structure more complex, making the price higher without increasing the actual value of use proportionally. For example, the Santa Fe PHEV, one of Hyundai’s most popular PHEV models, currently has a range of only about 55 km.

In addition, Hyundai is also researching and developing extended range electric vehicles (EREV), but the company's representative in Europe said it is still uncertain whether it can be widely commercialized in this market.

“PHEV and EREV are stepping stones. Making them more sophisticated would only increase costs, which is not sustainable in the long run,” Xavier Martinet , CEO of Hyundai Europe, told Auto News.

Mr. Martinet also warned that CO2 emission standards in Europe will be reviewed in 2028, which could significantly reduce the role of PHEVs, and that companies need to calculate carefully if they want to continue investing in this technology in the long term.

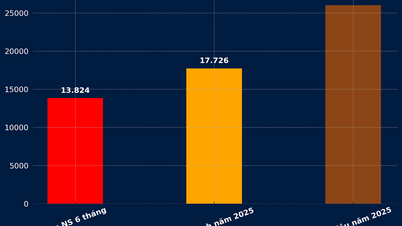

In Vietnam, PHEV cars are still a narrow segment.

In Vietnam, PHEV cars are still quite new and mainly appear in the luxury car segment such as: BMW XM, Porsche Panamera, Volvo S90/XC90, Range Rover Velar. In the popular segment, the number of PHEV models can currently be counted on the fingers, including Kia Sorento PHEV, Jaecoo J7 SHS, and BYD Sealion 6 (about to be sold).

Limited charging infrastructure and investment costs are the main barriers preventing PHEVs from taking off in Vietnam like they have in Europe or China. However, with the growing popularity of hybrid vehicles, it is entirely possible that mid-size or small-size PHEVs will enter the market in the near future.

Source: https://khoahocdoisong.vn/cac-hang-oto-chia-re-ve-tuong-lai-xe-hybrid-sac-dien-post1550747.html

![[Photo] Standing member of the Secretariat Tran Cam Tu chaired a meeting with Party committees, offices, Party committees, agencies and Central organizations.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/1/b8922706fa384bbdadd4513b68879951)

Comment (0)