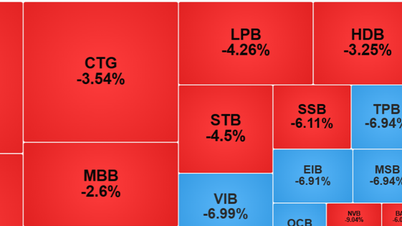

More than 280 stocks fell, causing the VN-Index to spend most of the trading time below reference and close with a decrease of more than 14 points, down to 1,231.89 points.

More than 280 stocks fell, causing the VN-Index to spend most of the trading time below reference and close with a decrease of more than 14 points, down to 1,231.89 points.

After yesterday's slight increase, some experts believe that the market may have a slow recovery in the short term. However, investors need to closely monitor the domestic exchange rate situation and the State Bank's actions in the coming time to determine the market trend more clearly.

In reality, the opposite happened when VN-Index was in the red since opening, but the decrease range was relatively narrow, even bouncing back to the reference point at times. The index representing the Ho Chi Minh City Stock Exchange gradually widened its decrease range from the end of the morning session due to strong selling pressure.

In the afternoon session, the index continued to fall sharply before closing at 1,231.89 points, losing 14.15 points from the reference and marking the sharpest decline in more than three months. The last time the index fell more than this level was on August 5 when it lost approximately 49 points.

Market breadth was tilted towards the downside as 284 stocks closed in red, while only 82 stocks increased. The VN30 basket was strongly differentiated as the selling side dominated, resulting in 23 stocks closing below the reference, while 5 stocks increased.

HPG became the strongest factor in pushing the index down, falling 2.77% to VND26,300. Banking stocks were also on the list of 10 stocks that negatively impacted the VN-Index. Specifically, CTG fell 2.18% to VND33,600, BID fell 1.41% to VND45,500, VCB fell 0.54% to VND92,000, VPB fell 1.81% to VND19,000, TCB fell 1.51% to VND22,800 and MBB fell 1.45% to VND23,800.

Stocks in the securities group also fluctuated negatively. Specifically, BSI decreased by 6.8% to VND44,450, VDS decreased by 4.9% to VND18,450, VCI decreased by 4.8% to VND32,950 and AGR decreased by 4.2% to VND17,050.

Selling pressure also appeared in the oil and gas group when most stocks decreased. Of which, PVD decreased by 2.5% to VND23,200, POW decreased by 1.7% to VND11,500, GAS decreased by 0.7% to VND69,000 and PVT decreased by 0.7% to VND27,900. PSH was the only code that increased to the ceiling price in this group, up to VND3,850 and closed with no sellers.

On the other hand, BCM increased by 1.03% to VND68,600, thereby becoming the market's support in today's session. The next positions in the list of positive impacts on the VN-Index came from many different groups of stocks such as aviation, real estate, seaports, etc. Specifically, HVN increased by 0.96% to VND26,250, HAG increased by 3.98% to VND11,750, LGC increased by 3.33% to VND62,000 and VIC increased by 0.25% to VND40,700.

Market liquidity today reached VND16,132 billion, up nearly VND800 billion compared to the previous session. This value came from about 693 million shares changed hands, up 32 million units compared to yesterday's session. The VN30 basket contributed a trading volume of more than 252 million shares and liquidity of approximately VND7,168 billion.

Domestic investors focused on buying HPG when this code topped the matched value with about 708 billion VND (equivalent to 26.6 million shares). The next positions were VHM with more than 690 billion VND (equivalent to 17 million shares) andFPT with approximately 653 billion VND (equivalent to 4.7 million shares).

Foreign investors maintained their net buying status for the sixteenth session. Specifically, foreign investors sold nearly 104 million shares, equivalent to VND2,483 billion, while only spending VND1,542 billion to buy 67 million shares. The net buying value accordingly reached VND941 billion.

Foreign investors focused on selling FPT with a net value of VND200 billion, followed by VPB with more than VND99 billion, MSB with VND83 billion and SSI with VND74 billion. In contrast, foreign cash flow focused on MCH shares with a net value of VND247 billion. HAH ranked next with a net absorption of more than VND32 billion, followed by VRE with approximately VND26 billion.

Source: https://baodautu.vn/vn-index-mat-hon-14-diem-giam-manh-nhat-ba-thang-qua-d230028.html

![[Photo] President Luong Cuong receives Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/7accfe1f5d85485da58b0a61d35dc10f)

![[Photo] Hanoi is ready to serve the occasion of the 80th National Day Celebration on September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/c838ac82931a4ab9ba58119b5e2c5ffe)

Comment (0)