"My stock portfolio all hit the ceiling this morning, everyone" - Nguyen, a broker at a securities company in Hanoi , texted the 700-member stock investment group he manages.

VN-Index nears 1,500 points, investors boast profits

Nguyen is one of the investors holding real estate, securities and retail stocks. Immediately after Nguyen's message, many other investors in the group responded, boasting that the entire portfolio's profits were much higher than the sharp decline on tariff day in early April.

According to Nguyen, he recommends investors in the group to "surf" real estate stocks, Vingroup stocks, and securities last week, earning about 20%.

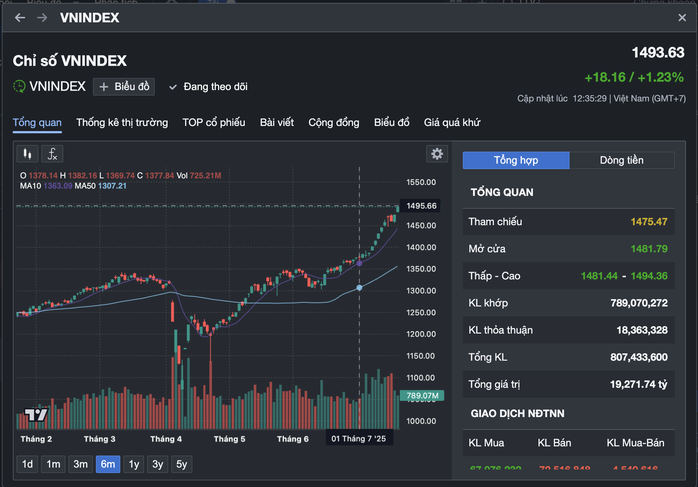

In the trading session this morning, July 17, VN-Index temporarily stopped at 1,493.63 points, up 18.16 points compared to the previous session and less than 7 points away from the 1,500 mark. VN30 Index far surpassed the 1,600 point mark; while HNX-Index also increased sharply by 4.19 points to 246.54 points.

Market liquidity continued to be high, as in the morning session alone, the transaction value on the HoSE floor was approximately 20,000 billion VND.

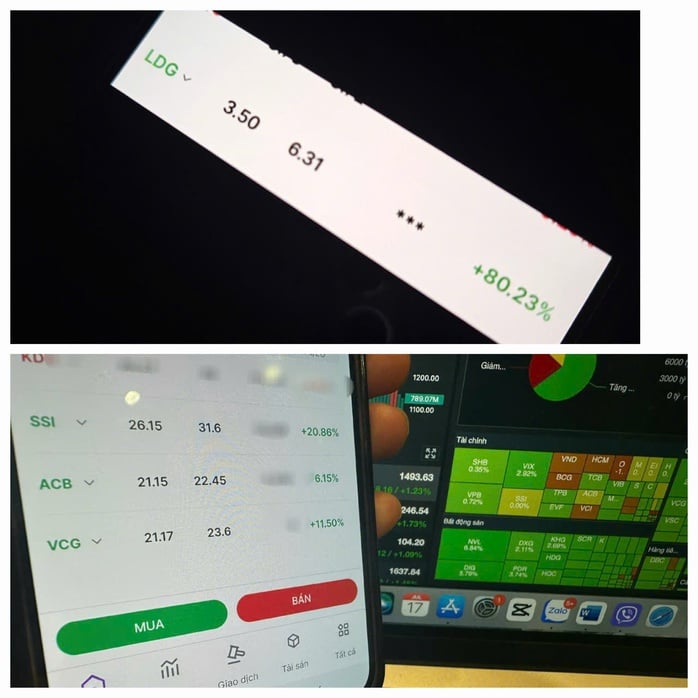

List of some investors who reported profits in a short period of time

According to reporters, on many forums and groups, many investors and securities brokers began to show off their profits as the market approached the 1,500 point mark.

Not only the pillar stocks in the VN30 basket, small-cap penny stocks also bring high profits to investors.

Many investors "have not returned to shore"

Ms. Thanh, an investor in Ho Chi Minh City, who is holding LDG shares, said she has made a profit of about 80% in the past month. LDG shares have increased sharply from VND2,000 at the end of June to VND6,750/share at present. This morning, LDG shares continued to increase by 6.97%.

VN-Index has not stopped increasing, heading towards the 1,500 point mark

Besides investors who boast of profits, there are still many investors who have not "returned to shore" or are staying out of the market after selling early at the VN-Index 1,400 point area. Mr. Ngoc Hoai, an investor in Ho Chi Minh City, said that when the market was around 1,400 points, many people recommended taking profits and waiting for the VN-Index to adjust, so he sold all stocks at this price area.

"In recent sessions, the market has increased strongly but I don't dare to buy, still waiting for correction" - Mr. Ngoc complained.

As reported by Nguoi Lao Dong Newspaper , although the VN-Index recovered strongly by more than 300 points from the April 2 tariff event, the increase has not spread to all stock classes.

Data from MBS Securities Company shows that only 12/50 stocks with the largest market capitalization have increased more strongly than the VN-Index since March 31, about 9 stocks have increased less than the general market. In fact, nearly half of the stocks in the top 50 have not yet recovered to pre-tariff levels.

In this context, if any investor buys the wrong stocks that increase in price, the probability of losing money or "not reaching the shore" is still very high, despite the VN-Index heading towards the 1,500-point mark. Furthermore, experts warn that risks to watch out for will be geopolitical fluctuations, exchange rate pressure if the FED delays lowering interest rates, and uncertainty in the policies of the US President's administration.

Source: https://nld.com.vn/vn-index-cach-moc-1500-chua-toi-7-diem-ke-cuoi-nguoi-khoc-196250717124121754.htm

Comment (0)