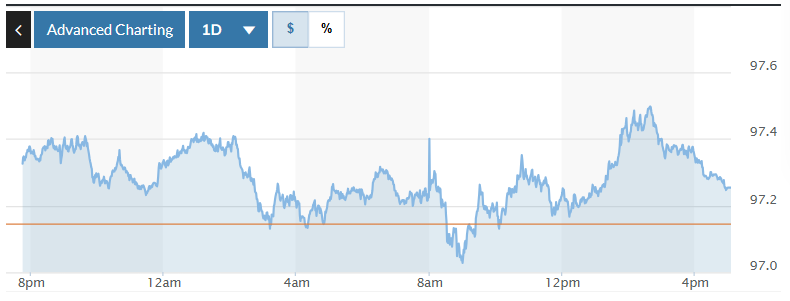

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.11%, currently at 97.25.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch |

USD exchange rate today in the world

The dollar recovered earlier losses against the euro on Friday, after US President Donald Trump announced the United States would end trade talks with Canada.

"Overall, this statement shows Trump's erratic behavior and any assumptions the market has built up can be shattered immediately," said Adam Button, senior currency analyst at ForexLive.

“The initial reaction was to buy the US dollar, but as things calm down that trend could reverse. The trade war has been weighing on the dollar for the past year,” said Button.

The Canadian dollar continued to fall during the day after Trump announced the U.S. was ending trade talks with Canada in response to the country’s digital services tax on technology companies. The CAD fell 0.5% against the greenback to CAD1.37/USD.

Earlier in the day, the US dollar fell to a three-and-a-half-year low against the euro as traders bet the US Federal Reserve would cut interest rates more often and sooner than expected, as some data showed the US economy was weakening.

A report on Friday showed U.S. consumer spending unexpectedly fell in May as people pre-empted new Trump tariffs, while monthly inflation remained moderate. The weekly jobs report on Thursday showed jobless claims rising to their highest level since November 2021, while first-quarter GDP was revised sharply downward due to weaker consumer spending.

Fed Chairman Jerome Powell's testimony before the US Congress this week was seen as dovish, after he noted that a rate cut could happen if inflation does not rise as expected. A rate cut by the Fed would reduce the interest rate advantage of the US dollar over other currencies.

The euro rose 0.05% to $1.1705 and hit $1.1754 - its highest since September 2021. The euro is on track to gain 1.57% for the week - its best since May 19.

The pound fell 0.19% to $1.3701, but was still on track for a 1.85% weekly gain - its best week since May 19.

The dollar fell 0.06% to 0.8 Swiss franc and was on track for a 2.26% weekly drop - its biggest since April 7.

The long-term outlook for the US dollar is seen as challenging as foreign investors are reassessing the “American exceptionalism” that once attracted large capital flows into the country.

Against the Japanese yen, the dollar rose 0.19% to 144.65, but was still on track for a 0.94% weekly decline, its biggest since May 19.

|

| Illustration photo: VnEconomy |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on June 28, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 25,048 VND.

* The reference USD exchange rate at the State Bank's buying and selling exchange center has slightly decreased, currently at: 23,846 VND - 26,250 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,880 VND | 26,270 VND |

Vietinbank | 25,765 VND | 26,275 VND |

BIDV | 25,910 VND | 26,270 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased, currently at: 27,825 VND - 30,754 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,764 VND | 31,364 VND |

Vietinbank | 29,706 VND | 31,416 VND |

BIDV | 30,094 VND | 31,342 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office increased, currently at: 165 VND - 182 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.42 VND | 185.50 VND |

Vietinbank | 176.40 VND | 186.10 VND |

BIDV | 177.47 VND | 185.33 VND |

THUY ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-28-6-dong-usd-phuc-hoi-257170.html

Comment (0)