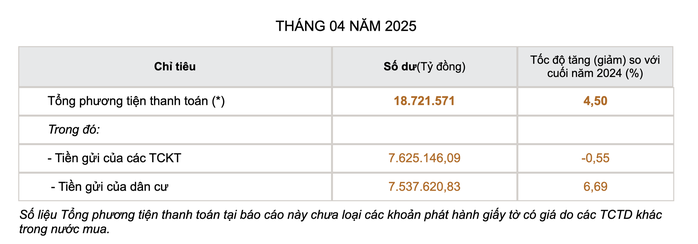

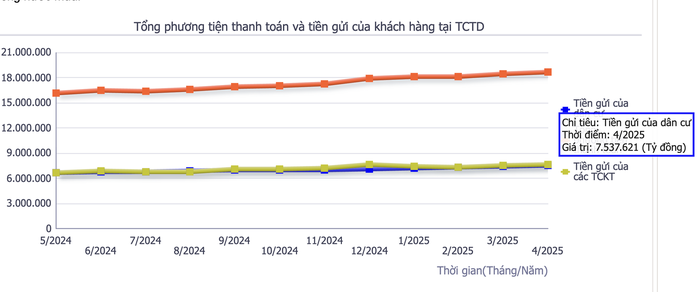

The State Bank has just announced information on customer deposits at credit institutions as of the end of April 2025. evident, people's savings deposits in the banking system reached the highest level of the year with more than 7.53 million billion VND, a sharp increase of nearly 6.7% compared to the end of last year.

In just the first four months of this year, people deposited nearly VND500,000 billion worth of idle money into the banking system.

Meanwhile, deposits of economic organizations decreased slightly by 0.55% compared to the end of last year but still exceeded 7.62 million billion VND.

If including deposits from residents and economic organizations, the total amount of idle money flowing into the credit institution system exceeds 15.16 million billion VND.

Latest data updated as of April 2025

According to a reporter from Nguoi Lao Dong Newspaper, many people said they still choose to save money even though the interest rate is stable, even showing a slight downward trend. Ms. Bich Ngoc (living in An Khanh Ward, Ho Chi Minh City) said that she had just matured a 6-month term deposit of VND500 million and chose to continue depositing. The previous term deposit interest rate at a digital bank was about 6%/year, now the new term is only about 5.7-5.8%/year.

"Interest rates have decreased slightly, but I have no investment or business plans, so I still choose to deposit money in the bank. The current gold price is too high, while stocks are risky," said Ms. Ngoc.

According to the General Statistics Office ( Ministry of Finance ), as of June 26, capital mobilization of credit institutions increased by 6.11%; credit growth of the economy reached 8.3%.

In just 4 months, people deposited about 500,000 billion VND of idle money into the banking system.

How do average deposit and lending rates affect savings deposits?

In the first half of 2025, the State Bank will continue to maintain operating interest rates, promote solutions to boost credit growth, and direct capital flows into production and business sectors and priority sectors.

As of May, the average VND deposit interest rate of domestic commercial banks was 0.1-0.2%/year for demand deposits and deposits with terms of less than 1 month; 4.5-5.5%/year for deposits with terms from 6 months to 12 months; 4.8-6%/year for deposits with terms from over 12 months to 24 months and 6.9-7.1%/year for terms over 24 months.

The average lending interest rate of domestic commercial banks for new and old outstanding loans is 6.6-8.9%/year. The average short-term lending interest rate in VND for priority sectors is about 3.9%/year, lower than the maximum rate prescribed by the State Bank of 4%/year.

Source: https://nld.com.vn/tien-gui-tiet-kiem-cua-nguoi-dan-tang-cao-nhat-tu-dau-nam-196250706160411685.htm

Comment (0)