Exceeding estimates thanks to comprehensive reform

According to the Tax Department, this result was achieved thanks to the uniform growth when 16/19 revenue items and taxes increased. In particular, revenue from e-commerce and digital economy activities reached 98 trillion VND, up 58%. Locally, 31/34 provinces and cities achieved good collection progress (over 55% of the estimate) and 33/34 localities recorded growth.

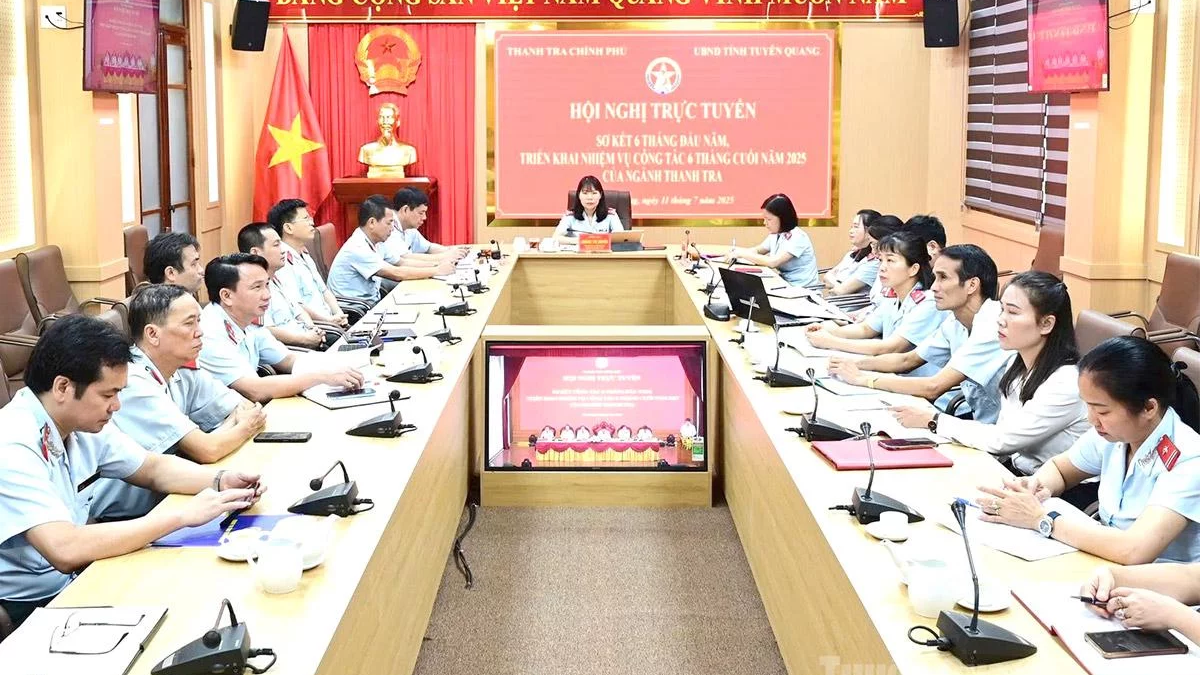

|

| Conference on preliminary tax work in the first 6 months of the year, deploying tasks for the last 6 months of the year, July 10. (Photo: Vietnam+) |

To achieve the above results, the Tax Department said it has implemented a comprehensive reform strategy, focusing on taxpayers. The industry has promoted the application of technology, deployed electronic invoices and automatic tax refunds. Currently, 99.4% of businesses have participated in electronic tax declaration. In 6 months, 269,941 files have been automatically refunded with a total amount of 1,253 billion VND.

Along with support, inspection and examination work has been tightened. The whole industry has conducted 26,290 inspections and examinations. The total amount of proposed handling is 28,430 billion VND, an increase of 32% over the same period. Debt management work has also been innovated, helping to recover 43,109 billion VND through measures such as electronic debt enforcement, connecting with the Ministry of Public Security to freeze accounts.

Heavy tasks in the last 6 months of the year

At the review conference, Deputy Minister of Finance Cao Anh Tuan highly appreciated the efforts of the industry. However, he also pointed out that the tasks for the last 6 months of the year are extremely heavy.

|

| Deputy Minister of Finance Cao Anh Tuan speaks at the conference. (Photo: Hanoimoi.vn) |

According to Official Dispatch No. 104/CD-TTg, the Prime Minister has directed the Ministry of Finance to strive to increase revenue by over 20% in 2025. Deputy Minister of Finance Cao Anh Tuan commented: "To achieve the above goal, the Tax sector needs to have appropriate solutions in the context of the world is still very complicated".

To implement the directive, Deputy Minister of Finance Cao Anh Tuan requested the Tax sector to focus on perfecting institutions, especially the draft Law on Tax Administration (amended). In addition, the sector needs to continue promoting digital transformation, perfecting the database and strengthening inspections of high-risk areas.

Regarding organization, the Tax sector has completed the restructuring of its apparatus according to the new model since July 1, operating uniformly with 34 provincial and municipal Tax agencies. A representative of the Tax Department said that this is the foundation for building a transparent and modern management system, serving people and businesses more effectively.

Source: https://thoidai.com.vn/thu-ngan-sach-6-thang-but-pha-nganh-thue-nhan-nhiem-vu-tang-thu-tren-20-214767.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)