Experts predict that from now until the end of 2025, the market will face many opportunities to break out and may reach the 1,500 point mark.

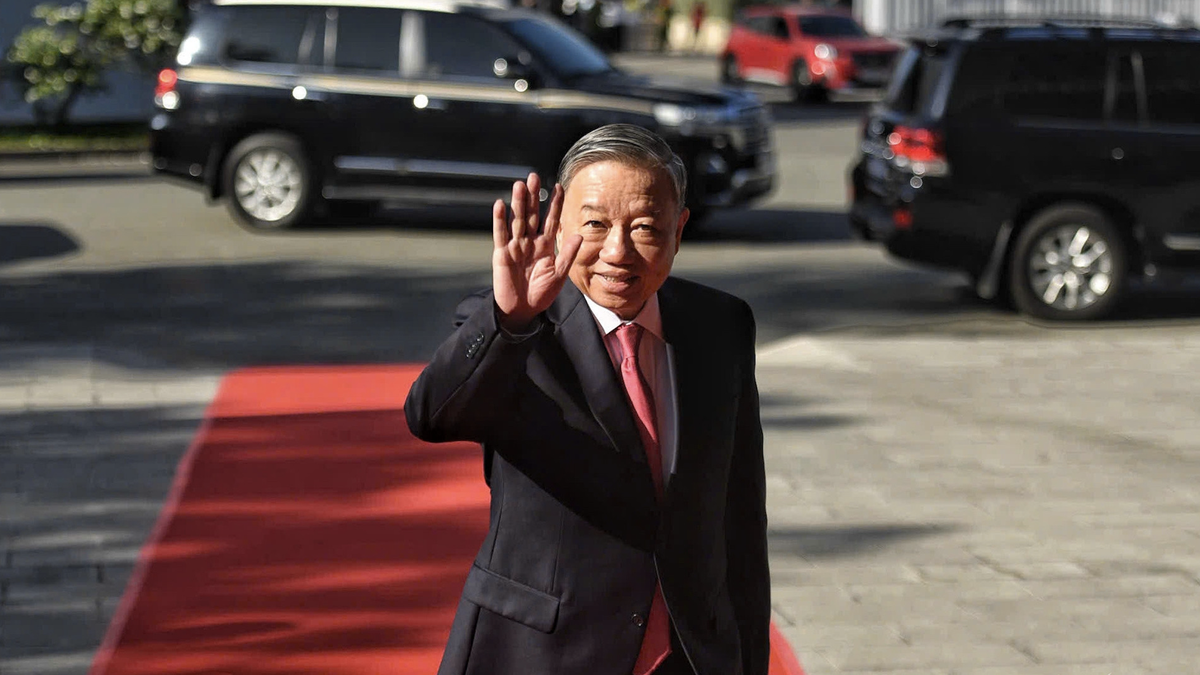

VN-Index hits new peak

After the reciprocal tax shock in early April 2025, the VN-Index fell sharply, from 1,340 points to 1,070 points at times, but the market also recovered impressively. At the end of the trading session on May 30, the VN-Index surpassed the 1,330 point mark, closing at 1,332.6 points, up more than 100 points (8.7%) compared to the end of April.

This development shows that positive sentiment has returned thanks to new progress in the US tariff negotiations with some countries and supportive macro signals. Although liquidity has decreased somewhat, foreign investors' capital flows continue to be a bright spot with net buying activities returning.

In June, the market experienced a significant decline due to geopolitical tensions in the Middle East, but soon rebounded. As of June 27, the VN-Index increased by nearly 40 points, equivalent to 2.9% compared to the end of May, reaching a new peak in 2025 at 1,371.44 points.

After a sharp decline following the announcement of the US countervailing duty, the domestic stock market has now seen a strong "V"-shaped increase. Many stocks that have fallen sharply have returned to their old peaks, and many have even surpassed their peaks.

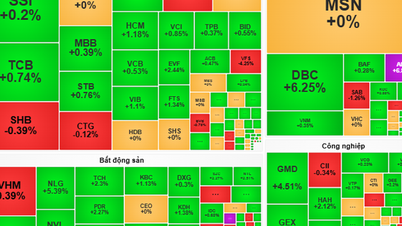

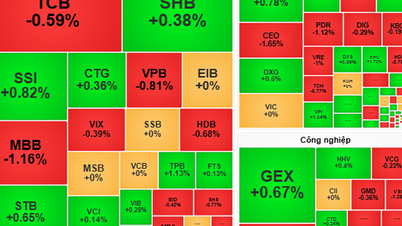

The VN-Index's upward momentum comes from the large-cap group, especially the group of stocks belonging to Vingroup Corporation, also known as the "Vin family" group, when VHM (Vinhomes) achieved good profits along with many other real estate companies opening new projects and earning cash flow, business activities grew compared to the previous period. Some bank stocks such as Techcombank had good business growth, while Sacombank was able to recover bad debts from the previous period...

Securities expert Nguyen Minh Giang, Head of Asset Management Department (Mirae Asset Securities Joint Stock Company) said that the recent uptrend in the stock market has attracted cash flow into many stock groups. In addition to the banking and real estate groups, other industries have also seen positive recoveries such as fertilizers, chemicals, seaports, and retail.

In recent sessions, when the 90-day reciprocal tax deferral is about to end, information about Vietnam's negotiations is positive, in the industry groups affected by reciprocal taxes such as seafood and textiles, good stocks have started to break out, with a strong increase to the old peak before the US announced the tax. Cash flow into the market is good, many sessions have seen high liquidity.

Many factors support the market

From now until the end of 2025, according to experts, the stock market will maintain positive growth in the medium term. The above assessment is made because there is a lot of positive information affecting the market. That is the expectation that FTSE will put the Vietnamese stock market on the upgrade list in the September 2025 assessment period.

On the macro side, after 90 days of reciprocal tax deferral, from July 4 to July 9, 2025, the US will announce the reciprocal tax rate and investors expect a good scenario. In fact, investors are worried about this issue and by that time, the tax imposition will be clear.

Along with that, from now until the end of the year, the tension on exchange rates will gradually decrease because the corresponding tax is announced, and the demand for exports will stabilize again.

“In the past, businesses did not know the specific reciprocal tax rate, so they boosted exports. Therefore, the USD became scarce and increased in value. When the reciprocal tax rate is announced by the US, exporting businesses will stabilize again, the demand for USD will decrease and the exchange rate tension will cool down. Moreover, the US Federal Reserve is expected to lower interest rates twice, and this will help ease the exchange rate tension,” expert Nguyen Minh Giang analyzed.

Domestically, many policies have been issued that will help the market in the medium and long term have a good growth rate and better cash flow.

Some other experts believe that market developments depend largely on the tariff rates announced by the US. If Vietnam is subject to the same or lower tariff rates compared to other countries in the region, Vietnam will have a competitive advantage. From there, the market has room for growth in the coming time, and the VN-Index may rise above the 1,400 point mark.

In the negative scenario, the high tariffs Vietnam has to pay compared to other countries will affect economic growth as well as the stock market, but the impact will not be as strong as in April. The market may decrease, but the decrease will be small. After that, the market will quickly regain momentum but not increase sharply, meaning that the market will not decrease too deeply and will not increase too strongly. The VN-Index is around 1,300 points.

In a recent report, Shinhan Securities Vietnam Co., Ltd. said that the Vietnamese stock market is still facing many great opportunities. The prospect of being upgraded to an emerging market by FTSE in September 2025 is an important driving force for the market. In addition, the stock market will be driven by the intrinsic strength of the economy, with an estimated profit growth of listed companies reaching nearly 15% in 2025. In a positive scenario, experts from this company expect the VN-Index to reach its old peak of 1,500 points.

Mr. Nguyen The Minh, Director of Research and Analysis of Yuanta Securities:

Large-cap stocks lead the increase

In the recent period, large-cap stocks have played a good role in leading the market growth, such as real estate and banking. Even when the market was affected by geopolitical tensions, the oil and gas group was also a support for the market.

The market is also supported by domestic factors. Resolutions and decisions to amend and supplement policies of the Government are one of the important driving forces to promote the market.

Notably, the government has maintained low interest rates since the beginning of the year. This has allowed money to flow into the market, helping to avoid deep downward pressure. After the tariff shock in April, the market quickly regained its upward momentum.

Over the past week, foreign investors have been net sellers. However, when the market adjusted due to the impact of tensions in the Middle East, this group was net buyers, becoming a support for the market, helping the market not to fall too much. Although foreign investors have not returned to net buying, they have more or less supported the market during the adjustment.

Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department, VNDirect Company:

The market trend is positive.

From now until the end of the year, the market trend is positive, because there are some supporting factors such as the Government implementing policies towards prioritizing economic growth, the market may be upgraded this year, the total market profit is expected to grow by about 14-15% in 2025...

Although the positive factors outweigh the risk factors, it is impossible to predict the variables related to the policies of US President Donald Trump or geopolitical conflicts. Therefore, investors should note that the barriers to the stock market from the beginning of the year will still exist in the coming time.

Therefore, investors need to observe more about the monetary policy of the US Federal Reserve (FED), the geopolitical situation, and developments related to tariff negotiations, in order to be able to flexibly respond and proactively manage portfolio risks, thereby avoiding times when the market may fluctuate strongly and pose risks to the portfolio.

Mr. Ngo Manh Hung, Eco Green City Apartment, Thanh Xuan District:

Hope the stock market grows well

Recently, I had some idle money. When the market dropped sharply in early April due to the information about the reciprocal tax, I bought some codes. Among them were stocks in the banking sector and have made a profit so far.

In the context of low savings interest rates and high gold prices, stocks are the channel chosen by many people. However, the stock market is particularly sensitive to positive and negative information. Therefore, investors need to have certain knowledge and monitor the market daily.

I hope that the market will soon be upgraded, thereby attracting more foreign investors to participate, creating momentum for the market to develop more strongly. At the same time, violations in the stock market need to be handled more strongly to create investor confidence and for the market to develop sustainably. With supporting factors, I hope that from now until the end of the year, the stock market will grow well so that investors can have an effective investment year.

Thanh Huong wrote

Source: https://hanoimoi.vn/thi-truong-chung-khoan-nua-cuoi-nam-2025-nhieu-co-hoi-but-pha-707324.html

Comment (0)