Since the beginning of May, the index representing the Ho Chi Minh City Stock Exchange has repeatedly reached a 3-year peak. The increase to 1,358 points yesterday also helped the index reach a new peak. However, many analysis groups believe that this trend has not stopped because investors are excited. Conquering the price range of 1,360 - 1,370 points in the short term to establish new peaks is not difficult.

Today, the VN-Index increased sharply at the opening, despite a series of oil and gas stocks falling sharply because of the adjustment of world oil prices due to the cooling of the war in the Middle East. The index accumulated 13 points at one point, surpassing 1,370 points. The increase range then narrowed, but by the end of the session, it was still 8 points away from the reference, closing at 1,367 points.

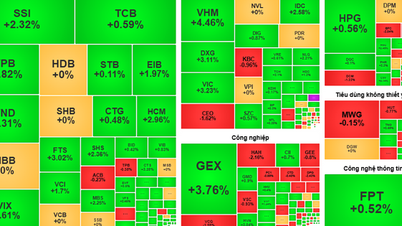

Vingroup stocks continued to be the main driving force, contributing 6 points to the VN-Index. VIC and VHM increased by 3.2% and 4.5% compared to the reference price, to VND95,800 and VND77,300, respectively. The two remaining capitalization stocks of this group, VRE and VPL, also increased, but the amplitude was not more than 1%.

By sector, stocks had the most unanimous increase. Except for TVB, all stocks in this group closed above the reference. VNDirect shares closed up 6.3%, followed by VIX, HCM, and SSI, which increased by 2-3%.

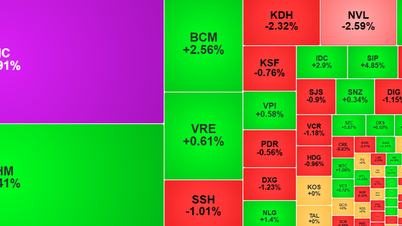

Real estate is similar when many codes accumulate over 2%. Besides VHM leading this group, LDG and DXG are equally excited when they increase 3.7% and 3% respectively.

The banking group today was strongly differentiated with only 4 stocks increasing by more than 1%, including EIB, NAB, ABB and KLB. Most of the leading stocks such as VCB, BID, CTG or TCB fluctuated around the reference price.

Going against the market trend were oil and gas, fertilizer and shipping stocks. Of these, the oil and gas group had the most drastic adjustment due to the direct impact of world oil prices. GAS and PLX, the two pillars of this group, lost 4.8% and 5.3% respectively. Small and medium-cap stocks such as PVT, BSR, PVD, and PVS also fell over 4%.

The positive signal in today's session is that the transaction value fluctuated strongly in a positive direction. More than 971 million shares were successfully transferred on the Ho Chi Minh City Stock Exchange, equivalent to VND 25,600 billion, about VND 4,000 billion higher than the previous session. SSI and GEX both had liquidity of thousands of billions, far surpassing the next banking and securities codes such as TCB, VPB, VND, VIX.

Foreign investors cut their net selling streak for four consecutive sessions. This group returned to disburse nearly VND2,900 billion, about VND1,200 billion higher than the previous session. Foreign demand focused on VND with a net purchase volume of nearly 13 million shares. SSI also net absorbed more than 6.2 million shares, followed by HPG, DGW and VPB.

TH (according to VnExpress)Source: https://baohaiduong.vn/chung-khoan-tiep-tuc-pha-dinh-3-nam-414874.html

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

Comment (0)