VN-Index hits 3-year peak, investor sentiment improves

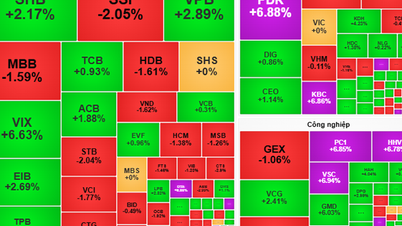

The Vietnamese stock market has just ended a week of vibrant trading with strong growth, bringing the VN-Index close to the 1,350 point mark, the highest level in more than 3 years.

Compared to last week, the HoSE index increased by about 2.6%, thanks to the simultaneous breakthrough of many leading stock groups such as oil and gas, banking, securities and steel. The strong recovery of the market took place in the context of significantly improved investor sentiment, when the Government prioritized growth stimulus policies and interbank interest rates continuously decreased - creating favorable conditions for money to flow into financial investment channels.

Market liquidity remains high, indicating that purchasing power is returning after a period of adjustment. Many individual investors have become more active on forums and social networking groups, actively discussing potential stocks and short-term cash flow trends.

Some investors even expressed regret for not being able to buy in time when the market adjusted in the previous two weeks, especially in industry groups that were assessed to have prospects in the second half of 2025.

The current rally is reinforcing expectations of a positive earnings season ahead, as many listed companies forecast improved profits thanks to lower capital expenditures and recovering demand.

However, some securities companies have a less optimistic view. SHS Securities Company believes that the short-term trend of VN-Index will maintain an upward trend above the support zone around 1,330 points, corresponding to the average price of 20 sessions, and the resistance zone around 1,350 points. However, short-term supply pressure will increase as the market continues to move towards the old peak price zone and is in the final stages of trade negotiations and tax postponement.

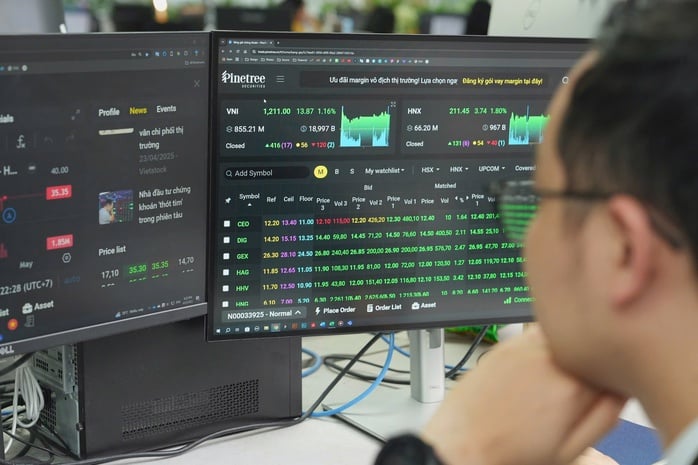

Mr. Nguyen Duc Khang, Head of Analysis Department, Pinetree Securities Company, analyzed further, that VN-Index had a week of trading with a strong increase of more than 30 points but was not convincing. The main trend was still a state of alternating pulling pillars, without a clear consensus between industry groups and stocks. The market cash flow continuously rotated between stock groups but each increase only focused on a few specific codes, instead of creating an even push for the whole industry.

VN-Index closed the week with a strong increase, approaching the 1,350 point mark

"Investors' cautious psychology and short-term surfing strategy in the context of lack of new supporting information are the main factors. With the index unable to break out of the old peak and cash flow showing clear signs of caution, it is likely that the VN-Index will experience a correction next week. Investors are waiting for the results of the Vietnam-US tariff negotiations scheduled for early July, which is a key factor in determining the next trend," said Mr. Khang.

Which industry stocks to buy?

From another perspective, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy, VNDIRECT Securities Company, commented that next week if VN-Index continues to hold above the 1,350 point mark, the short-term uptrend will be consolidated, opening up expectations of conquering a higher zone at 1,380 - 1,400 points. However, in the context of many existing risk factors, investors should keep their portfolios in a balanced state, avoiding excessive increase in proportion.

VN-Index is at its highest level in over 3 years

"Risk management is still a key factor, although the market is sending more positive signals. Stock groups with good liquidity and stable business prospects, less affected by geopolitical tensions such as retail, technology and real estate can be prioritized during this period," said Mr. Hinh.

SHS Securities Company also recommends that if buying stocks, it is necessary to base on updating and evaluating the fundamental factors, the valuation of the enterprise through the business results of the second quarter of 2025 and the growth prospects in the last 6 months of the year. Prioritize holding, waiting for evaluation and updating of fundamental factors. The investment target is towards codes with good fundamentals, leading in strategic industries, and outstanding growth of the economy .

Source: https://nld.com.vn/mua-co-phieu-gi-khi-vn-index-vuot-1350-diem-19625062210445701.htm

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)