The session on December 25th recorded an improvement in both scores and liquidity. With nearly 600 stocks increasing in price, of which 42 stocks hit the ceiling, it brought investors a 'warm' Christmas.

The market increased both points and liquidity on Christmas Day - Photo: QUANG DINH

Nearly 600 stocks increased in price with abundant liquidity

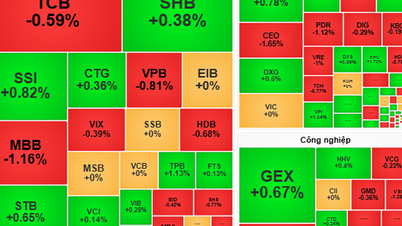

The stock market increased immediately upon opening the trading session on December 25. Near the end of the morning session, VN-Index jumped up sharply, with much better liquidity than the previous session thanks to active buying power.

At the end of the morning session, VN-Index increased by nearly 16 points, reaching 1,276 points. In the afternoon session, demand continued to be active, focusing on pillar stocks.

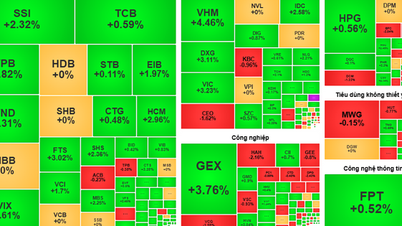

After a series of gloomy days, the index accelerated rapidly, creating a more exciting mood for investors on Christmas Day. Cash flow poured into the market, pushing liquidity on all three exchanges to more than VND21,000 billion - the highest in the past 3 months.

In general, the increase spread widely across all industry groups when only 6/22 were red, such as consumer services (-2.79%), household and personal goods (-0.23%), transportation (-1.11%), vehicles and components (-0.61%), pharmaceuticals - biology (-0.41%), hardware (-0.27%)...

The whole market had 515 stocks increasing points, 42 stocks hitting the ceiling.

On the other hand, 244 stocks decreased in price and 14 stocks hit the floor. Thanks to the dominance of stocks that increased in price, the market was covered in "green and purple" on Christmas Day this year.

The top 10 stocks that contributed most positively to the increase in the VN-Index were mostly banking groups, such as CTG of Vietinbank, TCB of Techcombank, BID of BIDV, STB of Sacombank, MBB of MBBank, ACB of Asia, VPB of VPBank, LPB of LPBank, HDB of HDBank...

On the contrary, the decrease in points of codes HVN of Vietnam Airlines , HAG of HAGL, EIB of Eximbank, VPI, DHG, IMP... is contributing to creating resistance for the index.

In addition to the score, another positive point today also comes from the trading trend of foreign investors when this group net bought more than 200 billion VND after a long period of net selling.

Of which, HPG, SSI, STB, HDB, CTR... are the stocks that foreign investors "aggressively" bought the most.

Exchange rate is still a factor to watch

There is no special information to explain the stock market performance on Christmas Day.

However, looking at the currency market, the exchange rate tends to cool down, the State Bank has switched to a state of net pumping of VND liquidity into the banking system, after a strong net withdrawal last week.

Previously, the interbank exchange rate had exceeded the intervention USD selling price. The State Bank had to sell a large amount of foreign currency to stabilize the market. This was one of the reasons why the stock market continuously adjusted last week.

Mr. Nguyen The Minh - Director of Yuanta Securities Vietnam - said that it is still necessary to closely observe the exchange rate movement even though the State Bank is still doing a good job of regulating the market and the USD supply from remittances and payment for export orders can be supplemented. Because the USD index (DXY) is still anchored at a 2-year peak.

Mr. Dinh Quang Hinh - VNDirect Securities expert - expects that a more stable global financial market will help improve domestic investor sentiment and promote the recovery of stock indexes.

"Investors should take advantage of the recovery to restructure their portfolios, reduce leverage if it is high, and build their portfolios around industries with supportive information and improved business prospects, including shipping, logistics, import-export (textiles, seafood) and banking," said Mr. Hinh.

Source: https://tuoitre.vn/qua-noel-cho-nha-dau-tu-gan-600-co-phieu-xanh-tim-tien-chay-vao-doi-dao-20241225154144058.htm

Comment (0)