In a decisive statement on June 27 at the White House, President Donald Trump affirmed that he would not appoint anyone to be Fed chairman if that person did not commit to cutting interest rates. “Hold rates? Hesitant? I will pass. I will only choose people who are willing to cut deep, and I know there are many people who are willing to do that,” President Trump declared without beating around the bush.

Not stopping there, Mr. Trump even said that "he would be happy if Powell resigned".

It is not the first time Mr. Trump has put pressure on the Fed, but this time, he has set a clear “red line”: whoever does not cut interest rates will not have a seat.

For Mr. Trump, low interest rates are the key to boosting growth, accelerating consumption, boosting the stock market and scoring points with voters in the midterm elections. He has called for lowering interest rates from the current 4.25-4.5% to 1%, despite concerns from the Fed and experts that this could reignite the wave of inflation that shocked the world after Covid-19.

Meanwhile, Powell and other Fed policymakers have remained cautious, arguing that Trump’s tough trade and tariff policies could raise import costs and push up consumer prices, making them hesitant to cut interest rates aggressively.

The Fed is only expected to cut interest rates by about half a percentage point this year, a figure far short of what Trump has been calling for. This key point has created an increasingly bitter conflict between the White House and the central bank.

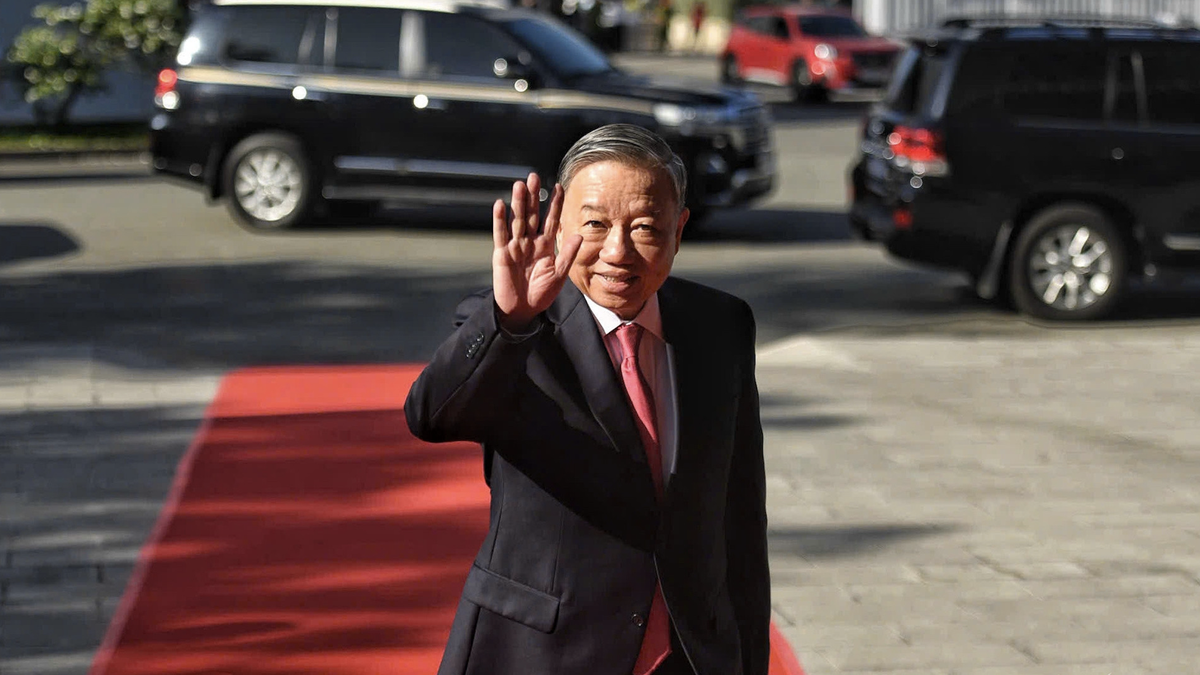

President Donald Trump has publicly declared war on the Fed, demanding a sharp cut in interest rates and warning that he will only appoint a new Fed Chairman if that person is "obedient" to his proposed monetary policy (Photo: Shutterstock).

Powell's "hot seat" is starting to shake?

Despite repeated threats to fire Powell, Trump appears to have changed tack. After the US Supreme Court ruled that the president cannot remove a Fed chair over policy disagreements, the White House has shifted to a new front: shaping his successor.

Mr. Powell’s term as chairman ends in May 2026. But Mr. Trump has no intention of waiting. By publicly looking for and considering three or four replacement candidates now, he is creating a “shadow chairman” effect.

A nominee soon, perhaps later this year, would become the voice of monetary policy that Trump wants, thereby weakening Powell's power and credibility for more than a year into his term.

Treasury Secretary Scott Bessent, one of the potential candidates for the Fed chair, played down the rumors. “I don’t think anyone is taking it seriously,” he told CNBC. But he did offer a clear scenario: “It’s very likely that the successor will be appointed in January 2026, which means the nomination process could start as early as October or November.”

This suggests that, despite public denials, an early transition plan is being considered. The list of potential candidates also includes White House economic adviser Kevin Hassett, former Fed Governor Kevin Warsh, and current Governor Christopher Waller.

Notably, Mr. Waller - who was appointed by Mr. Trump in his first term - recently signaled his readiness to support an interest rate cut at the July meeting, suggesting that Mr. Trump may already have allies within the Fed.

Economic Paradox: Tariffs Hinder Low-Interest Rate Dreams

Ironically, one of the biggest hurdles keeping the Fed from cutting rates is Trump’s economic policies. Fed policymakers, including Chairman Powell, are concerned that the tariffs the Trump administration has imposed could push inflation back up.

Mr. Powell told lawmakers that without the uncertainty surrounding import tariffs, the Fed might have started cutting interest rates.

Inflation remained subdued in May, but economists expect prices to rise in the coming months as businesses pass on the cost of tariffs to consumers. The Fed is in a quandary: it needs several more months of data to be sure inflation is under control, but the White House is demanding immediate action.

The Fed’s independence has long been the cornerstone of the stability and credibility of the US economy, especially in the eyes of global investors. However, with public statements and direct pressure from Mr. Trump, the prospect of a “soft on principle” Fed under him is causing concern in the financial world.

“Trump doesn’t just want like-minded people, he wants people who listen to him,” said one former Fed official. “That goes against the very nature of central bank independence.”

Source: https://dantri.com.vn/kinh-doanh/fed-truoc-suc-ep-tu-ong-trump-cat-lai-suat-hay-cat-ghe-20250628081309335.htm

Comment (0)