At the press conference announcing the results of the 9th session of the 15th National Assembly on the morning of June 27, National Assembly Deputy in charge of the Economic and Financial Committee Pham Thi Hong Yen said that, based on the provisions of the current Law on Personal Income Tax, in case the consumer price index (CPI) fluctuates by more than 20% compared to the time the law takes effect or the time of the most recent adjustment of the family deduction level, the Government will submit to the National Assembly Standing Committee to adjust the family deduction level.

This adjustment is in line with price fluctuations and applies to the next tax period.

According to Ms. Yen, this regulation has allowed the Government to submit to the National Assembly Standing Committee to adjust the family deduction level if there is any change in accordance with the law.

She informed that at the upcoming 10th session, the Government plans to submit a comprehensive revision of the Personal Income Tax Law. "Both contents mention adjustments related to personal family deductions. National Assembly agencies will base on the law and ordinance plan program of 2025 to carry out the implementation," said Ms. Yen.

Delegate Pham Thi Hong Yen (Photo: Gia Han).

According to this person, if the Government submits to the National Assembly Standing Committee only to adjust Point b Clause 1 Article 39, then the National Assembly Standing Committee's resolution will be issued.

Ms. Yen added that if the Government included the content of the comprehensively revised Personal Income Tax Law, it would also reflect the above content.

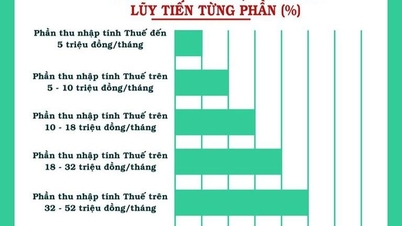

According to the current Personal Income Tax Law, individuals are entitled to deduct social insurance, health insurance, unemployment insurance, professional liability insurance for certain occupations that require compulsory insurance, minus family deductions, charitable and humanitarian contributions, allowances and subsidies as prescribed... the remaining amount is the income used as the basis for calculating personal income tax.

From the 2020 tax period, the deduction for taxpayers is 11 million VND/month (132 million VND/year); the deduction for each dependent is 4.4 million VND/month.

Source: https://dantri.com.vn/kinh-doanh/ke-hoach-sua-muc-giam-tru-gia-canh-dieu-chinh-thue-thu-nhap-ca-nhan-20250627122002389.htm

Comment (0)