Millions of families are waiting

The Personal Income Tax Law was passed by the National Assembly in 2007 and has been amended three times. After 18 years, some of the contents of this law are no longer suitable for the current socio -economic context, requiring more comprehensive amendments.

Many opinions say that waiting until the end of 2026 to amend the personal income tax is too long when this tax law affects the lives of millions of families. Therefore, most taxpayers hope that the law will be prioritized to be amended sooner.

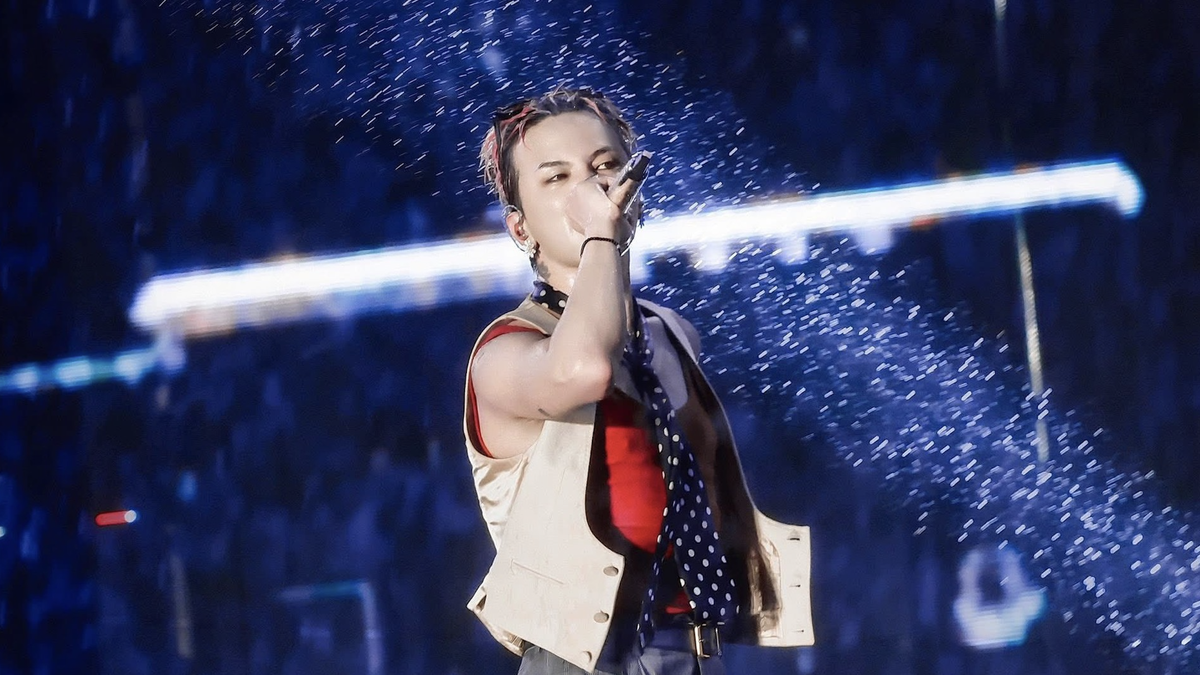

Speaking to the press on the sidelines of the National Assembly on June 18, Deputy Prime Minister Ho Duc Phoc said that the revised Law on Personal Income Tax will be submitted to the National Assembly for consideration and approval at the 10th Session under a simplified procedure. This information has received the consensus of experts and the expectation of the people.

Mr. Nguyen Van Thuc, senior tax and accounting expert, senior advisor to the General Director of Hanoi Accounting Group Joint Stock Company, assessed that the current regulations on family deduction levels are no longer suitable for real life and do not ensure the meaning of family deductions.

“Family deductions aim to ensure a minimum standard of living for taxpayers, including those who work, and family deductions for dependents. Raising the family deduction level and speeding up the revision of the Personal Income Tax Law would be a good thing for millions of families,” Mr. Thuc assessed.

In addition to the family deduction, according to Mr. Thuc, it is necessary to expand the tax threshold to ensure family expenses for the workers themselves, or those they are obliged to support, in accordance with the current context.

Ms. Minh Thu, who lives and works in Hanoi, believes that the regulation that individuals without dependents must pay tax when their income from salary or wages exceeds 11 million VND/month is not appropriate because prices and living expenses are increasing.

“I hope that the regulation will soon be amended, raising the income level from salaries and wages subject to personal income tax starting from 18 million VND/month and applied from the beginning of 2026 to reduce the burden on people,” Ms. Thu shared.

Need to adjust the method and basis for building family deduction levels

Mr. Nguyen Van Duoc, Head of Policy Department of Ho Chi Minh City Tax Consultants and Agents Association, General Director of Trong Tin Accounting and Tax Consulting Company Limited, emphasized the need to soon adjust personal income tax towards increasing family deductions.

According to Mr. Duoc, the current basis and method of constructing and calculating the family deduction level of 11 million VND for the individual, 4.4 million VND for dependents and the regulation that the CPI changes by 20% before adjusting the family deduction level is not appropriate.

“Practice shows that it takes 5-7 years for the CPI to change by 20%. At the same time, the mechanical adjustment of the family deduction level according to the increased CPI always makes the law outdated and unable to keep up with the consumer price index as well as people's living conditions. The delay in adjustment will affect the rights of taxpayers. This also makes the policy ineffective and ineffective in tax management and collection,” said Mr. Duoc.

Therefore, Mr. Duoc recommended that it is necessary to soon adjust the method and basis for building family deduction levels to be appropriate in the direction of approaching the living standards of cities and urban areas, thereby helping people in mountainous and rural areas gradually catch up with the living standards in urban areas.

In particular, the amendment to the CPI regulation only requires a change of 5-10% for the Government to be allowed to adjust the family deduction level, instead of having to submit the decision to the National Assembly Standing Committee for a 20% CPI change. This regulation will make the policy more sensitive, more suitable to reality, thereby gaining more consensus from the people.

The progressive tax schedule applicable to resident individuals with income from salaries and wages is currently divided into 7 tax rate levels: 5%, 10%, 15%, 20%, 25%, 30% and 35%.

Mr. Duong assessed that there were too many tax rates, so he proposed to reduce them to only 5 rates to make it easier to calculate and pay taxes. At the same time, the step-up rate at lower tax rates should be adjusted more slowly and at higher tax rates more quickly to reduce tax pressure on low-income and middle-income earners while still ensuring budget revenue due to additional revenue from high-income earners.

At the Government's monthly legal meeting on June 21, giving opinions on specific contents of the policy dossier of the Law on Personal Income Tax (replacement), Prime Minister Pham Minh Chinh emphasized the requirement to collect correctly, fully, and promptly, but at the same time, it is necessary to encourage, create development, and facilitate tax payment and refund.

Source: https://baohaiduong.vn/trieu-gia-dinh-cho-dieu-chinh-thue-thu-nhap-ca-nhan-nang-muc-giam-tru-gia-canh-414830.html

![[Photo] Prime Minister Pham Minh Chinh chairs the national online conference on combating smuggling, production and trade of counterfeit goods.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/4a682a11bb5c47d5ba84d8c5037df029)

![[Photo] Prime Minister Pham Minh Chinh holds meeting to launch exhibition of national achievements to celebrate 80th National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/0c0c37481bc64a9ab31b887dcff81e40)

![[Infographic] The 1st Congress of the Party Committee of the Ministry of Culture, Sports and Tourism, term 2025-2030](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/24/8afbd7c780424568b23fd09cd74c8b1d)

Comment (0)