Securities companies will collect an additional 10% value added tax on the above fees actually collected from customers from July 1 - Illustration photo: AI

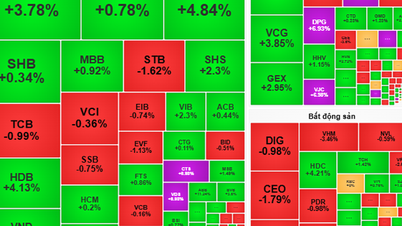

A series of securities companies such as SHS, VNDirect, VCBS, Rong Viet... have updated new fee schedules for some securities services subject to value added tax (VAT), effective from July 1.

Specifically, Saigon - Hanoi Securities Joint Stock Company (SHS) said that securities custody service fees were previously not subject to tax, but from July 1, a tax rate of 10% will be applied. Many other types of services will also be subject to similar tax rates.

Therefore, SHS has sent a notice to customers about the application of a new service fee schedule from tomorrow. For example, previously the depository service fee for stocks, fund certificates, and covered warrants was collected at VND0.27/unit/month.

In the new fee schedule, SHS collects VND0.297/share, fund certificate, and secured warrant/month. Similarly, corporate bonds will increase from VND0.18/unit (maximum VND2 million/month/code) to VND0.198 (maximum VND2.2 million/month/code).

The depository withdrawal fee was also raised by this securities company from 0.2% of the total value of securities (minimum 50,000 VND/withdrawal, maximum 1 million VND) to 0.22% (minimum 55,000 VND/withdrawal and maximum 1.1 million VND).

Similarly, ownership transfer fees; freezing fees, release fees, transfer fees for purchase rights, processing inheritance and donation documents, or account service fees (issuing OTP cards) all increased by 10%.

Not only SHS, many securities companies simultaneously announced changes to comply with the provisions of the Law on Value Added Tax which takes effect from tomorrow.

According to Rong Viet Securities Joint Stock Company, securities custody fees (stocks, bonds, debt instruments, etc.), fees for withdrawal and transfer of securities, fees for clearing derivative securities, fees for management of collateral assets paid to VSDC, etc. are not subject to tax. However, from tomorrow, they will be subject to a 10% tax.

A representative of Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Company (VCBS) also said that securities custody fees, derivative securities margin management fees, derivative securities position clearing fees, securities transfer fees, and securities blocking fees at VSDC will be subject to 10% value added tax from tomorrow.

Accordingly, VCBS will collect an additional 10% value added tax on the above fees actually collected from customers, in order to comply with current legal regulations.

Proposal to pay tax immediately upon receiving stock dividends

The Ministry of Finance is seeking comments on a draft decree amending and supplementing a number of articles of Decree 126 guiding the implementation of the Law on Tax Administration.

Accordingly, the tax authority has proposed that personal income tax will be deducted, declared and paid immediately when individuals receive dividends and bonuses in the form of securities.

"Do not wait until transferring securities of the same type to declare and pay personal income tax on this income," the Ministry of Finance stated.

Source: https://tuoitre.vn/cong-ty-chung-khoan-dong-loat-tang-thu-nhieu-loai-phi-tu-ngay-mai-20250630210518479.htm

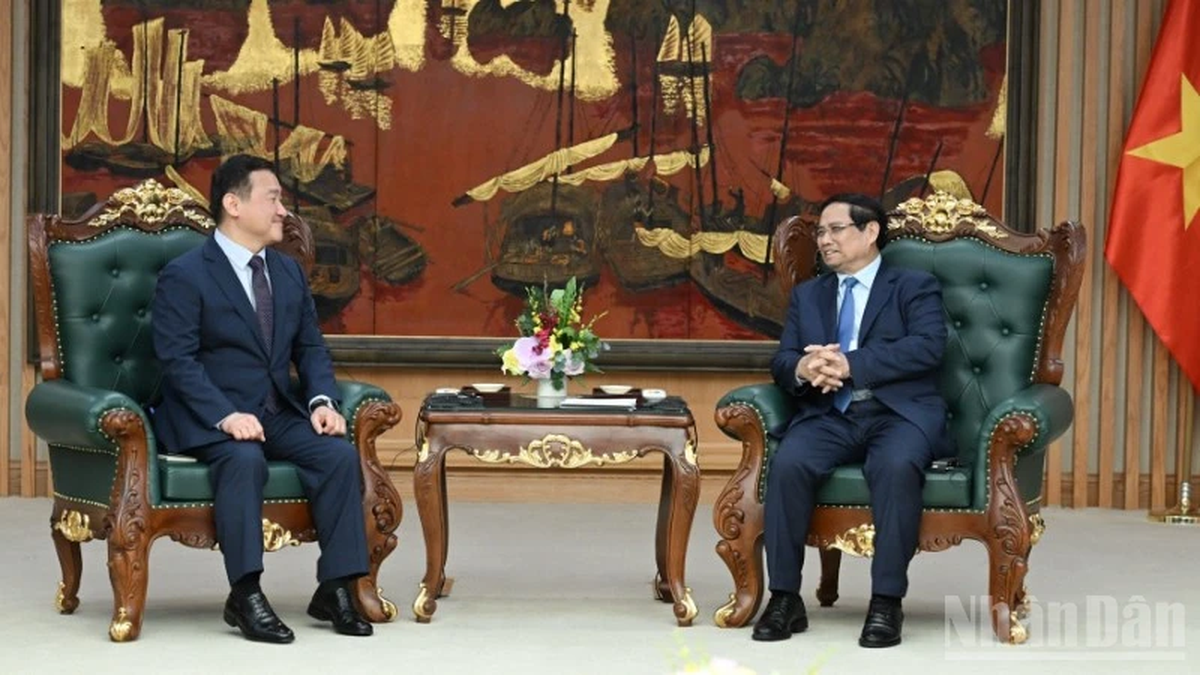

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)