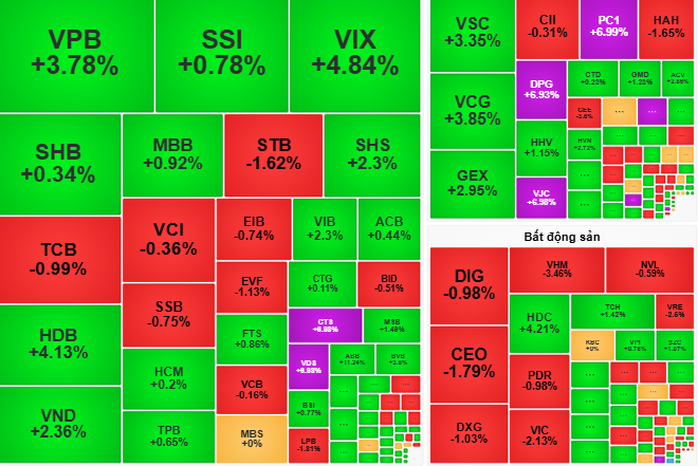

At the end of the session on July 23, the VN-Index of Vietnamese stocks closed at 1,512 points.

VN-Index opened on July 23 in an upbeat mood, up 10 points at the beginning of the session, reflecting the optimism of stock investors. In the morning session, green spread widely, covering all stock sectors. Large-cap stocks such as VPB, HDB, and VJC played a major supporting role for VN-Index. The Securities, Banking, and Real Estate sectors continued to attract active demand, leading market sentiment.

In the afternoon session, VN-Index moved within a narrow range of 1,507 - 1,512 points, under pressure from a large amount of profit-taking stocks when the index remained at a high level. However, strong cash flow absorbed the number of stocks sold, reinforcing the upward trend of most industry groups. In addition to the three main industry groups (Securities, Banking, Real Estate), the Public Investment, Construction Materials, Chemicals, and Energy groups also attracted the attention of investors. Market liquidity reached a record level of VND 37,900 billion.

At the end of the session, VN-Index closed at 1,512 points, up 2.7 points (+0.18%).

According to VCBS Securities Company, the trading session on July 23 with a sudden increase in liquidity showed a fierce dispute between buyers and sellers. Market developments showed that the index fluctuated strongly during the session but the increase at the end of the session was quite modest. Therefore, investors can still expect the continuation of the uptrend. However, the market may need a few more sessions of accumulation at high levels to narrow the supply or a breakout session to attract cash flow for a new uptrend.

"Investors should closely follow market developments, prioritize disbursement into stocks that have not increased rapidly in price and maintain margin lending ratios at a safe level" - VCBS Securities Company recommends.

Meanwhile, Dragon Capital Securities Company (VDSC) commented that investors are actively taking short-term profits. However, cash flow is still trying to support the market, creating opportunities for the market to increase again when profit-taking pressure weakens. It is expected that the dispute over buying and selling stocks will continue in the trading session on July 24.

"Investors need to closely monitor stock supply and demand, consider taking profits on stocks that have reached their targets or increased rapidly to resistance levels, and take advantage of corrections to buy stocks with good business prospects," VDSC stated.

Source: https://nld.com.vn/chung-khoan-ngay-mai-24-7-nha-dau-tu-nen-quan-tam-co-phieu-chua-tang-gia-nong-196250723174759769.htm

![[Photo] Signing of cooperation between ministries, branches and localities of Vietnam and Senegal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/24/6147c654b0ae4f2793188e982e272651)

Comment (0)