Update the latest gold price details today, July 7, 2025 in the domestic market

At the time of the survey at 10:00 am on July 7, 2025, domestic gold prices recorded a uniform downward trend across all major brands. This was the sharpest decline of the week, creating notable fluctuations in the gold market. specific:

SJC gold price in Hanoi is listed at 118.5 million VND/tael (buy) and 120.5 million VND/tael (sell), down 400 thousand VND/tael in both directions compared to yesterday.

DOJI Group also recorded a similar decrease, with buying and selling prices of VND118.5 million/tael and VND120.5 million/tael, respectively.

SJC gold price in Ho Chi Minh City continued to decrease sharply, with a decrease of 400 thousand VND/tael in both buying and selling prices, bringing the listed price down to 118.5 million VND/tael (buying) and 120.5 million VND/tael (selling).

PNJ also recorded a significant decrease, the buying price was only 114.2 million VND/tael, down to 600 thousand VND/tael, while the selling price decreased 500 thousand VND/tael, down to 116 million VND/tael.

Mi Hong gold price decreased slightly, with a decrease of 200 thousand VND/tael in buying price, down to 119.3 million VND/tael. Selling price decreased by 200 thousand VND/tael, down to 120.5 million VND/tael.

Vietinbank Gold's selling price has decreased by 400,000 VND/tael, currently listed at 120.5 million VND/tael.

SJC gold price at Phu Quy decreased by 400 thousand VND/tael in both directions, bringing the buying price down to 117.8 million VND/tael and the selling price to 120.5 million VND/tael.

Bao Tin Minh Chau also decreased by 400 thousand VND/tael, listed at 118.5 million VND/tael (buy) and 120.5 million VND/tael (sell).

Gold price trend forecast today July 7, 2025

The downward trend in gold prices today, July 7, 2025, shows that the gold market is under great pressure from international economic and political factors. This could be an attractive investment opportunity for those who want to buy gold at low prices. However, investors need to closely monitor market developments to make appropriate decisions.

Gold price update table today July 7, 2025 latest

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.5 | ▼400K | 120.5 | ▼400K |

| DOJI Group | 118.5 | ▼400K | 120.5 | ▼400K |

| Red Eyelashes | 119.3 | ▼200K | 120.5 | ▼200K |

| PNJ | 114.2 | ▼600K | 116.0 | ▼500K |

| Vietinbank Gold | 120.5 | ▼400K | ||

| Minh Chau Newspaper | 118.5 | ▼400K | 120.5 | ▼400K |

| Phu Quy | 117.8 | ▼400K | 120.5 | ▼400K |

| 1. DOJI - Updated: July 7, 2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,500 ▼400K | 120,500 ▼400K |

| AVPL/SJC HCM | 118,500 ▼400K | 120,500 ▼400K |

| AVPL/SJC DN | 118,500 ▼400K | 120,500 ▼400K |

| Raw material 9999 - HN | 107,800 ▼500K | 112,000 ▼500K |

| Raw material 999 - HN | 107,700 ▼500K | 111,900 ▼500K |

| 2. PNJ - Updated: 07/07/2025 10:00 - Time of the source website - ▼ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,200 ▼600K | 116,900 ▼500K |

| HCMC - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Hanoi - PNJ | 114,200 ▼600K | 116,900 ▼500K |

| Hanoi - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Da Nang - PNJ | 114,200 ▼600K | 116,900 ▼500K |

| Da Nang - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Western Region - PNJ | 114,200 ▼600K | 116,900 ▼500K |

| Western Region - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Jewelry gold price - PNJ | 114,200 ▼600K | 116,900 ▼500K |

| Jewelry gold price - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Jewelry gold price - Southeast | PNJ | 114,200 ▼600K |

| Jewelry gold price - SJC | 118,500 ▼400K | 120,500 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,200 ▼600K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,200 ▼600K | 116,900 ▼500K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,200 ▼600K | 116,900 ▼500K |

| Jewelry gold price - Jewelry gold 999.9 | 113,400 ▼700K | 115,900 ▼700K |

| Jewelry gold price - Jewelry gold 999 | 113,280 ▼700K | 115,780 ▼700K |

| Jewelry gold price - Jewelry gold 9920 | 112,570 ▼700K | 115,070 ▼700K |

| Jewelry gold price - Jewelry gold 99 | 112,340 ▼690K | 114,840 ▼690K |

| Jewelry gold price - 750 gold (18K) | 79,580 ▼520K | 87,080 ▼520K |

| Jewelry gold price - 585 gold (14K) | 60,450 ▼410K | 67,950 ▼410K |

| Jewelry gold price - 416 gold (10K) | 40,860 ▼300K | 48,360 ▼300K |

| Jewelry gold price - 916 gold (22K) | 103,760 ▼650K | 106,260 ▼650K |

| Jewelry gold price - 610 gold (14.6K) | 63,350 ▼430K | 70,850 ▼430K |

| Jewelry gold price - 650 gold (15.6K) | 67,990 ▼450K | 75,490 ▼450K |

| Jewelry gold price - 680 gold (16.3K) | 71,460 ▼480K | 78,960 ▼480K |

| Jewelry gold price - 375 gold (9K) | 36,110 ▼270K | 43,610 ▼270K |

| Jewelry gold price - 333 gold (8K) | 30,900 ▼230K | 38,400 ▼230K |

| 3. SJC - Updated: July 7, 2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,500 ▼400K | 120,500 ▼400K |

| SJC gold 5 pieces | 118,500 ▼400K | 120,520 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,500 ▼400K | 120,530 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,900 ▼400K | 116,400 ▼400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,900 ▼400K | 116,500 ▼400K |

| Jewelry 99.99% | 113,900 ▼400K | 115,800 ▼400K |

| Jewelry 99% | 110,153 ▼396K | 114,653 ▼396K |

| Jewelry 68% | 72,001 ▼272K | 78,901 ▼272K |

| Jewelry 41.7% | 41,543 ▼166K | 48,443 ▼166K |

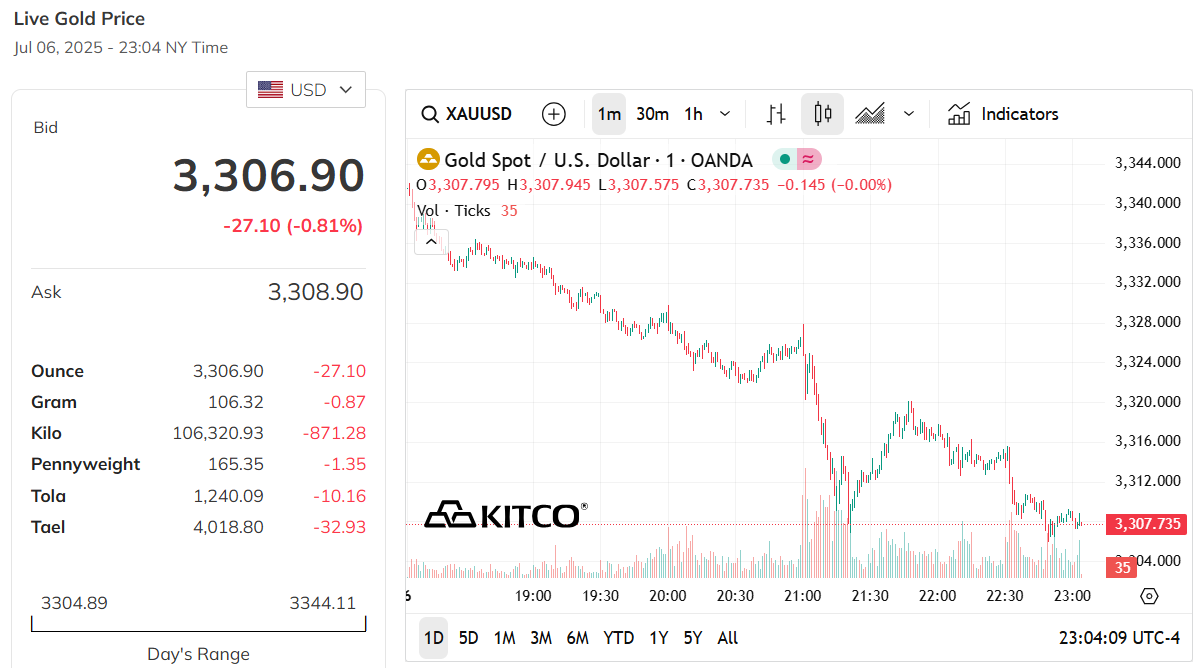

Update gold price today July 7, 2025 latest on the world market

World gold price, at 10:00 on July 7, 2025 (Vietnam time), the world spot gold price was at 3,306.9 USD/ounce. Today's gold price decreased by 27.1 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,320 VND/USD), the world gold price is about 109.19 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (118.5-120.5 million VND/tael), the current SJC gold price is about 11.31 million higher than the international gold price.

The price of gold today, July 7, 2025, on the world market has decreased slightly compared to the previous day. The main reason is that US President Donald Trump announced progress in trade agreements with many countries, and extended the time to impose new taxes. This information makes gold, which is considered a safe asset in times of instability, less attractive to investors. Specifically, the spot price of gold on the international market decreased by 0.6%, to 3,314.21 USD per ounce, while the price of gold futures in the US also decreased similarly, reaching 3,322 USD per ounce.

Developments related to US trade policy are in the spotlight. President Trump said the US is close to finalizing several important trade deals in the coming days. At the same time, he announced that he would impose higher tariffs on a number of countries, starting August 1. He had previously announced plans in April to impose 10% tariffs on most countries, with additional tariffs that could reach 50%. However, he decided to delay the implementation of most of those tariffs until July 9, creating a short-term extension. According to expert Kelvin Wong of OANDA, this tariff extension has caused gold prices to fall in the short term. He predicted that gold prices could fluctuate around $3,320 and possibly rise slightly to $3,360, but would struggle to break above that level.

In addition, the market is concerned about inflation caused by tariff policies, leading to predictions that the US Federal Reserve will slow down in cutting interest rates. Currently, investors do not expect the Fed to cut interest rates this month and only predict two small rate cuts by the end of the year. High interest rates tend to reduce the appeal of gold, because gold does not pay interest like other assets.

In addition, last week, President Trump signed a large tax cut and spending package into law at the White House. According to analysis, this policy package could add more than $3,000 billion to the national debt, which is currently at $36,200 billion. This also affects market sentiment, causing today's gold price to be under pressure to decrease.

Other precious metals also fell. Spot silver fell 0.8% to $36.81 an ounce. Platinum and palladium also lost value, down 0.8% to $1,380.55 and 1% to $1,123.31 an ounce, respectively. These fluctuations in sentiment reflect a shift in investment as investors weigh global economic and trade policy factors.

Gold price assessment today July 7, 2025

International situation

In the international market, the world gold price is currently trading around 3,337 USD/ounce, near its historical peak after 2 years of strong growth. However, with an increase of about 27% since the beginning of 2025, the market is facing profit-taking pressure from large investors. This raises concerns about the possibility of gold prices adjusting downward in the short term.

US economic policies are also shaping gold's price trend. Republicans and the White House are pushing back against negative forecasts about the national debt, while highlighting the benefits of income tax cuts and welfare reform. If these policies boost economic growth without causing strong inflation, gold prices could face further downward pressure.

Meanwhile, the more stable situation in the Middle East after the ceasefire agreement between Israel and Iran has reduced the demand for safe haven gold. However, the trade risk from the US tariff policy, especially with Japan and other countries, is still a factor supporting gold prices in the long term.

Domestic situation

In Vietnam, domestic gold prices are greatly influenced by world gold prices. Today, the price of SJC gold bars recorded a sharp decrease, with the buying price in Hanoi and Ho Chi Minh City at 118.5 million VND/tael, down 400 thousand VND/tael compared to yesterday. The selling price also decreased similarly, down to 120.5 million VND/tael.

Major brands such as DOJI, Mi Hong, and PNJ all recorded similar downward trends. In particular, gold prices at PNJ fell more deeply, with a decrease of VND600,000/tael in buying and VND500,000/tael in selling.

Forecast and investment opportunities

Strong jobs data and the Federal Reserve's interest rate policy will determine the direction of gold prices in the coming period. A rate cut by the Fed in July or September could boost inflation and support gold prices. However, if economic growth is strong, money could flow into stocks, putting downward pressure on gold prices.

Domestically, the proposed amendment to Decree 24 by the State Bank, expected to be completed before July 15, could have a strong impact on the gold market. If the gap between domestic and international gold prices narrows, SJC gold bars could face major fluctuations.

In general, the price of gold today, July 7, 2025, is falling sharply, but it is still an attractive investment channel in the long term, especially for those who want to take advantage of the opportunity to buy at low prices. Investors need to closely monitor market developments and economic factors to make appropriate decisions.

Source: https://baodanang.vn/gia-vang-hom-nay-7-7-2025-gia-vang-trong-nuoc-va-the-gioi-chat-vat-giang-co-giu-dinh-dau-tuan-3265144.html

Comment (0)