Domestic gold price today 7/5/2025

As of 4:30 a.m. on July 5, 2025, the domestic gold bar price is based on the closing price yesterday, July 4. Specifically:

DOJI Group listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy - sell), a decrease of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.9-120.9 million VND/tael (buy - sell), a decrease of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.7-120.7 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 100 thousand VND/tael for buying and 300 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by the enterprise at 118.9-120.9 million VND/tael (buy - sell), the price decreased by 400 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.2-120.9 million VND/tael (buy - sell), gold price decreased 400 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 5, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.5-117.5 million VND/tael (buy - sell); the price decreased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell); the gold price decreased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 5, 2025 is as follows:

| Gold price today | July 5, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.9 | 120.9 | -400 | -400 |

| DOJI Group | 118.9 | 120.9 | -400 | -400 |

| Red Eyelashes | 119.7 | 120.7 | -100 | -300 |

| PNJ | 118.9 | 120.9 | -400 | -400 |

| Bao Tin Minh Chau | 118.9 | 120.9 | -400 | -400 |

| Phu Quy | 118.2 | 120.9 | -400 | -400 |

| 1. DOJI - Updated: 7/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC HCM | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC DN | 118,900 ▼400K | 120,900 ▼400K |

| Raw material 9999 - HN | 108,300 ▼500K | 112,500 ▼500K |

| Raw material 999 - HN | 108,200 ▼500K | 112,400 ▼500K |

| 2. PNJ - Updated: 7/5/2025 04:30 - Time of website supply source - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,800 | 117,400 |

| HCMC - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Hanoi - PNJ | 114,800 | 117,400 |

| Hanoi - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Da Nang - PNJ | 114,800 | 117,400 |

| Da Nang - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Western Region - PNJ | 114,800 | 117,400 |

| Western Region - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - PNJ | 114,800 | 117,400 |

| Jewelry gold price - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - Southeast | PNJ | 114,800 |

| Jewelry gold price - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,800 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Jewelry gold 999.9 | 114,100 | 116,600 |

| Jewelry gold price - Jewelry gold 999 | 113,980 | 116,480 |

| Jewelry gold price - Jewelry gold 9920 | 113,270 | 115,770 |

| Jewelry gold price - Jewelry gold 99 | 113,030 | 115,530 |

| Jewelry gold price - 750 gold (18K) | 80,100 | 87,600 |

| Jewelry gold price - 585 gold (14K) | 60,860 | 68,360 |

| Jewelry gold price - 416 gold (10K) | 41,160 | 48,660 |

| Jewelry gold price - 916 gold (22K) | 104,410 | 106,910 |

| Jewelry gold price - 610 gold (14.6K) | 63,780 | 71,280 |

| Jewelry gold price - 650 gold (15.6K) | 68,440 | 75,940 |

| Jewelry gold price - 680 gold (16.3K) | 71,940 | 79,440 |

| Jewelry gold price - 375 gold (9K) | 36,380 | 43,880 |

| Jewelry gold price - 333 gold (8K) | 31,130 | 38,630 |

| 3. SJC - Updated: 7/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,900 ▼400K | 120,900 ▼400K |

| SJC gold 5 chi | 118,900 ▼400K | 120,920 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,900 ▼400K | 120,930 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,300 ▼200K | 116,800 ▼200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,300 ▼200K | 116,900 ▼200K |

| Jewelry 99.99% | 114,300 ▼200K | 116,200 ▼200K |

| Jewelry 99% | 110,740 ▼198K | 115,240 ▼198K |

| Jewelry 68% | 72,410 ▼136K | 79,310 ▼136K |

| Jewelry 41.7% | 41,790 ▼83K | 48,690 ▼83K |

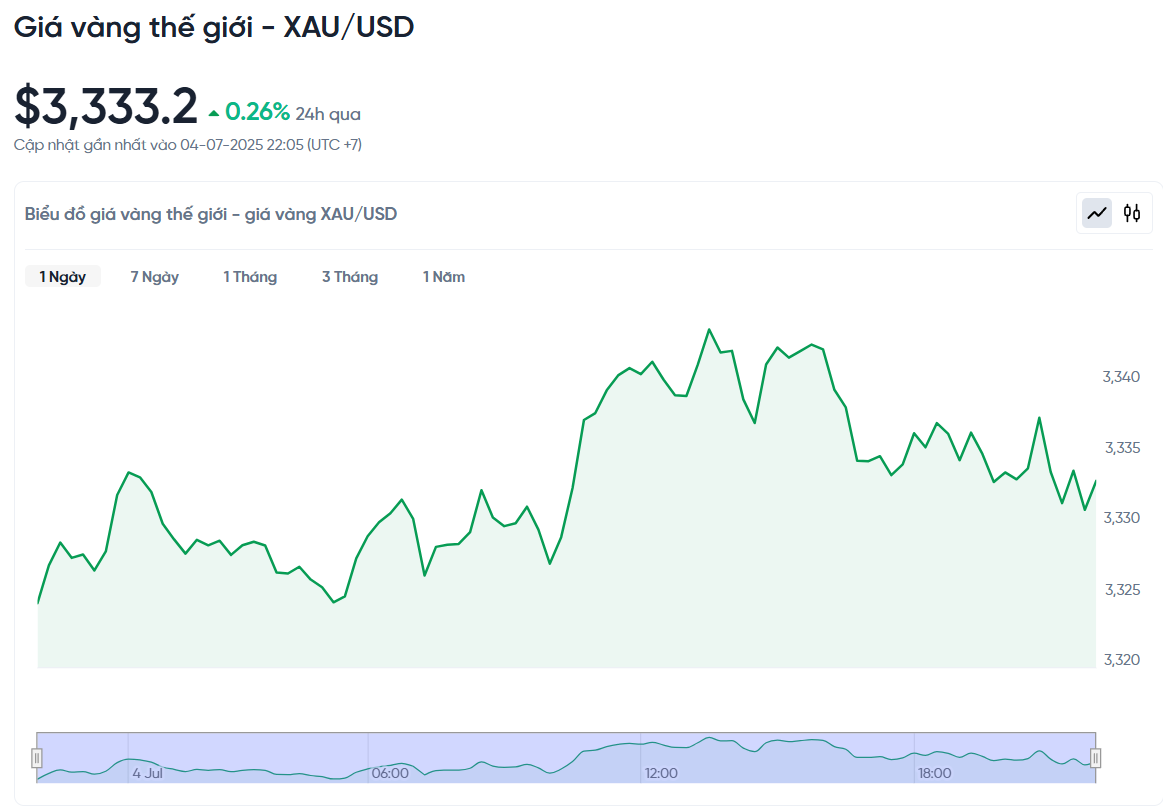

World gold price today 7/5/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 5, Vietnam time, was 3,333.2 USD/ounce. Today's gold price increased by 8.67 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,350 VND/USD), the world gold price is about 109.35 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.55 million VND/tael higher than the international gold price.

World gold prices rose slightly and are likely to increase this week, thanks to the depreciation of the USD and investors' demand for safe havens. The main reason is that the deadline for trade negotiations set by US President Donald Trump is approaching.

Specifically, spot gold prices increased by 0.26% during the day, recording an increase of 1.85% during the week. Meanwhile, gold futures prices in the US also increased slightly by 0.16% to 3,333.13 USD/ounce.

The dollar fell 0.2%, marking its second straight weekly decline, making gold cheaper for buyers using other currencies.

Concerns about the US fiscal situation after Congress passed Mr. Trump's tax cut bill, along with uncertainty surrounding the July 9 deadline on tariffs, have boosted demand for gold as a safe-haven asset, according to Mr. Ricardo Evangelista, an analyst at ActivTrades.

Earlier, Mr. Trump announced that the US government would send letters to countries on the US Independence Day, changing from the original plan for individual trade deals. On April 2, he proposed tariffs of 10-50%, but then reduced them to 10% and extended them until July 9 to allow more time for negotiations.

Meanwhile, Mr Trump's tax cut bill cleared its final hurdle in Congress on Thursday, making permanent the 2017 tax cuts and adding new tax incentives as promised during the 2024 campaign.

On the economic front, data showed the US labor market grew more strongly than expected in June, but nearly half of new jobs came from the public sector, while the private sector recorded its slowest growth in eight months as businesses faced many difficulties.

Mr. Giovanni Staunovo, a commodity analyst at UBS, said that the employment data showed that the US economy was slowing but not stagnating, making the Federal Reserve (Fed) not need to rush to cut interest rates.

Besides gold, spot silver prices edged up 0.2% to $36.90 an ounce, while palladium fell 0.1% to $1,135.79. Platinum prices rose sharply by 1.5% to $1,387.54 an ounce, recording its fifth consecutive weekly gain.

Gold Price Forecast

After holding support around $3,250 an ounce, gold is on track to end the short trading week with a significant gain. This is a positive sign for investors, showing that gold still retains its appeal despite some volatility.

The recent sell-off in gold is not surprising, as markets are recalibrating interest rate expectations, said Ole Hansen, head of commodity strategy at Saxo Bank. However, he said the long-term bullish trend for gold remains intact, despite the current narrow range.

Mr. Hansen said that gold needs a signal of a rate cut to gain further momentum. In the coming weeks, with low market liquidity, gold needs to stay above $3,245/ounce to avoid a deeper correction. However, he remains optimistic because the fundamentals supporting gold still exist and will continue to do so in the coming period.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said that based on recent employment data, the US Federal Reserve (Fed) may delay cutting interest rates until the end of the third quarter or even the fourth quarter.

If the Fed keeps interest rates high for longer, it could put negative pressure on gold prices. Higher interest rates increase the opportunity cost of holding gold, while supporting the US dollar and US Treasury yields.

Therefore, in the short term, gold prices may continue to move sideways or weaken slightly, as investors do not have strong motivation to buy but are waiting for clearer signals from the Fed or new economic data.

Robert Minter, director of ETF strategy at abrdn, points out that the US public debt has officially surpassed $37 trillion, a worrying figure for the financial situation. However, the US is not the only country with budget deficit problems. Many European countries have also increased spending recently, reflecting a global trend.

According to Mr. Minter, the currency depreciation is clearly reflected in the price of gold, as the metal continues to maintain a record high against most major currencies. He believes that the price above $ 3,000 / ounce is completely reasonable in the context of high global debt, and it is unlikely that the price of gold will fall below this level again.

Mr. Minter predicts that once the Fed starts cutting interest rates, gold prices could rise another $300 an ounce, bringing prices close to $3,500 an ounce. This shows that the long-term outlook for gold remains very positive, especially in the context of the global economy facing many financial and inflation risks.

Source: https://baonghean.vn/gia-vang-hom-nay-5-7-2025-gia-vang-trong-nuoc-va-the-gioi-huong-den-tuan-tang-nhe-10301599.html

![[OCOP REVIEW] Bay Quyen sticky rice cake: A hometown specialty that has reached new heights thanks to its brand reputation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/3/1a7e35c028bf46199ee1ec6b3ba0069e)

Comment (0)