Domestic gold price today 7/13/2025

As of 3:30 p.m. on July 13, 2025, the domestic gold bar price remained unchanged compared to yesterday. Specifically:

The price of SJC gold bars listed by DOJI Group is at 119.5-121.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday but increased by 600 thousand VND/tael in both buying and selling directions compared to last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.5-121.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The closing price this week increased by 600 thousand VND/tael in both buying and selling directions compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.5-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price decreased by 300 thousand VND/tael for both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.5-121.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday, increasing 600 thousand VND/tael in both buying and selling directions compared to last week.

SJC gold price at Phu Quy is traded by businesses at 118.8-121.5 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, increased by 600 thousand VND/tael in both buying and selling directions compared to last week.

As of the afternoon of July 13, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116-119 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price increased by 500 thousand VND/tael in buying direction - increased by 1.5 million VND/tael in selling direction compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell); the gold price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 500 thousand VND/tael in both buying and selling directions compared to last week.

The latest gold price list today, July 13, 2025 is as follows:

| Gold price today | July 13, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.5 | 121.5 | - | - |

| DOJI Group | 119.5 | 121.5 | - | - |

| Red Eyelashes | 119.5 | 120.5 | - | - |

| PNJ | 119.5 | 121.5 | - | - |

| Bao Tin Minh Chau | 119.5 | 121.5 | - | - |

| Phu Quy | 118.8 | 121.5 | - | - |

| 1. DOJI - Updated: July 13, 2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,500 | 121,500 |

| AVPL/SJC HCM | 119,500 | 121,500 |

| AVPL/SJC DN | 119,500 | 121,500 |

| Raw material 9999 - HN | 108,900 | 110,000 |

| Raw material 999 - HN | 108,800 | 109,900 |

| 2. PNJ - Updated: July 13, 2025 15:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,950 | 12,150 |

| PNJ 999.9 Plain Ring | 11,520 | 11,820 |

| Kim Bao Gold 999.9 | 11,520 | 11,820 |

| Gold Phuc Loc Tai 999.9 | 11,520 | 11,820 |

| 999.9 gold jewelry | 11,460 | 11,710 |

| 999 gold jewelry | 11,448 | 11,698 |

| 9920 jewelry gold | 11,376 | 11,626 |

| 99 gold jewelry | 11,353 | 11,603 |

| 750 Gold (18K) | 8,048 | 8,798 |

| 585 Gold (14K) | 6.115 | 6,865 |

| 416 Gold (10K) | 4,136 | 4,886 |

| PNJ Gold - Phoenix | 11,520 | 11,820 |

| 916 Gold (22K) | 10,486 | 10,736 |

| 610 Gold (14.6K) | 6,408 | 7,158 |

| 650 Gold (15.6K) | 6,877 | 7,627 |

| 680 Gold (16.3K) | 7,228 | 7,978 |

| 375 Gold (9K) | 3,656 | 4.406 |

| 333 Gold (8K) | 3.129 | 3,879 |

| 3. SJC - Updated: 7/13/2025 3:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,500 | 121,500 |

| SJC gold 5 chi | 119,500 | 121,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,500 | 121,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 | 117,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 | 117,600 |

| Jewelry 99.99% | 115,000 | 116,900 |

| Jewelry 99% | 111,242 | 115,742 |

| Jewelry 68% | 72,750 | 79,650 |

| Jewelry 41.7% | 42,002 | 48,902 |

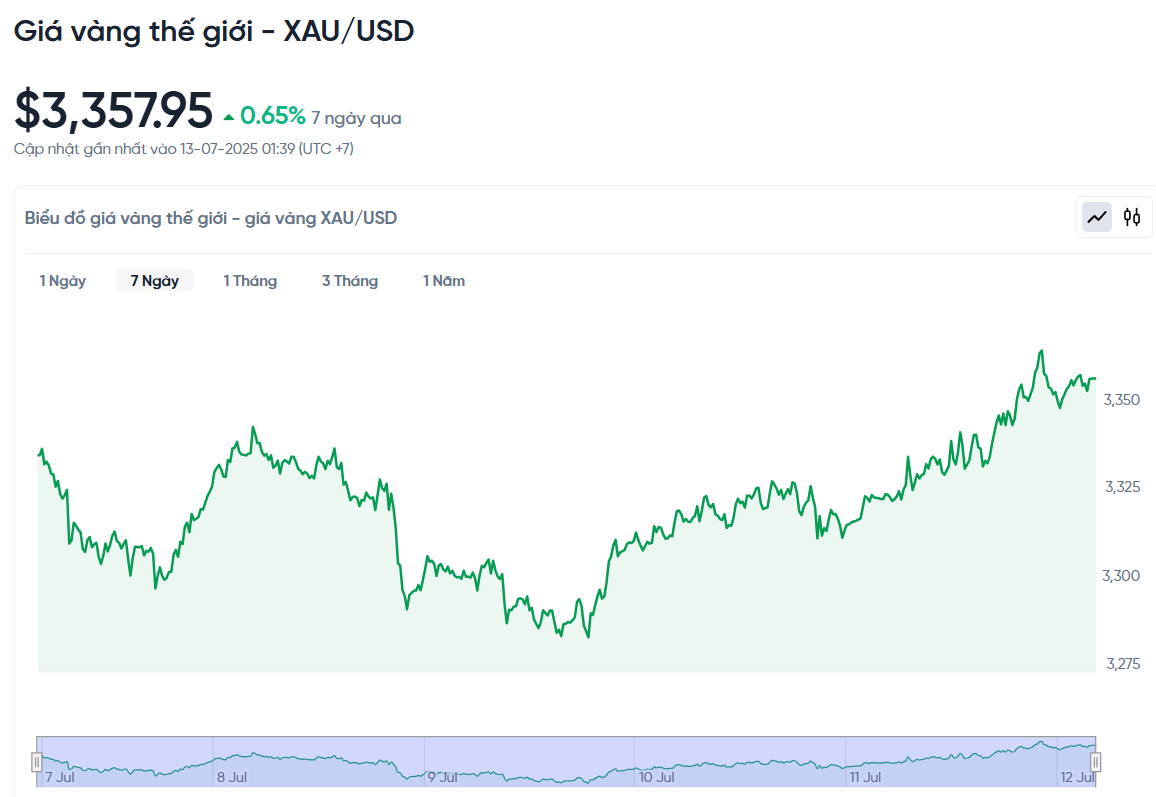

World gold price today July 13, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 3:30 p.m. on July 13, Vietnam time, was 3,357.95 USD/ounce. Today's gold price is unchanged from yesterday; up 21.72 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,290 VND/USD), the world gold price is about 109.91 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.59 million VND/tael higher than the international gold price.

Gold prices have been volatile this week, affected by trade announcements and predictions about the US Federal Reserve’s (Fed) policy. Despite some gains, the precious metal has not been able to escape the recent stable price range of $3,355/ounce.

Another important factor was President Donald Trump’s decision to impose a 35% tariff on goods from Canada and plans to impose 15-20% tariffs on many other countries. While Asian and European stocks were volatile, the US market plunged. In response, many investors withdrew money from stocks and switched to buying gold, pushing up the price of gold.

Not only politics, but also economic developments have contributed to the increase in gold prices. Although the USD has increased slightly, it is not enough to pull down the price of gold, because the anxiety has caused a huge demand for gold. Crude oil prices are currently stable, while the interest rate on US government bonds has increased to nearly 4.4%, showing that the market is worried about the country's huge debt.

Even without a real financial crisis, the US’s large budget deficit is enough to make investors seek gold as a safe haven, according to the World Gold Council. Gold has always been seen as a safe haven in times of economic uncertainty, and now the combination of political tensions and economic risks is causing gold prices to continue to rise.

Spot gold started the week at $3,338.55 an ounce. After dipping slightly below $3,300 early Monday morning, gold surged as U.S. traders returned to the market after a long holiday, pushing prices to $3,336 by the end of the North American session and hitting a weekly high of $3,345 later that day.

However, the gains were short-lived, with Asian and European traders later pushing prices lower to around $3,320 before the North American session pushed prices below $3,300 on Tuesday morning. That level then acted as resistance, causing gold to trade sideways for the rest of the session.

On Wednesday, North American traders once again led the market, pushing prices above $3,300 at the open. Asian and European sessions continued to provide support, pushing prices closer to $3,330 overnight.

Gold’s steady rally began early Thursday morning in Asia. Spot gold first crossed $3,336 at 8:30 p.m., then broke above its weekly high of $3,345 on Friday morning.

After another sharp rally in the North American morning session, gold hit a weekly high of $3,368.86 around 11:15 a.m. After testing support at $3,350, the precious metal traded in a narrow range of about $5 around $3,355 heading into the weekend.

Gold Price Forecast

According to the latest survey from Kitco News, industry experts are divided on the short-term gold price outlook, while retail investors have abandoned their previous bullish bias.

The expert survey results showed a notable change when 15 Wall Street experts participated, with only 1 person holding a bearish view. Specifically, 7 experts (47%) predicted prices to increase, 1 person (7%) said prices to decrease, and the remaining 7 (47%) expected prices to remain flat.

Meanwhile, an online poll of 231 retail investors found that the bullish majority has narrowed significantly, with only 104 (45%) predicting a rise, 63 (27%) expecting a fall, and 64 (28%) expecting a further correction in the coming week.

'US tariffs appear to have helped gold recover, but it remains unclear whether the correction after hitting a record high near $3,500 is over,' said Marc Chandler, CEO of Bannockburn Global Forex.

Chandler said the current correction has a high of around $3,422 and a low of around $3,275. He added: 'US CPI data on Tuesday and the EU tariff announcement could help clarify the direction of the market. Few are actually bearish on gold, it's more about timing than direction at the moment.'

Darin Newsom, senior analyst at Barchart.com, expressed optimism: 'I don't even need to look at the charts or the news anymore. As long as the situation in the US remains the way it is, gold will continue to be seen as a safe haven asset, especially heading into the weekend.'

James Stanley, market strategist at Forex.com, agrees: 'The anti-fiat sentiment is strong, and gold is currently lagging Bitcoin and Silver in the short term. I see this as an anomaly rather than a negative sign. The past two weeks have seen a strong reaction in gold after hitting support. Longer term, I believe gold will continue to rally as it has over the past 17 months.'

After a relatively quiet holiday week, the market enters the new week with a series of important economic data that could impact gold prices. Most notably, the June consumer price index (CPI) report will be released on Tuesday, along with the Empire State manufacturing survey.

Next up is the producer price index (PPI) on Wednesday. On Thursday, the market will turn its attention to retail sales, the Philly Fed manufacturing survey and weekly jobless claims. The week will close with housing starts and the University of Michigan consumer sentiment survey on Friday.

Source: https://baonghean.vn/gia-vang-chieu-nay-13-7-2025-gia-vang-trong-nuoc-va-the-gioi-co-tuan-tang-nhe-gan-1-trieu-dong-va-van-se-tang-nhu-trong-17-thang-qua-10302171.html

Comment (0)