Energy market sinks deep into red

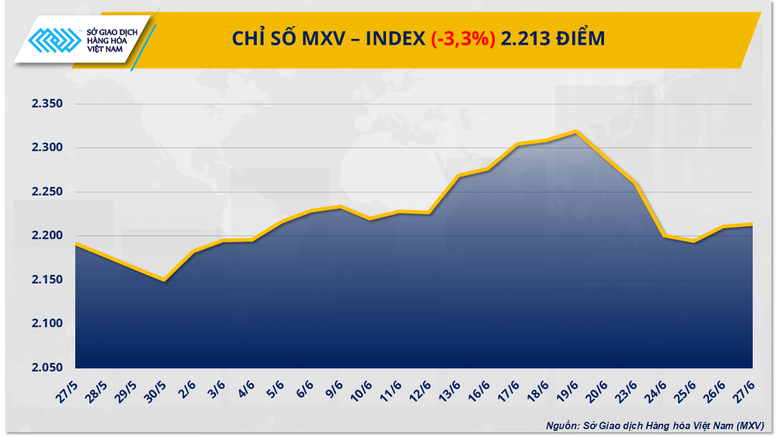

According to MXV, the global energy market has just experienced a volatile trading week when oil prices fell freely in the context of concerns about the risk of supply disruption from the Middle East being almost completely eliminated.

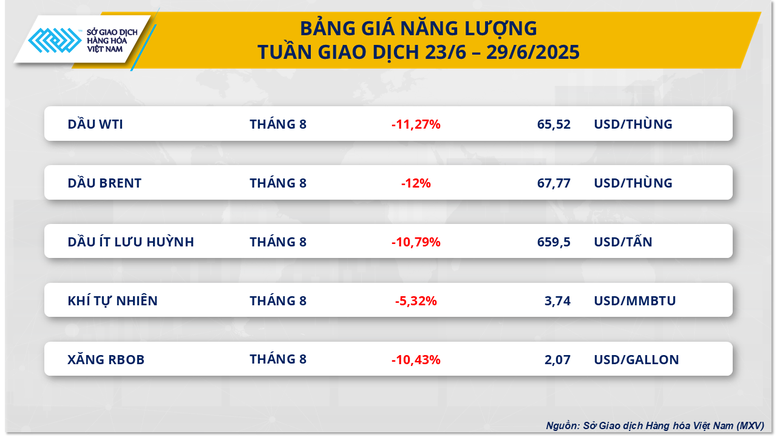

At the end of the week, most petroleum products fell by more than 10%. In particular, the prices of both Brent and WTI oil recorded record weekly declines, at 12% and 11.27%, respectively - far exceeding the sharpest declines since the beginning of the year. At the end of the week, Brent oil stopped at 67.8 USD/barrel, while WTI oil fell to 65.5 USD/barrel, marking the lowest prices of both products in the past two weeks.

The rapid de-escalation of tensions between Israel and Iran, coupled with no reports of serious disruptions to oil exports through the Strait of Hormuz during the 12-day conflict, sent oil prices plunging in the first two trading sessions of the week, with daily declines of up to 6%.

In the remaining three trading sessions of the week, oil prices recorded only modest recoveries, all below 1%, mainly due to expectations of increased oil demand in the US in the coming time. According to the latest reports from the US Energy Information Administration (EIA) and the American Petroleum Institute (API), US commercial crude oil reserves continued to decline in the week ending June 20, marking the fifth consecutive week of decline, thereby providing some support for oil prices in the context of the market still under great pressure from the supply side.

On Saturday (June 28), after news spread that OPEC+ planned to increase oil production by 411,000 barrels per day in August, following a similar production increase plan in July, oil prices came under further pressure and continued to fall.

Meanwhile, natural gas inventories in the United States continued their upward trend since March and recorded another increase in the week ending June 20, according to a report from the US Energy Information Administration (EIA). This development, along with the easing of political tensions in the Middle East, has put great pressure on natural gas prices. Last week, natural gas prices traded on the NYMEX fell sharply by 5.32% to $3.74/MMBtu.

Platinum prices rise for fourth consecutive week

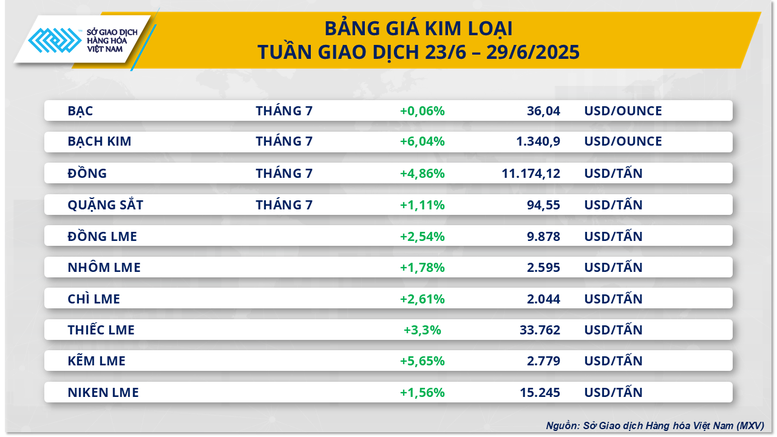

At the end of the last trading week, the metal market recorded positive buying power across all 10 commodities in the group. Platinum in particular increased by more than 6% last week, reaching $1,340/ounce, marking the fourth consecutive week of increase. Notably, this is also the highest price range in nearly 11 years.

Concerns about supply shortages have supported the rally, according to MXV. In South Africa, which accounts for more than 70% of global platinum production, mining continues to be hampered by high electricity costs and inefficient transport infrastructure. The country’s platinum production is expected to fall 6% this year to 3.9 million ounces, according to the World Platinum Investment Council (WPIC).

Meanwhile, platinum demand from the jewelry industry is expected to increase by 5% to 2.1 million ounces. The global platinum market is expected to continue to face a deficit of about 966,000 ounces this year, marking the third consecutive year of severe imbalance between supply and demand.

However, in the long term, the high interest rate environment in the US could put pressure on industrial demand for platinum, as rising borrowing costs reduce the incentive for businesses to expand production and business.

In addition, demand for platinum in the automotive sector is also forecast to decline. It is expected that by 2025, platinum demand from the automotive industry will decrease by 2% to about 3 million ounces. Platinum is mainly used in the catalytic converters of diesel, gasoline and hybrid vehicles (PHEVs). However, the strong growth of electric vehicles in recent years is narrowing the market share of traditional vehicles, thereby reducing the demand for platinum in the global market.

In the base metals market, COMEX copper prices jumped nearly 5% last week to $11,174/ton. The main driver for this price increase was mainly concerns about the possibility of Washington imposing import tariffs on copper, causing the market to worry about the risk of domestic supply-demand imbalance due to the lack of domestic production capacity.

Source: https://baochinhphu.vn/gia-nang-luong-lao-doc-gia-bach-kim-len-muc-dinh-11-nam-102250630091413131.htm

Comment (0)