According to the "Report on assessing the impact of regulations on using electronic invoices from cash registers connected to tax authorities on business households and individuals" surveyed by the Vietnam Federation of Commerce and Industry (VCCI) from June 7 to 30, up to 73% of business households reported a lack of knowledge and skills in technology; 53% were concerned about complicated procedures; 49% encountered barriers in changing business habits; 37% lacked time to learn and did not have enough capital to invest in equipment. In addition, a number of business households also expressed concerns about data security when switching to a digital environment.

From the survey results, the research team believes that timely and practical support from management agencies will be a key factor in helping business households stabilize their operations and develop in the digital business environment.

Specifically, management agencies need to proactively communicate comprehensively, easily understood and to the right audience, especially to small businesses in rural areas or industries with low awareness rates.

In addition, supplement appropriate regulations on accounting, invoices, and documents that are close to the practical operations of business households. Raise awareness of information security and build trust in the system.

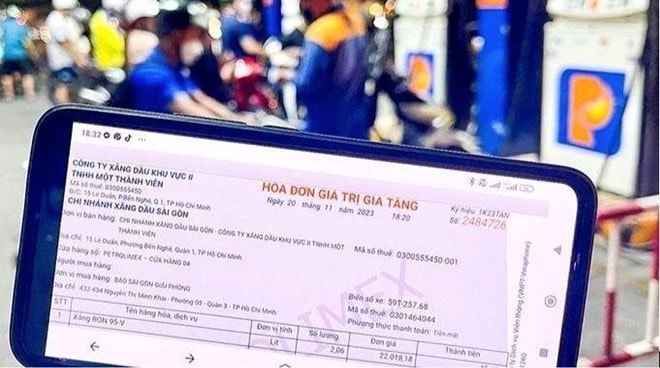

According to the VCCI research team, Decree 70 requires that electronic invoices must have the tax code or personal identification number of the buyer, except in cases of selling goods or providing services to non-business buyers.

This provision causes difficulties for business households, because in reality, many customers come to buy goods and business households cannot identify whether they are individual consumers or individual businesses. The seller's responsibility should be considered complete when they have issued full invoices for their sales transactions, regardless of whether those invoices contain complete buyer information or not.

Therefore, it is necessary to soon issue guidelines allowing sellers to clearly state “buyer did not provide information” in cases where the buyer does not provide a tax code or personal identification number, to ensure operational feasibility, and at the same time contribute to standardizing the legal basis between different links in the supply chain.

Requiring invoices to contain all buyer information not only disrupts transactions at the invoicing stage, leading to indirect congestion of goods and disruption of the legal supply chain, but also entails risks in the post-audit stage.

According to VCCI, in reality, many businesses and business households, despite having fully prepared invoices, accurately declared and fulfilled tax obligations, can still be subject to inspection if the identity of the buyer cannot be traced.

If the obligation to declare and pay taxes has been fulfilled by the seller, then post-audit should not become the basis for attributing a violation, unless there are clear signs of intentional misconduct.

Source: https://hanoimoi.vn/73-ho-kinh-doanh-thieu-kien-thuc-ky-nang-khi-trien-khai-hoa-don-dien-tu-708824.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)