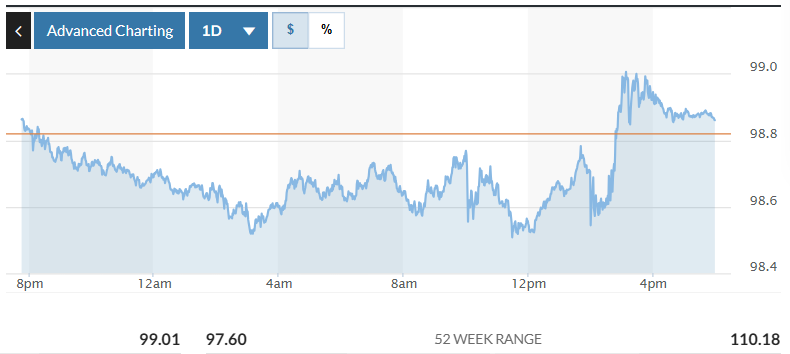

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.05% to 98.86.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch |

USD exchange rate today in the world

The US dollar rose against most major currencies, but remained weaker against the Japanese yen, after the US Federal Reserve kept interest rates unchanged as economic uncertainty and tariffs continued to weigh on the economic outlook.

Policymakers still forecast a half-percentage-point interest rate cut this year amid concerns that President Donald Trump's tariffs could fuel inflation.

“The speculation is still in the air. The second quarter numbers will be important to really see that we are in recessionary pressure, which will force the Fed to reconsider policy,” said Juan Perez, director of trading at Monex USA.

Following the Fed’s decision, markets continued to focus on the conflict between Israel and Iran, which has sent investors rushing to safe haven assets. The dollar has regained its safe-haven status, rising about 1% against both the Japanese yen and the Swiss franc since last Thursday. However, on Wednesday, the U.S. currency fell slightly against the yen and franc, and was down more sharply against the euro and the British pound.

The dollar has fallen about 8 percent year-to-date against six major currencies. Against the yen, the dollar fell 0.06 percent to 145.18 yen and rose 0.36 percent against the Swiss franc to 0.8190 franc.

Recent data have begun to show the impact of Mr. Trump’s erratic decisions on trade and tariffs. Escalating conflict in the Middle East and a spike in crude oil prices to around $75 a barrel have further complicated the situation for policymakers.

“Although not mentioned directly, concerns about inflation due to tariffs and oil price shocks from the Middle East are also reasons for not cutting rates,” said Phil Blancato, chief market strategist at Osaic. However, Blancato said the Fed is “missing the boat by not starting the rate-cutting process.”

The dollar was lower early in the day after data showed the number of Americans filing new unemployment claims fell but remained high. Meanwhile, the Swedish central bank cut interest rates as expected, weakening the krona against the euro, which rose 1% to 11.0770.

On Thursday, the Swiss National Bank, the Bank of England and Norges Bank (Norway) will announce their interest rate decisions.

One disappointment for investors was that the G7 meeting in Canada made little progress on tariffs, as Mr Trump's deadline for imposing additional import duties in early July approaches.

|

| Illustration photo / vneconomy.vn |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on June 19, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD at 24,994 VND.

* The reference USD exchange rate at the State Bank's buying and selling exchange center has decreased, currently at: 23,795 VND - 26,193 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

25,853 VND | 26,243 VND | |

Vietinbank | 25,911 VND | 26,243 VND |

BIDV | 25,883 VND | 26,243 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center has decreased, currently at: 27,291 VND - 30,163 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,217 VND | 30,758 VND |

Vietinbank | 29,630 VND | 30,885 VND |

BIDV | 29,588 VND | 30,835 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 163 VND - 181 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.01 VND | 185.07 VND |

Vietinbank | 173.71 VND | 185.20 VND |

BIDV | 176.57 VND | 184.39 VND |

THUY ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-19-6-dong-usd-tang-sau-quyet-dinh-cua-fed-256002.html

Comment (0)