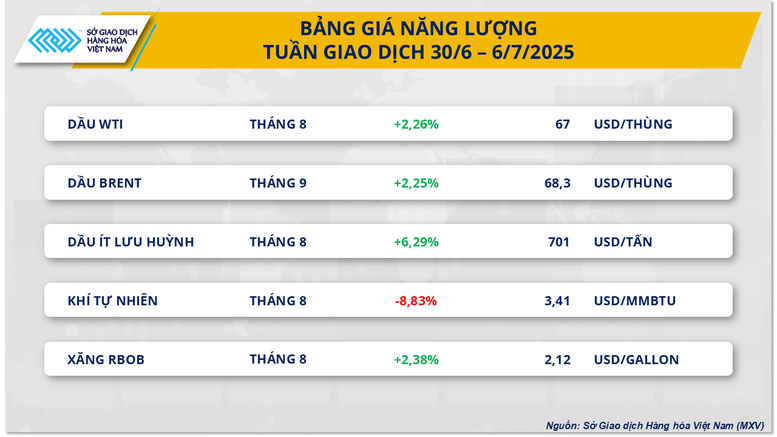

Energy market recovers, green dominates

According to MXV, the energy market has recovered positively in the past trading week thanks to optimism about the macroeconomic outlook that will boost global oil demand. In particular, Brent oil prices recorded an increase of 2.25%, reaching 68.3 USD/barrel. Similarly, WTI oil prices also increased by 2.26%, stopping at 67 USD/barrel.

Over the past week, a series of positive indicators on the US economy have contributed to the rise in oil prices. The JOLTS job openings index increased in May, the manufacturing PMI index released by S&P Global also recorded an improvement in June along with a decrease in the unemployment rate, indicating that the US labor market is continuing to recover. These signals reinforce expectations of a recovery in economic activity, thereby boosting energy demand in the US.

However, many investors believe that the current situation will cause the US Federal Reserve (Fed) to continue to delay the decision to cut interest rates. Previously, the Fed expressed concerns about the risk of rising inflation due to the White House's tariff policies, as well as potential instability for the US economy after August 1, when the super tax and budget spending bill of the Donald Trump administration was passed.

In addition, the market also expects new trade agreements between the US and major partners in the world . Notably, on July 2, the US and Vietnam announced a new trade agreement, becoming one of the main drivers pushing prices up about 3% in the trading session on the same day.

On the other hand, natural gas prices on the NYMEX continued to plummet last week, falling 8.83% to $3.41/MMBtu. The downward pressure on prices mainly came from the continuous increase in natural gas inventories in the US since March, along with the decrease in demand from power plants. The cooler weather in the US last week also reduced the demand for cooling energy, thereby directly affecting the demand for natural gas in the market.

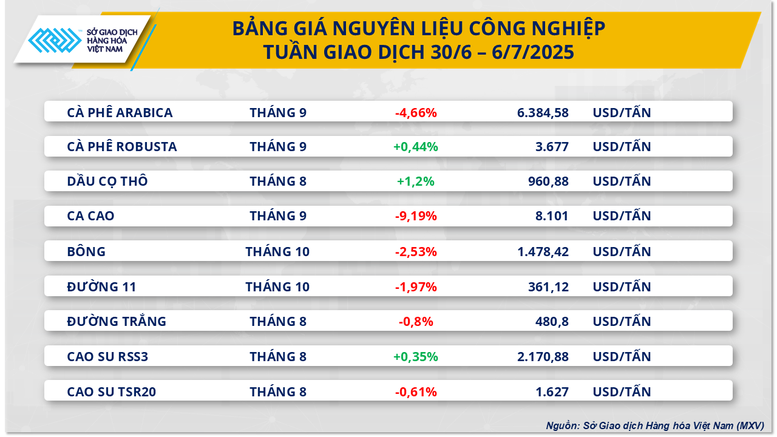

Contrary to the general market trend, the industrial raw material group recorded overwhelming selling pressure on most key commodities. Of which, Arabica coffee prices lost more than 4.6% to 6,384 USD/ton. On the contrary, Robusta coffee prices recorded a slight increase of nearly 0.5% to 3,677 USD/ton.

The downward pressure on Arabica coffee prices is mainly due to increased global supply. According to the International Coffee Organization (ICO), global coffee exports in May of the 2025-2026 crop year reached 12.65 million bags, up 5% compared to the same period last year. Notably, Arabica exports in the last 12 months increased by 6% to 86 million bags, while Robusta decreased by 3.44% to 50.7 million bags. In Brazil alone, the world's leading coffee exporter, as of July 4, coffee export requirements for July had reached 490,200 bags and are expected to reach 5 million bags for the whole month, far exceeding the 3.77 million bags in the same period last year.

At the same time, coffee consumption demand in major markets in the Northern Hemisphere is showing signs of slowing down due to the long summer holidays, especially in the US and Europe.

However, the EU Deforestation Regulation (EUDR) will officially come into effect from January 1, 2026. This may prompt importers to increase purchases early to ensure coffee is shipped to Europe before December 31, 2025, thereby creating support for coffee prices in the coming time.

Source: https://baochinhphu.vn/thi-truong-giang-co-dau-tho-tang-gia-ca-phe-arabica-va-robusta-di-nguoc-chieu-102250707092650391.htm

Comment (0)