Risks from trade policy

The World Bank (WB) has identified five key risks that could slow economic growth across the board. These include rising trade barriers and policy uncertainty; weak global economic growth; the risk of financial instability and tightening; falling commodity prices; climate change; and rising geopolitical tensions and conflicts.

The gloomy global trade outlook in 2025 will affect global growth (illustrative photo). Photo: My Thanh

As of June 2025, international organizations including the Organization for Economic Cooperation and Development (OECD), the International Monetary Fund (IMF), the United Nations (UN), and the World Bank (WB) all revised down global economic growth by 0.2 to 0.5 percentage points compared to the forecasts made in early 2025, except for Fitch Ratings (FR). Specifically, OCED forecasts global economic growth at 2.9%, the IMF forecasts 2.8%, the UN 2.4%, the WB 2.3%, and the lowest is FR at 2.2%.

For Southeast Asian economies, the Asian Development Bank (ADB) forecasts growth of 4.7% in 2025, down slightly from 4.8% in 2024 but still robust, driven by domestic demand and increased tourism. The ASEAN+3 Macroeconomic Research Office (AMRO), the World Bank and ADB forecast growth for the ASEAN and East Asia- Pacific region to slow to 4.7% in 2025 from 2024, reflecting a rather bleak outlook for global trade in 2025 due to rising trade tensions and policy uncertainty.

According to the World Trade Organization (WTO), global merchandise trade is expected to pick up in early 2025 as imports buy ahead of expected higher tariffs from the United States. But weaker export orders suggest that the momentum may not be sustained. The goods trade gauge rose to 103.5 in June 2025 from 102.8 in March 2025, but the new export orders sub-index was just 97.9, suggesting weaker trade growth in late 2025 as businesses import less and reduce accumulated inventories.

Most major economies have been affected by changes in trade policy, especially the announcement of tariffs by the United States. International organizations have lowered their forecasts for US economic growth in 2025 by 0.3 to 0.9 percentage points compared to previous forecasts, with growth ranging from 1.4% to 1.8%, lower than in 2024.

For the Eurozone, the impact of rising trade tensions and policy uncertainty will negatively impact investment and trade in these countries in 2025. The forecast is for Eurozone growth to reach 0.7% to 1% in 2025. As for Japan, growth is forecast to be below 1%; China's growth is below 5%, with forecasts of 4.6%, 5.5%, 4.2% and 4% respectively.

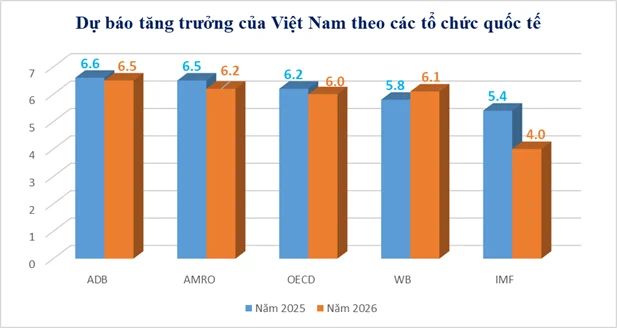

Regarding Vietnam, international organizations all predict that Vietnam's growth in 2025 will be lower than in 2024. In particular, ADB, AMRO and OECD forecast Vietnam's growth in 2025 to reach over 6%, at 6.6%, 6.5% and 6.2% respectively. WB and IMF forecast Vietnam's growth in 2025 to reach 5.8% and 5.4% respectively. In particular, AMRO also noted that although Vietnam leads the growth in Southeast Asia, the growth prospects of the ASEAN+3 region depend heavily on US trade policies.

The OECD said that higher trade barriers and policy uncertainty are major risks to Vietnam's economic outlook, potentially undermining Vietnam's growth. The WB warned of weaker global growth prospects and weaker confidence in investment, exports and consumption. The IMF is optimistic that some countries, including Vietnam, may find opportunities to reshape their trade networks and positions in global value chains.

Make the most of opportunities

According to international organizations, the main reason for the deterioration in the global trade outlook is the increase in trade barriers, especially tariffs, along with widespread and increasing policy uncertainty. The IMF said that new tariffs by the United States and countermeasures by trading partners have brought global tariffs to their highest level in a century. Trade tensions and policy uncertainty are having a profound negative impact on investment, business confidence and consumer confidence. Many companies are adopting a “wait and see” approach, delaying or cutting back on investment spending. Geopolitical tensions and rising tariffs are reshaping global foreign direct investment (FDI) patterns.

Despite the headwinds, some sectors have shown relative resilience. The World Bank said global trade in services growth has been relatively stable, with tourism activity approaching pre-pandemic levels. The ADB said “regional technology exporters remain a bright spot, benefiting from strong global demand for electronics,” with the semiconductor market expected to grow by 11.2% in 2025,…

Many economists predict that markets may respond to the new US tariff policy by increasing technical barriers to protect domestic industries. With these fluctuations, average commodity prices are expected to fall by about 10% in 2025 and will fall by another 6% in 2026.

Meko Garment Joint Stock Company (Can Tho City) always focuses on innovation and technology application. Photo: GIA BAO

As a trade-dependent economy, Vietnam is easily affected by external developments, directly by the decline in exports and FDI inflows. However, the bright spot in the first 6 months of the year was the trade surplus of 7.63 billion USD (the same period last year had a trade surplus of 12.15 billion USD). With export turnover reaching 219.83 billion USD, an increase of 14.4% over the same period in 2024, of which the FDI sector accounted for 73.%%. In terms of markets, the United States is still the largest export market with an export turnover of 70.91 billion USD; China is Vietnam's largest import market with a turnover of 84.7 billion USD.

According to Mr. Tran Chi Gia, General Director of Meko Garment Joint Stock Company (Can Tho City), in the past 3 years, trade fluctuations have affected the company's product processing prices. However, the company has made efforts to improve technology, invest in modern machinery to increase labor productivity, although processing prices have decreased, the company still makes a profit. Currently, the company exports more than 90% to Japan, with only 1% to the US market, so tax policies have not affected the business much. The company is only having difficulty recruiting workers for year-end export orders, currently the company has about 1,100 workers.

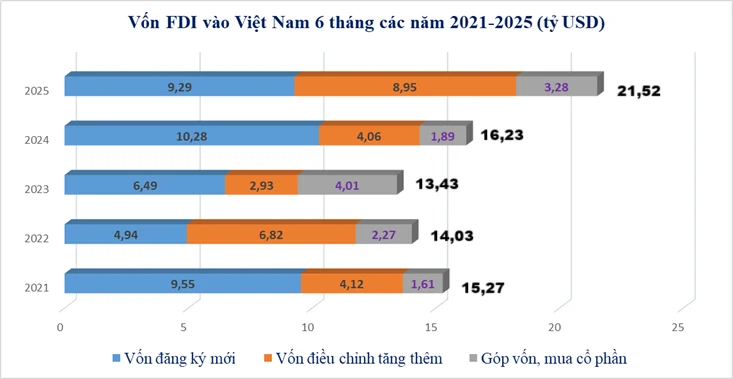

Despite the decline in business and investment confidence, Vietnam remains an attractive destination for FDI investors. Specifically, in the first 6 months of 2025, total FDI capital in Vietnam reached 21.52 billion USD, up 32.6% over the same period last year. In particular, FDI capital has shifted to new production projects in the fields of high technology, semiconductors, AI, etc.

FDI capital realized in Vietnam in the first 6 months of 2025 is estimated at 11.72 billion USD, up 8.1% over the same period last year. This is the highest amount of foreign direct investment capital realized in 6 months in the past 5 years. Foreign investors also highly appreciated Vietnam's efforts to improve the investment environment in recent times and many investors have plans to maintain or expand their investment in the coming time.

Article and photos: GIA BAO

Source: https://baocantho.com.vn/tan-dung-du-dia-de-tang-truong-trong-boi-canh-kho-khan-a188390.html

![[Photo] General Secretary receives heads of political party delegations from countries attending the 80th anniversary of our country's National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/ad0cb56026294afcae85480562c2e790)

![[Photo] Solemn reception to celebrate the 80th anniversary of the National Day of the Socialist Republic of Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/e86d78396477453cbfab255db1e2bdb1)

![[Photo] Celebration of the 65th Anniversary of the Establishment of Diplomatic Relations between Vietnam and Cuba](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/0ed159f3f19344e497ab652956b15cca)

![[Photo] People eagerly wait all night for the parade on the morning of September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/0cf8423e8a4e454094f0bace35c9a392)

![[Photo] National Assembly Chairman Tran Thanh Man receives Cambodian Senate President Hun Sen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/7a90c9b1c1484321bbb0fadceef6559b)

![[Photo] Chu Dau Ceramics – Proud of Vietnamese identity at Exhibition A80](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/1/c62ab2fc69664657b3f03bea2c59c90e)

Comment (0)