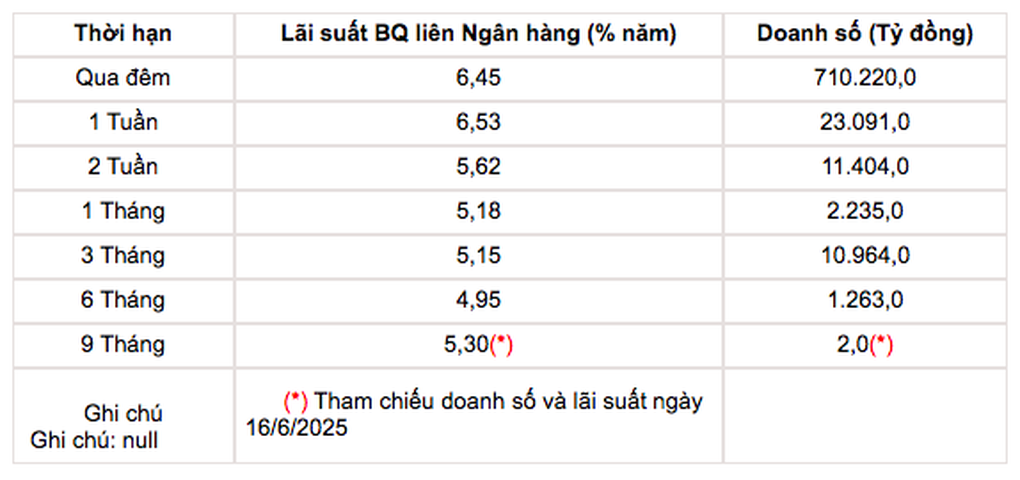

According to data from the State Bank, the average interbank interest rate (the market where banks borrow from each other) has increased sharply at all terms.

Specifically, the current overnight interest rate reached 6.45%/year, up nearly 5 percentage points compared to the closing price on June 23 (1.66%/year).

Similarly, interest rates for longer terms also increased. The interest rate for a one-week term jumped from 2.3%/year just over a week ago to 6.53%/year; for a two-week term from 3.87%/year to 5.62%/year. The interest rate for a one-month term also increased from 3.45%/year to 5.18%/year.

Previously, interbank interest rates had been continuously on a downward trend since early March and fell to a 16-month low on June 23, before suddenly bouncing back to the current level.

Interbank interest rates skyrocket (Screenshot).

Interbank interest rates skyrocketed amid increased demand for system liquidity in the middle of the year, despite the State Bank's strong net injection.

On the channel of lending against valuable papers, on June 30, the State Bank offered VND50,000 billion for a 7-day term, VND25,000 billion for a 14-day term and VND5,000 billion for a 91-day term, with interest rates at 4%. As a result, more than VND52,904 billion won the bid in all 3 terms. There was no maturity volume.

Thus, the operator lent the banking system more than VND52,904 billion through the open market operation (OMO) channel in the last trading session of June. In fact, the State Bank had previously reopened the bill issuance channel on June 24, but has temporarily stopped and increased money injection through the OMO channel in recent sessions.

Interbank interest rate is the interest rate at which banks borrow from each other through the interbank market (market 2) when banks lack reserves at the State Bank. According to regulations, each bank must maintain a required reserve ratio.

The interest rate level maintained at a high level reflects the liquidity of the system in a rather limited state. This can put pressure on deposit and lending rates in the residential market (market 1).

Recently, the State Bank has stopped issuing treasury bills and continuously conducted daily term bids for valuable papers, diversified and extended the term of the bids, and increased the volume of bids to promptly and fully meet the liquidity needs of banks in order to support banks in accessing low-cost capital from the State Bank.

This helps banks have the conditions to continue reducing lending rates in accordance with the Government 's orientation and policies.

Excess liquidity in VND and the widening interest rate gap between USD and VND in the context of a stronger USD have caused the USD/VND exchange rate to rise since the first half of June. The central exchange rate has recently set a record at 25,058 VND/USD.

Since the beginning of the year, the USD/VND exchange rate has increased by nearly 3%, despite the USD-Index - a measure of the greenback's strength against a basket of major currencies on the international market - falling by about 10%.

Source: https://dantri.com.vn/kinh-doanh/lai-suat-ngan-hang-cho-nhau-vay-tang-vot-20250702010321480.htm

![[Photo] General Secretary To Lam attends the launch of 3 digital platforms serving the implementation of Resolution No. 57-NQ/TW](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/2/d7fb7a42b2c74ffbb1da1124c24d41d3)

Comment (0)